Throughout the European session, Bitcoin finally made some upside movement, getting bounced from the double-bottom support degree of $15,650. Genesis Global Capital, among the largest cryptocurrency lenders, stopped customer withdrawals as a result of liquidity issue brought on by a rise in withdrawal demands following a FTX collapse.

Following a demise of FTX, Genesis announced on November 16 that withdrawals could be temporarily stopped because of “unparalleled market turmoil.”

On November 10, the organization disclosed openly it had money kept in an FTX buying and selling account worth roughly $175 million. The battling cryptocurrency investment bank is at talks with potential investors about raising another $1 billion.

In addition, based on reports, the cryptocurrency exchange Binance held discusses potentially saving the loan provider controlled through the Digital Currency Group.

The Wall Street Journal reported on November 21 that Genesis had contacted Apollo Global Management and Binance for funding. Binance, however, rejected it because of potential conflicts of great interest. Because it seeks new funding, Genesis Global Buying and selling has pointed out personal bankruptcy just as one option.

On November 21, Genesis mentioned it had “no plans” to declare personal bankruptcy in the near future and would attempt to achieve a “consensual” solution. Due to the news, BTC/USD fell to new two-year lows.

Insufficient Rely upon Exchanges Triggers FUD

The current Bitcoin decline surprised most market participants since the dust had settled following a FTX crisis. Despite Santiment’s explanation, the very first cryptocurrency continues to be battling to keep its value.

Santiment, an analytical firm, tweeted concerning the declining worth of BTC/USD on November 21. Based on the research firm, FUD caused the drop to $15,800 the very first time in 2 years because of the growing anxiety about centralized exchanges following a FTX crisis.

The incident might have also had an effect on Bitcoin address activity, which in fact had arrived at a six-month high. In addition, based on Santiment, Bitcoin arrived at the benchmark over the past weekend.

On November 20, 1.a million BTC addresses were active every day, based on data analysis. It recommended the currency was given to numerous addresses.

In addition, it made an appearance that lots of investors profited by transferring assets from centralized exchanges. It had been because of the fact supplying outdoors of exchanges outweighed inflows into exchanges. In addition, the reported exchange increase has decreased in recent days.

On November 17, the newest increase per inflow was 253,000. It recommended that, despite little selling pressure, investors continued to be skeptical of CEXes.

El Salvador’s Bitcoin Adoption “not so Sustainable”

Vitalik Buterin, the creator of Ethereum, has asked the Bitcoin community’s enthusiasm for El Salvador and it is president, Nayib Bukele, claiming they have overlooked the truth that Bukele’s administration is “not so democratic.”

Based on Ethereum co-founder Vitalik Buterin,

“many Bitcoin users overlooked the truth that the federal government in Bukele isn’t a particularly democratic government, it provides extensive issues, and they are terrible at respecting other individual freedoms.”

El Salvador was the very first country to create Bitcoin legal tender, requiring companies to simply accept the biggest cryptocurrency as payment.

The experience sparked prevalent bitterness among citizens and companies. The adoption of El Salvador’s Bitcoin law coincided using the cryptocurrency Bull Run, where the cost of Bitcoin arrived at a higher in excess of $69,000.

The cryptocurrency market has collapsed, with Bitcoin losing greater than 76% of their value since its peak.

Buterin mentioned the Bitcoin adoption model in El Salvador was built around the assumption that prices would rise, speculate Bitcoin’s cost fell, “it now looks just terrible, and never so many people are utilizing it.”

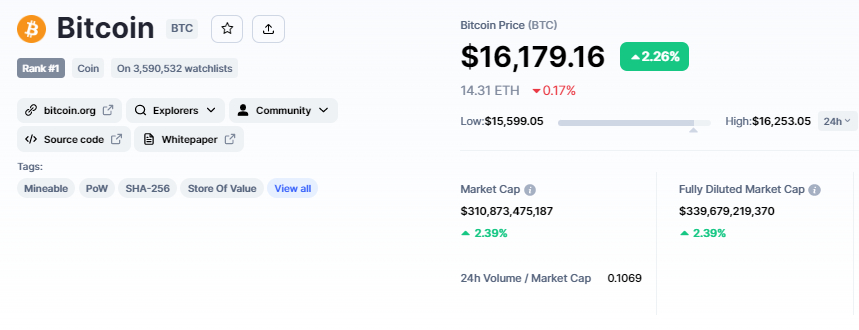

Bitcoin Price

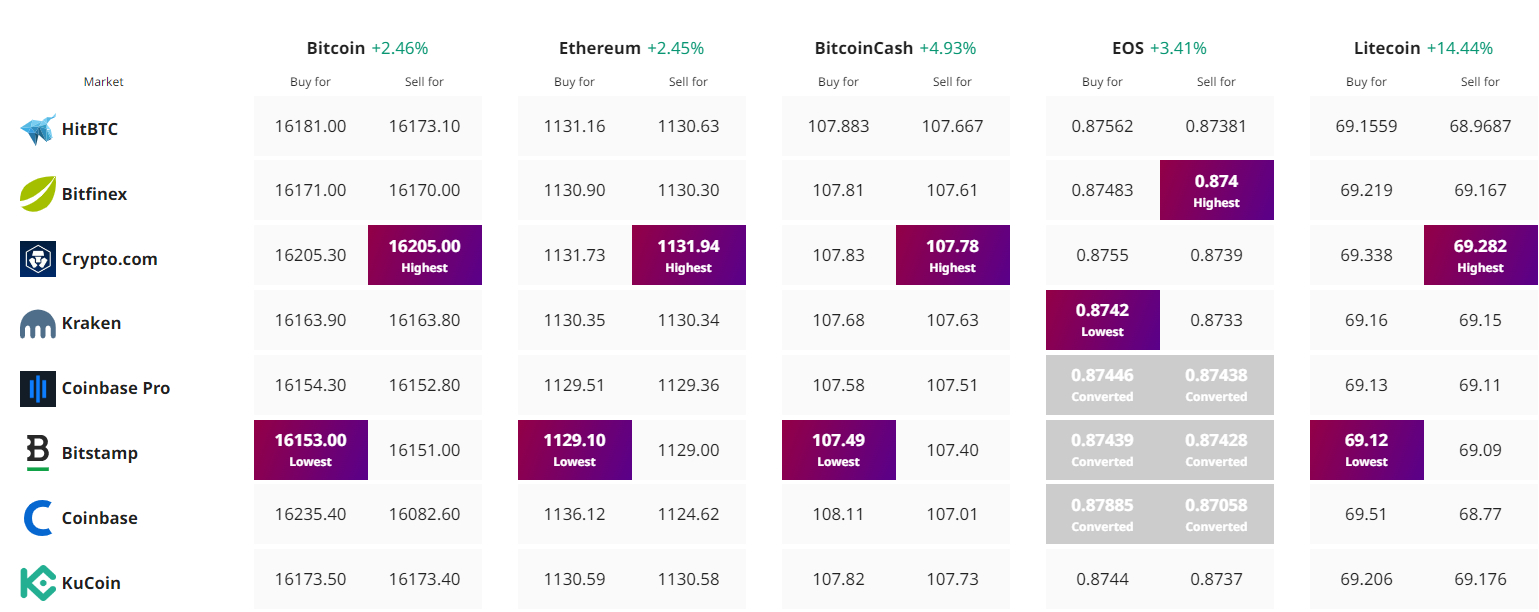

The present Bitcoin cost is $16,156, and also the 24-hour buying and selling volume is $33 billion. Bitcoin has acquired by over 2% within the last 24 hrs.

CoinMarketCap now ranks first, having a live market cap of $310 billion. It features a total volume of 21,000,000 BTC coins along with a circulating way to obtain 19,213,406 BTC coins.

The BTC/USD pair started buying and selling at $15,766 on November 22, reaching a higher cost of $16,281 along with a low cost of $15,616. Close to the $15,850 level, Bitcoin is gaining immediate tech support team. Candle lights closing above this level indicate the potential of a bullish reversal.

A tweezer’s bottom pattern above $15,850 suggests the potential of a bullish reversal. Consequently, elevated buying pressure may propel an upward trend towards the $16,500 and $17,180 resistance levels.

When the $17,180 level is damaged again, there might be more room for purchasing before the $18,650 level, that is extended through the 38.2% Fibonacci retracement level.

The RSI and MACD indicators continue to be indicating a sell trend below $16,500, and also the 50-day moving average can also be indicating a sell trend. Consequently, a bearish breakout below a triple bottom pattern may expose the BTC cost towards the $14,475 range.

Today, keep close track of $15,850 as chances are it will behave as a pivot point for Bitcoin.

Presale Cryptocurrency With Enormous Potential Gains

Dash 2 Trade (D2T)

Dash 2 Trade, produced through the Learn 2 Trade service, provides investors with market-driven insights, buying and selling signals, and conjecture services. The cryptocurrency initiative offers to provide consumers with sufficient information to create seem decisions.

D2T is definitely an Ethereum-based buying and selling intelligence platform that gives traders of abilities with real-time analytics and social data, letting them make more informed decisions.

D2T started selling tokens three days ago and it has elevated greater than $6.8 million. Additionally, it announced the start of its first CEX listing on LBank market. The present worth of 1 D2T is .0513 USDT, however this is anticipated to increase to $.0533 within the next stage of sales and $.0662 within the final stage.

Get The Best Cost to purchaseOrMarket Cryptocurrency