The BTC/USD pair is presently buying and selling sideways, having a narrow selection of $16,750 to $16,900 on December 8. However, Bitcoin’s cost conjecture remains bearish as a result of introduction to an upward trendline.

This season, Bitcoin has dropped 75% from the previous a lot of $69,000. The reason for these losses might be related to various factors, for example the collapse of FTX and growing selling pressure from whales reducing their inflow volumes.

Furthermore, miner capitulation risk remains an issue for traders searching to go in lengthy positions.

Based on ClimateTech Vice Chair Daniel Batten, nearly 29 mining companies take into account 16.48% from the entire Bitcoin network and employ 90%-100% alternative energy. This hasn’t yet impacted the costs of BTC.

Around the positive side, PayPal, a significant financial services provider, intends to launch cryptocurrency services in Luxembourg, which might help to expand using cryptocurrencies within the Eu.

What is the news was considered among the most significant factors that may assist BTC prices in restricting further losses.

Meanwhile, Binance Chief executive officer Changpeng Zhao mentioned there are no outstanding loans around the exchange and advised anybody to verify this claim. This can be great news for cryptocurrency investors and also the industry in general.

Miner Capitulation Poses a significant Risk Within the Bitcoin Cost

Bitcoin’s downtrend might be from the elevated chance of miner capitulation, which is constantly on the scare traders trying to open lengthy positions and puts pressure around the cost of BTC.

Miners can sell their Bitcoin holdings because of tight budgets, based on on-chain statistics. It makes sense visible within the declining share values of mining companies.

The need for NASDAQ-listed cryptocurrency mining firms for example Marathon Digital, Core Scientific, Riot Blockchain, Hut 8 Mining, HIVE Blockchain Technologies, and many more have fallen by 46%, 20%, and 38% inside a month during the last six several weeks, correspondingly, and also the problem has become worse this month.

This month saw home loan business mining activity, producing a reduction in hashrate and mining difficulty. The mining market is pressurized because of low gold coin values, rising energy costs, and high debt loads.

Because of financial difficulty and declining share values, companies eventually go under, with Bitcoin being dumped like a last measure. It’s also important to note that miners’ BTC reserves have decreased by 13K BTC. Based on Glassnode, it’s presently in a 14-month low of just one,818,280.032 BTC.

CZ Confirms Zero Outstanding Loans Through the Exchange

Binance Chief executive officer Changpeng Zhao mentioned the exchange doesn’t have outstanding loans and advised anybody to verify this claim. Binance issued a Bitcoin evidence of reserves previously November 25 to exhibit that it is on-chain reserves of 582,485.9302 BTC were 1% more than total client deposits of 575,742 BTC.

Binance’s Bitcoin reserve was overcollateralized by greater than 100% of their total liabilities, based on a study released on December 7 by famous financial auditing firm Mazars. Consequently, it was considered among the major factors that may boost investor confidence.

Bitcoin Price

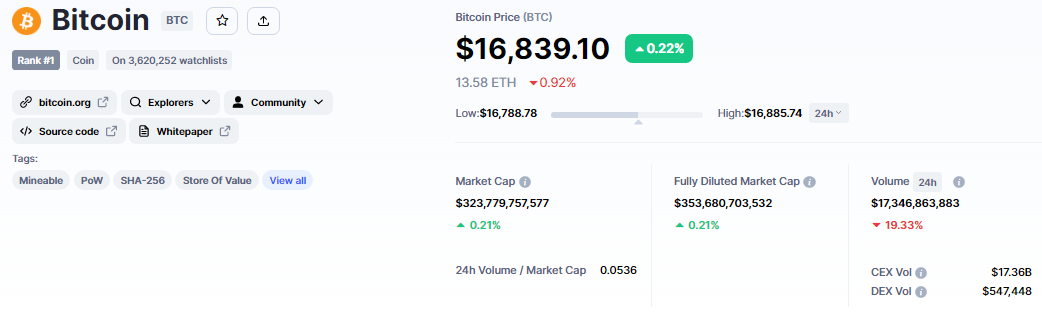

Bitcoin’s current cost is $16,844, and also the 24-hour buying and selling volume is $17 billion. The BTC cost is mainly unchanged today, getting acquired only .20%, while Ethereum, the 2nd-leading cryptocurrency, has acquired nearly 1%.

If Bitcoin prices stay below $16,900, a substantial technical level of resistance, more losses will probably come. Around the 4-hour time-frame, the $16,900 level acted as support and it was extended by an upward trendline however, the existence of Doji candle lights signifies that the downtrend might be developing.

When searching in the downside, $16,500 is a higher level of support for Bitcoin. If the level is breached, the cost of BTC could fall even more to $16,000 or $15,450.

If Bitcoin cannot sustain its recent selling trend and rather displays a bullish break above $17,000, a healthy rally to a minimum of $17,350 isn’t surprising. When the bullish trend continues, Bitcoin’s cost may achieve $17,650 or $18,000.

Massive Upside Potential Coins

Regardless of the bearish cost action, the coins here are going from strength to strength catching the interest of crypto whales.

IMPT – Presale Leads To 4 Days

The IMPT presale has elevated nearly $15 million as early investors hurry to buy the altcoin prior to it being for auction on exchanges in 7 days. The purchase is scheduled to finish in under four days, adopted by confirmed listings on Uniswap, LBANK Exchange, and Changelly Pro.

As these listings happen to be confirmed, the IMPT purchase has acquired momentum in the final stages.

Simultaneously, the Ethereum-based carbon credit marketplace’s fundamentals put it inside a strong position to secure lengthy-term growth, using the platform already showing well-liked by ESG-focused cryptocurrency investors.n

IMPT has elevated greater than $15 million in the presale to date with 1 IMPT presently selling for $.023.

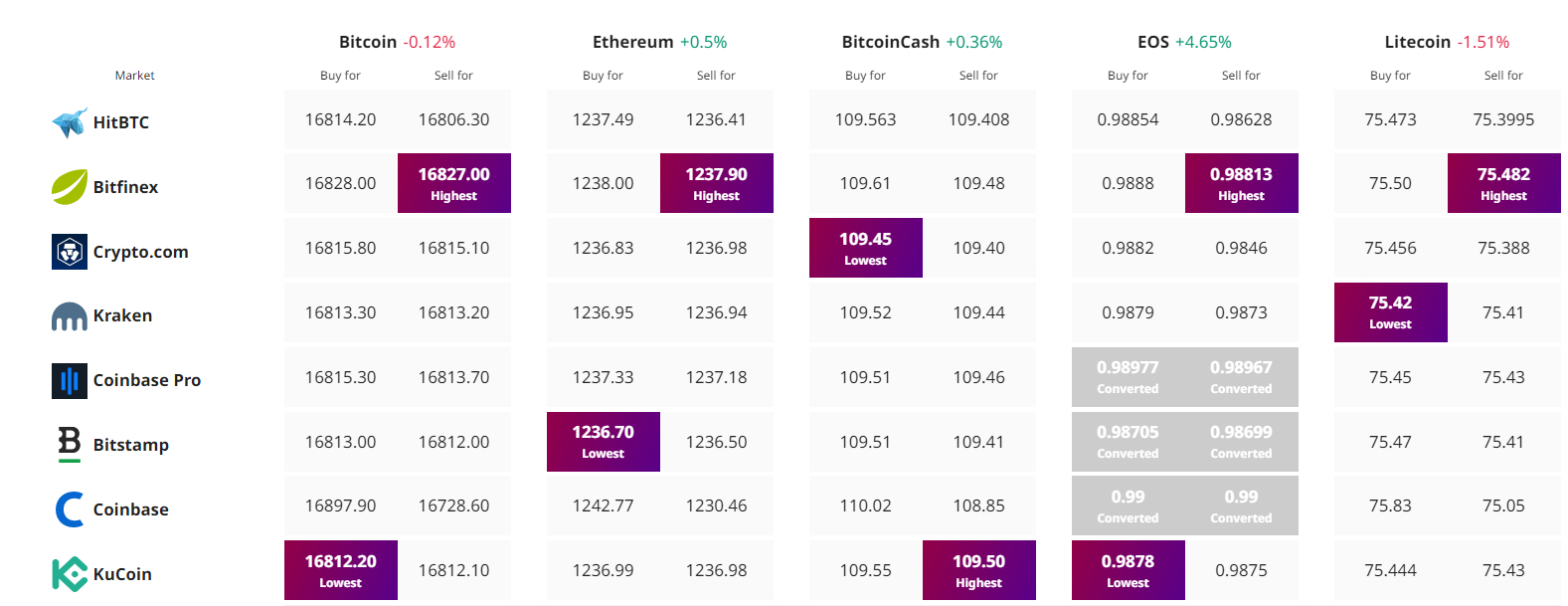

Get The Best Cost to purchaseOrMarket Cryptocurrency