On November 29, the Bitcoin price conjecture continued to be bearish underneath the $16,650 level of resistance because the “Risk-off” sentiment ongoing to dominate the worldwide markets. BlockFi may be the latest victim from the FTX collapse, and it is a loan provider within the troubled cryptocurrency space which has declared personal bankruptcy.

BlockFi and eight affiliates declared Chapter 11 personal bankruptcy inside a US personal bankruptcy court in Nj on November 28. The filling will let the firm to stabilize its operations and finalize an extensive restructuring agreement that maximizes value for those clients along with other stakeholders.

BlockFi Personal bankruptcy – Quick Review

BlockFi, a Nj-based company, mentioned it owed money to in excess of 100,000 creditors. Since it’s second-largest creditor, it listed FTX, a cryptocurrency exchange, owing $275 million.

At the start of 2022, BlockFi experienced difficulties because of a clear, crisp stop by cryptocurrency prices, which led to customer withdrawals and also the liquidation of assets in the battling Singapore-based Three Arrows Capital.

Within the summer time, the organization received a $400 million line of credit from FTX, which permitted the financial institution to prevent personal bankruptcy. On November 11, however, FTX declared personal bankruptcy.

Within the U . s . States, a business can apply for Chapter 11 personal bankruptcy to restructure its financial obligations while operating under court supervision. This news that cryptocurrency loan provider BlockFi had declared personal bankruptcy brought to some stop by the need for BTC/USD.

Singapore Banks’ Bitcoin Exposure is “Minor” but Susceptible to Greatest Risk Weight

Singapore’s senior minister, Tharman Shanmugaratnam, mentioned on November 28 that banks in the united states must hold $125 in capital for each $100 contact with dangerous crypto assets for example Bitcoin (BTC) and Ethereum (ETH).

Inside a written reaction to Singapore’s parliament, Shanmugaratnam claimed that Singaporean banks have “minor” contact with cryptocurrencies. Based on the Financial Authority of Singapore (MAS) minister, the exposure was “under .05% of the total risk-weighted assets.”

Shanmugaratnam revealed Singapore’s active participation within the Basel Committee on Banking Supervision’s (BCBS) framework for banks’ cryptocurrency exposure. The audience is anticipated to provide its final framework through the finish of the season, he added.

Bitcoin’s exposure will grow if Singapore attracts more crypto players, that will help the cost of BTC/USD.

Binance’s PoR Audit Process

Based on Binance Chief executive officer Changpeng “CZ” Zhao, the organization is shifting massive levels of bitcoin included in its proof-of-reserve (PoR) audits. Based on a Whale Alert report, Binance deposited 127,351 Bitcoin totaling greater than $2 billion for an unknown wallet on November 28.

The huge Bitcoin transaction rapidly sparked FUD, or fear, uncertainty, and doubt, through the community, with lots of mentioning that Binance transferred a fortune’s price of BTC in one transaction.

CZ later announced on Twitter on November 28 the significant transaction was a part of Binance’s PoR auditing process. Also, he advised the city to stay calm and also to neglect the rumors.

Bitcoin Cost

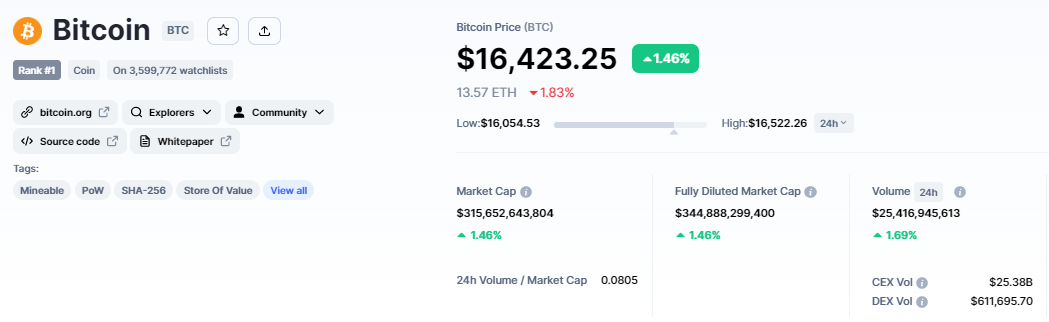

The present Bitcoin cost is $16,420 and also the 24-hour buying and selling volume is $25 billion. Over the past 24 hrs, the BTC/USD pair has surged over 1.5%, while CoinMarketCap presently ranks first having a live market cap of $315 billion, up from $344 billion throughout the Asian session. It features a total way to obtain 21,000,000 BTC coins along with a circulating way to obtain 19,218,643 BTC coins.

Throughout the United kingdom session, the BTC/USD traded slightly bullish, after gaining support in the $16,000 mental buying and selling level. Within the 4-hour time-frame, an upward trendline is extending support round the $16,000 level, and also the closing of candle lights above this level has triggered a bullish recovery in Bitcoin.

Around the upside, the immediate resistance for Bitcoin reaches $16,650, that is based on a downward trendline. Bitcoin has additionally created a dual top level at $16,650, along with a break above this level could send BTC up to $17,250.

Leading technical indicators like the RSI and MACD have joined the buying zone, signaling the start of a buying trend. Bitcoin has lately surpassed the 50-day moving average of $16,250, indicating the beginning of another bullish trend.

If Bitcoin breaks the low symmetrical triangular pattern and closes the candle below $16,000, it will likely be susceptible to the $15,650 support zone.

Cryptocurrency Pre-Purchase With Massive Profit

Despite market slowdowns, a couple of coins have enormous upside potential. Let’s examine them more carefully.

Dash 2 Trade (D2T)

Dash 2 Trade is really a buying and selling intelligence platform that provides real-time analytics and social buying and selling data to investors, letting them make more informed buying and selling decisions.

The purchase of their native D2T token, that is set to produce within the first quarter of 2023, has elevated greater than $7.4 million. It’s also announced BitMart and LBANK Exchange listings for early the coming year, giving early investors a high probability to create some decent returns.

RobotEra (TARO)

RobotEra (TARO) is really a Sandbox-style Metaverse which will launch its alpha version within the first quarter of 2023.

Gamers can play as robots and lead to the development of its virtual world, that will include NFT-based land, structures, along with other in-game products, on its Ethereum-based platform.

1 TARO is presently being offered for .020 USDT (it may be purchased with either USDT or ETH), however this cost will rise to $.025 throughout the second stage of their presale, that will begin soon.

Calvaria (RIA)

Calvaria (RIA) is really a blockchain-based card-buying and selling game by which players fight with NFT-based cards to earn rewards. Certainly one of its most intriguing features is it enables gamers to experience it without getting any cryptocurrency, which might help it to gain traction over other crypto-based titles.

The presale for that token has elevated $2.a million and it is presently in the 4th stage, where 40 RIA can be purchased with 1 USDT.

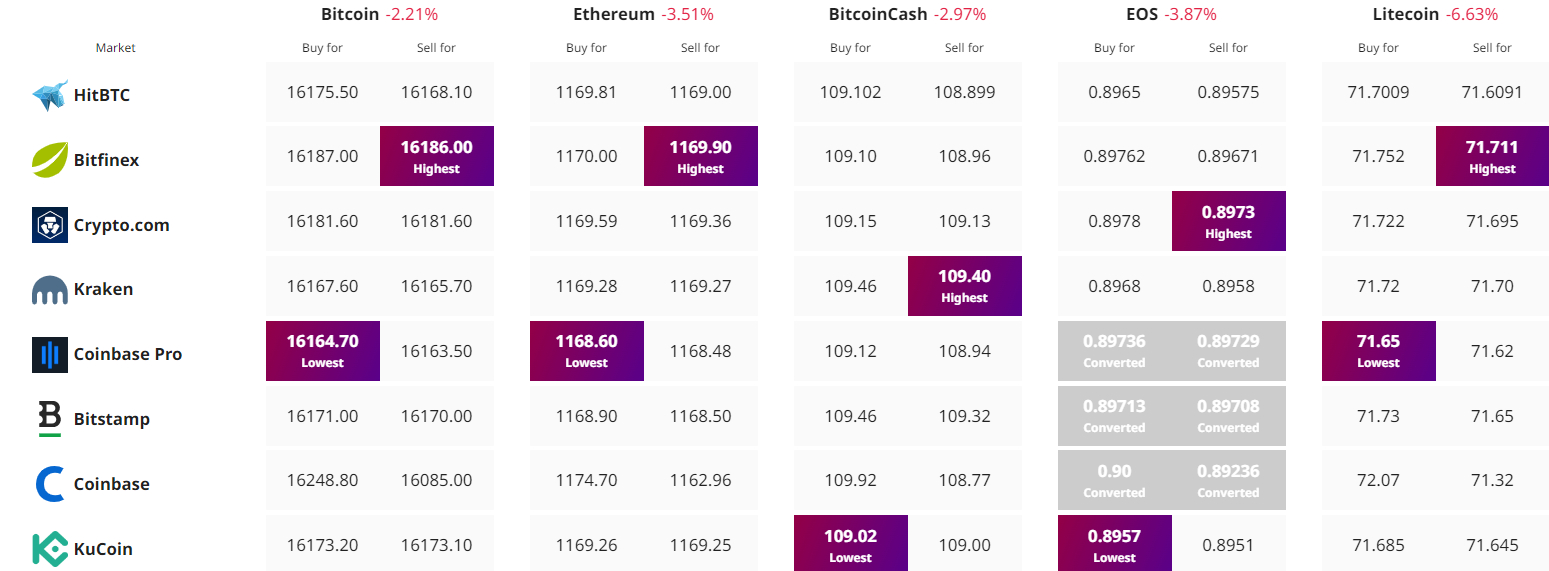

Get The Best Cost to purchaseOrMarket Cryptocurrency