On November 28, Bitcoin price conjecture will probably remain bearish under $16,360 support, that will become resistance. Protests in China, the earth’s second-largest economy, have caused the majority of the selling pressure within the overall cryptocurrency market.

The cryptocurrency marketplace is falling like a wave of investor jitters taken global markets, fueled by protests in China against Covid limitations. Protesters outraged through the harsh COVID-19 rules required the resignation of China’s strong leader.

Updates: China Unrest Situation

A fireplace in a condominium in Urumqi, within the northwesterly province of Xinjiang, wiped out a minimum of ten people on November 24. Due to China’s zero-covid policy, many victims were trapped in their homes and were not able to leave. Protests started on November 25 in lots of metropolitan areas, such as the nation’s capital, Beijing, and a large number of college campuses.

China’s economy may be the world’s second-largest. Consequently, it features a significant effect on worldwide markets, prompting investors to find safe havens for his or her investments. Investors’ risk aversion has a tendency to increase the need for safe-haven assets like the US dollar, bonds, and also the yen.

The continuing unrest in China may exploit a vulnerability within the cryptocurrency markets, which happen to be rattled through the collapse from the crypto exchange FTX earlier this year. In addition, because stocks and cryptocurrencies are dangerous assets, they’re experiencing negative market action.

The earth’s markets were pressurized on November 28 as investor concern increased. The result are visible in the cryptocurrency industry, using the entire crypto market falling by 3% the day before. Furthermore, because of the strong correlation between your cost of cryptocurrency and also the stock markets, BTC/USD remains a dangerous asset, which is its recent decline.

Bitcoin Storage on Exchange Platforms is Declining

Santiment, a blockchain analysis company, tweeted an amount on November 26 demonstrating the number of Bitcoin’s supply traded on exchanges has fallen to single digits.

The tweet mentioned that “just 6.95% of Bitcoin is located on exchanges,” talking about a sluggish trend in BTC getting into child custody that started in March 2020. However, the current FTX volatility has faster the popularity.

Based on Santiment, the quantity of Bitcoin on exchange platforms has dropped the very first time since November 24, 2018. In addition, based on Glassnode statistics, output from bitcoin exchanges has arrived at an exciting-time high (ATH).

During the last thirty days, cryptocurrency exchanges have forfeit as many as 179,250 Bitcoin. The amount of confirmed transactions each day surpassed the multi-month a lot of 246K. You should observe that exchange withdrawal transfers taken into account 29.2% (77.1k withdrawals) of total transactions.

However, the exchange of deposit transfers makes up about 18.2% of total transactions (48.1k deposits). It shows that the marketplace is nearing its bottom, and BTC/USD is falling.

The collapse of Crypto Exchanges

The collapse of FTX and Alameda is distributing, with plenty of other crypto exchanges and initiatives experiencing liquidity issues. Genesis Buying and selling, Gemini, along with other exchanges have temporarily stopped buying and selling and withdrawals for many or all accounts.

If creditors are not able to enable them to using their liquidity issues, Genesis Buying and selling, a division of Digital Currency Group, has mentioned that declaring personal bankruptcy might be a choice.

Grayscale, Genesis Trading’s sister company and GBTC’s supervisor, has mentioned that they’re unsusceptible to the situation. However, some investors remain concerned because of the market’s fragility and insufficient certainty.

The careful attitude reflects the magnitude of future uncertainty, because it seems that increasingly more companies are now being impacted.

The cryptocurrency market’s uncertain condition justifies the prior week’s low cost performance and explains why there is not much demand from investors. Because of the continuing turbulence within the cryptocurrency market, the need for BTC/USD is falling.

Bitcoin Cost

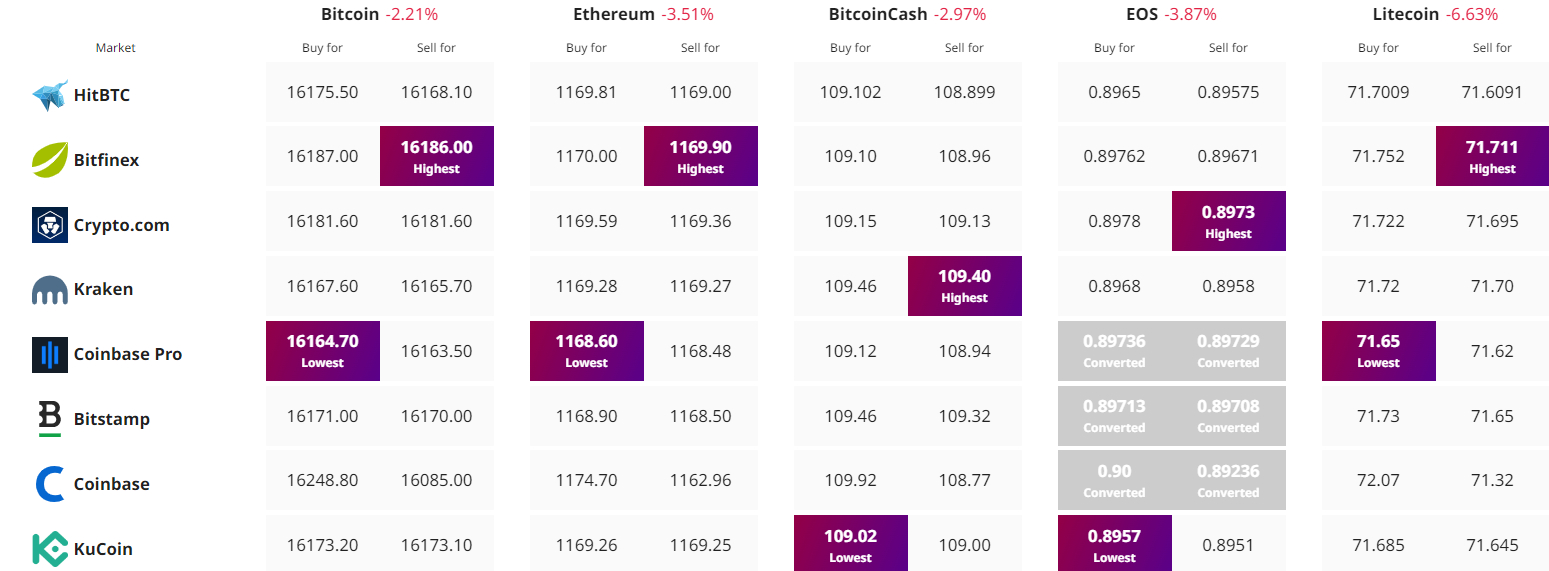

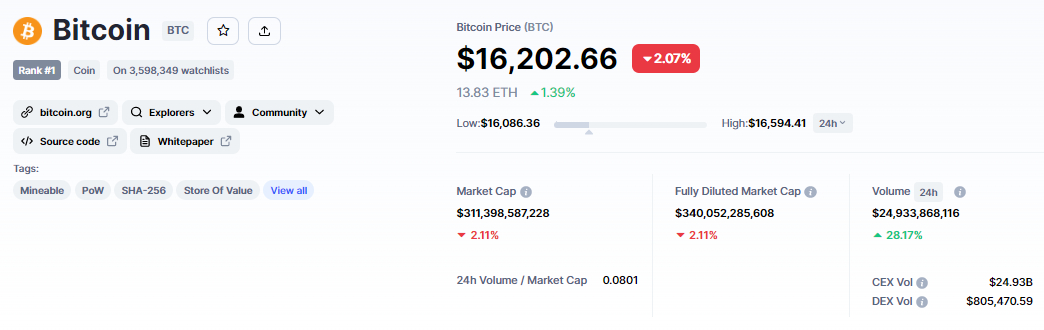

The present Bitcoin cost is $16,174 and also the 24-hour buying and selling volume is $24 billion. Over the past 24 hrs, the BTC/USD pair has dropped nearly 2%, while CoinMarketCap presently ranks first having a live market cap of $311 billion, up from $310 billion throughout the Asian session. It features a total way to obtain 21,000,000 BTC coins along with a circulating way to obtain 19,218,643 BTC coins.

On Monday, the BTC/USD pair is buying and selling lower after denial underneath the $16,600 level of resistance, that was extended with a downward trendline.

Within the 4-hour time-frame, Bitcoin has created a climbing down triangular pattern, which generally drives a selling trend.

Bitcoin is presently buying and selling at $16,150, by having an immediate support degree of $16,000 around the corner. Bitcoin’s next support level, based on this, is $15,650, that is extended with a double bottom support level.

Leading technical indicators such as the RSI and MACD have been in a sell zone, indicating that there’s lots of selling pressure. The 50-day moving average is extending resistance at $16,450, implying the downtrend will likely continue.

If buyers go into the market, a bullish breakout from the $16,450 level could propel Bitcoin to $17,000 within days.

Cryptocurrency Pre-Purchase With Massive Profit

Despite market slowdowns, a couple of coins have enormous upside potential. Let’s examine them more carefully.

Dash 2 Trade (D2T)

Dash 2 Trade is definitely an Ethereum-based buying and selling intelligence platform that gives traders of abilities with real-time analytics and social data, letting them make smarter-informed decisions. The woking platform goes reside in the very first quarter of 2023, supplying information to investors to enable them to for making positive buying and selling decisions.

After raising $seven million in only more than a month, Dash 2 Trade, a platform for crypto buying and selling intelligence and signals, has piqued investors’ interest. Consequently, the D2T team has made the decision to abandon the work at stage 4 and lower hard cap target to $13.4 million.

Dash 2 Trade has additionally been successful, with two exchanges (LBank and BitMart) pledging to list out the D2T token when the presale has ended.

1 D2T is presently worth .0513 USDT, however this will rise to $.0533 in the finish from the purchase. D2T has elevated greater than $7.4 million to date by selling greater than 84% of their tokens.

RobotEra (TARO)

RobotEra (TARO) is really a Sandbox-style Metaverse which will release an alpha version within the first quarter of 2023. Gamers can play as robots on its platform which help build its virtual world, that will include NFT-based land, structures, along with other in-game products.

TARO has elevated over $269,000, and something TARO is presently offered for .020 USDT (it may be purchased with either USDT or ETH), however this cost will rise to $.025 throughout the second stage of their presale, that will begin soon.

Calvaria (RIA)

Calvaria is really a new gaming company that can monopolize the play-to-earn market. Based on Calvaria (RIA) developers, the requirement of digital currencies to be able to play has shown to be a significant barrier to prevalent Web3 gaming adoption.

Consequently, the sport may have both free-to-play and pay-to-win modes, using the free-to-play mode available to players who don’t possess cryptocurrency.

The presale has elevated nearly $two million since its beginning and it is now in the final stages following the developers made the decision to finish it early. The presale was designed to last ten stages and can include 300 million RIA tokens.

However, the developers have made the decision to change the presale offering, meaning stage 5 would be the final opportunity for investors to buy RIA prior to being released towards the public market, where costs are likely to skyrocket.

Get The Best Cost to purchaseOrMarket Cryptocurrency