The key cryptocurrency, Bitcoin, is buying and selling sideways, using the cost remaining inside a limited selection of $22,500 to $23,350. On The month of january 23rd, BTC/USD closed at $23,114 after reaching a higher of $23,114.

Bitcoin Reaches Historic Highs, Surpassing $23K Mark

BTC, the earth’s largest cryptocurrency by market capital, arrived at $23,000 the very first time since mid-August 2022 on Saturday. This level was breached again on Monday, indicating a potential bullish trend ahead.

This upward trend also pressed the entire cryptocurrency market cap above $1 billion the very first time in five several weeks. There have been numerous causes of the bullish momentum in Bitcoin prices that drove them over the $23K mark. Let’s now examine them.

Positive CPI Data

The CPI report released on The month of january 12 demonstrated a .1% reduction in overall inflation, the biggest drop since April 2020. The marketplace grew to become more positive as inflation ongoing to be seduced by six several weeks consecutively.

In addition, bets around the Fed backing lower from your aggressive rate of interest hike elevated. Consequently, BTC prices elevated, raising the possibilities of an extensive crypto market recovery.

Going Through The US Dollar Index Weakness

Bitcoin prices were also taking advantage of a weakening US Dollar Index. In the past, whenever the DXY falls, risk asset sentiment increases. Because of the united states Dollar Index’s weakness, Bitcoin may be the riskier asset gain.

Given rising expectations for slower Given rate hikes, the DXY was pressurized because the week started, testing a brand new 9-month low.

Bitcoin and Equities Correlation

The correlation coefficient between Bitcoin and major stock indices has lately been high. The S&P500, Dow jones Johnson, and NASDAQ would be the major indices that offer an over-all summary of the economy. It’s not uncommon for rates of interest to become decreased, resulting in the economy to develop and, consequently, equities to increase.

Because of their high correlation coefficient, better performance of those indices will give you a more powerful push to Bitcoin prices. The bullish equity financial markets are also driving Bitcoin prices nowadays.

On Monday, the Dow jones Johnson Industrial Average (DJI) acquired 1.1%, the NASDAQ acquired 2.4%, and also the S&P 500 (SPX) acquired 1.5%.

As the BTC cost is indicating bullish prospects for the short term, among restored wants rate of interest cuts, you may still find numerous challenges to think about. The main chance of centralized exchange insolvency, in addition to Binance reserve concerns.

Additionally, the personal bankruptcy of Genesis and looming crypto legislation are the factors stopping BTC prices from rising further. In addition, many of these factors have brought some analysts to think that BTC could fall as little as $15,000 soon.

Bitcoin Price

Bitcoin is presently worth $22,800 and it has a 24-hour buying and selling amount of $28 billion. Within the last 24 hrs, Bitcoin has surged by nearly 1%. CoinMarketCap presently ranks first having a live market cap of $435 billion.

Every day, Bitcoin is encountering strong resistance near a dual-top pattern at $22,830. When the candle lights close below this level, a bearish correction will probably begin and continue before the $21,500 level is arrived at.

The RSI and MACD indicators are overbought, indicating the potential of a bearish correction in BTC. When the cost of Bitcoin falls below $21,500, it might fall as little as $20,450.

Around the upside, Bitcoin’s immediate resistance reaches $22,850, along with a break above this level could expose BTC to levels up to $23,900 and $25,150.

Bitcoin Alternatives

If you are searching for other high-potential crypto projects alongside BTC, we have reviewed the very best 15 cryptocurrencies for 2023, as examined through the CryptoNews Industry Talk team.

Their email list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Talk section features insights by crypto industry players and isn’t an element of the editorial content of Cryptonews.com.

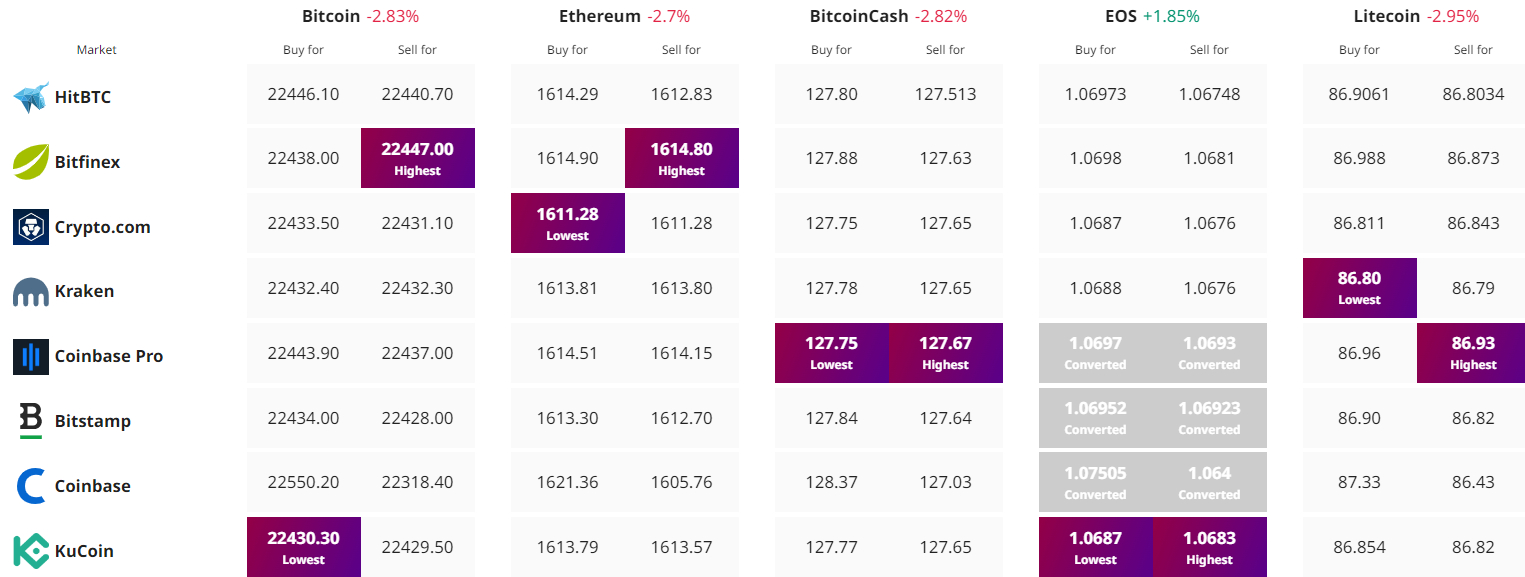

Get The Best Cost to purchaseOrMarket Cryptocurrency