Bitcoin (BTC) was buying and selling near a current cost floor because the weekend started on the bearish note. Bitcoin is buying and selling slightly lower on Saturday, underneath the 23.6% Fibonacci retracement level, with resistance at $17,250.

Stock-to-Flow Sets a brand new Low

A previously negative trend continues to be reinforced through the continuous stop by BTC’s cost within the wake from the FTX debate. This affects not just miners but additionally a number of Bitcoin’s best-known metrics, and contains repercussions for a lot of other essential areas of the Bitcoin network.

One of these simple is stock-to-flow (S2F), whose cost predictions they are under greater scrutiny and critique. The model, which used block subsidy halving occurrences like a central component in plotting exponential cost growth over time, was extremely popular until Bitcoin’s last all-time full of November 2021.

While S2F isn’t “up only,” it will permit large cost swings yet, despite individuals factors taken into account, current targets remain considerably greater compared to market cost.

On November 19th, Bitcoin should trade for any little over $72,000, or perhaps a multiple of -1.47, based on the dedicated tracking resource S2F Multiple. On November tenth, because the market felt the results of FTX, the multiple touched -1.5, an adverse studying isn’t seen before in S2F’s history.

FTX Troubles are Getting A Whole Lot Worse

Even though it’s been two days, FTX-driven fear, uncertainty, and doubt (FUD) is keeping Bitcoin prices pressurized. FTX was underneath the careful eye from the Securities Commission of Bahamas (SCB) the 2009 week.

To consider FTX’s violations, the regulator partnered using the Financial Crimes Analysis Branch. The commission’s quick denial from the SCB’s request came after FTX announced it might begin allowing Bahamian funds withdrawals. Recent news, however, implies that SCB action was taken from the exchange days prior to the analysis even started.

The 2009 week, the governing body issued an announcement saying it’d taken charge of FTX Digital Markets (FDM) funds and transferred these to an electronic wallet managed through the SCB. The commission claimed they did this to safeguard customer money and assets.

With increased government bodies searching in to the FTX exchange, the business’s already dire situation deteriorated further. Disruptions towards the cryptocurrency market have adopted the exchange’s closure. Due to this, individuals who hold BTC/USD might choose to liquidate their holdings for safety reasons.

The unpredictable market movement does mean the cost may go up, lower, or sideways.

Bitcoin Cost Conjecture

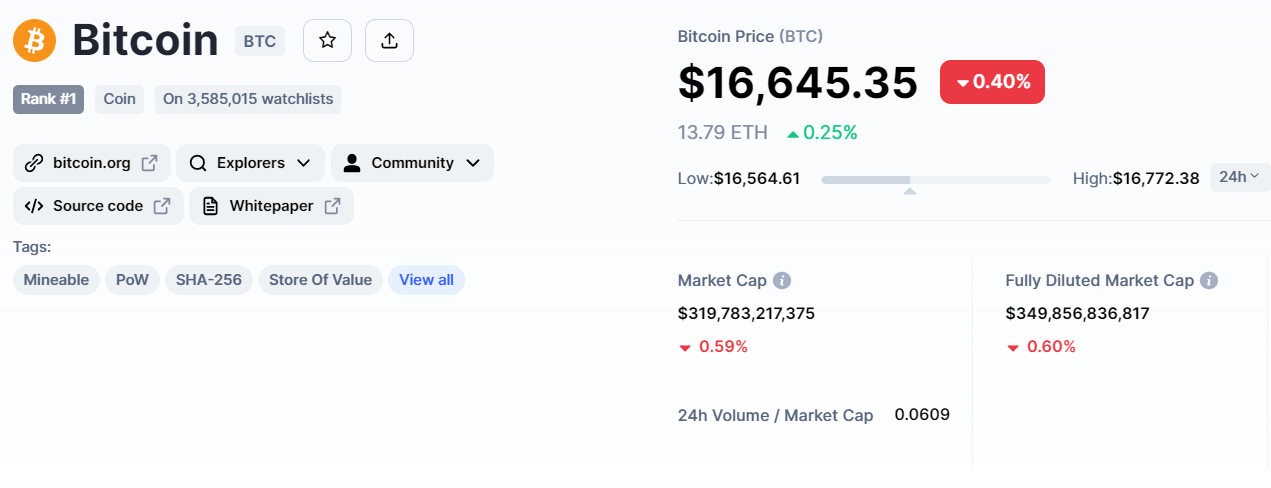

It started buying and selling at $16,683, having a a lot of $16,772 along with a low of $ 16,564. BTC/USD is presently buying and selling at $16,653, lower by nearly .50% in 24 hrs. CoinMarketCap now ranks first, having a live market cap of $320 billion.

It features a total way to obtain 21,000,000 BTC coins along with a circulating way to obtain 19,211,562.

Bitcoin’s cost is consolidating inside a wide buying and selling range, presently between $15,800 to $17,200. Since Bitcoin’s cost dropped underneath the 23.6% Fibonacci degree of $17,250, the likelihood of a downtrend remain strong before the next support section of $15,800.

Around the downside, Bitcoin’s immediate support reaches $14,530, and when the bearish trend continues, the cost could fall as little as $13,850. Since the RSI and 50-day moving average indicate a bearish bias, the cost of Bitcoin could fall below $15,830 if current support does not hold.

Today, however, the selling bias remains strong underneath the $17,250 level. However, elevated BTC demand can push the BTC/USD cost above $18,250 and toward $20,000.

Top Crypto Coins on Pre-Sale

Dash 2 Trade (D2T)

Dash 2 Trade is definitely an Ethereum-based buying and selling intelligence platform that gives real-time analytics and social data to traders of abilities, letting them make more informed decisions.

It began its token purchase three days ago and it has already elevated greater than $6.5 million. Additionally, it announced its first CEX listing on LBank exchange.

The present worth of 1 D2T is .0513 USDT, however this is anticipated to increase to $.0533 within the next stage of sales and $.0662 within the final stage.

Calvaria (RIA)

Calvaria is really a new cryptocurrency gaming project that can dominate the marketplace for play-to-earn games. Among the primary barriers to prevalent Web3 gaming adoption, based on Calvaria developers, is the fact that games require users to possess technical understanding of crypto. Which means that a lot of users are excluded.

Consequently, Calvaria enables users who don’t own cryptocurrency to have fun playing the game, distinguishing it in the competition and allowing another audience to sign up.

Calvaria’s presale is obtaining steam, using the project already in stage 4 of 10 and nearly $1.8 million in funding.

1 RIA token costs $.025 right now, however this will rise incrementally with every subsequent stage from the presale, that is presently in Stage 4.

RobotEra (TARO)

Another project using the possibility to alter the gaming community and also the virtual world is RobotEra (TARO). Even though the asset’s presale only has lately begun, there’s already lots of interest from potential customers.

The platform’s native token is TARO, which is a blockchain-based Metaverse where users can make avatars and explore an electronic world. Players in RobotEra can purchase land, develop it, and expand their regions with assorted assets.

RobotEra also offers a shared metaverse where users can participate in a number of activities for example sports, concerts, along with other competitive occasions. The very first stage of TARO’s presale has become live, which is rapidly selling out.

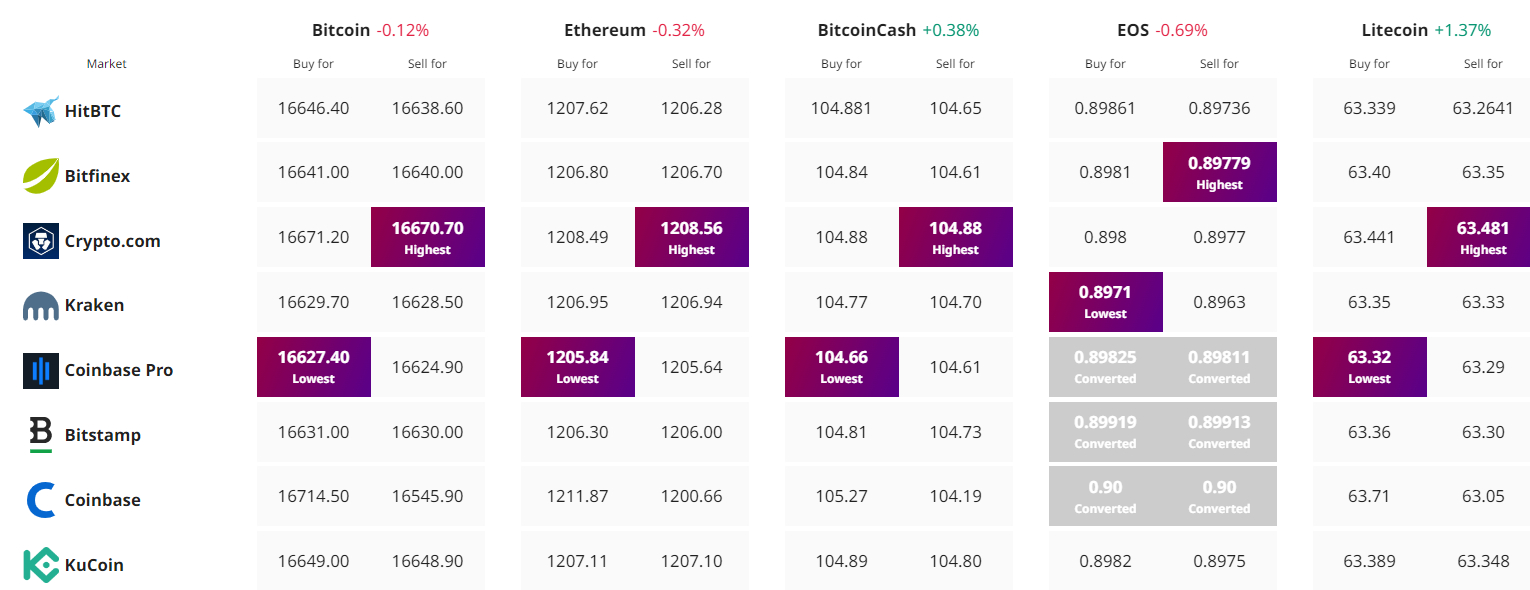

Get The Best Cost to purchaseOrMarket Cryptocurrency