Following a discharge of the Given rate hike decision, that is strengthening the united states dollar and finally creating a stop by BTC cost, Bitcoin cost conjecture has switched bearish. Bitcoin cost arrived at a higher of $18,400 before an adverse reaction. Now, BTC is buying and selling near to an important support level, having a possible rebound if prices review $17,550.

The worldwide crypto market cap declined 1.42% to $857.98 billion on the day before, as major cryptocurrencies plummeted in early stages December 15. The whole cryptocurrency market volume during the last 24 hrs is $45.67 billion, a 14.40% decline.

DeFi’s total volume is presently $2.94 billion, comprising 5.49% from the entire 24-hour volume within the crypto market. The general amount of all stablecoins has become $53.26 billion, comprising 99.53% from the total 24-hour amount of the crypto market.

US Given Rate Of Interest Decision is Announced

On Wednesday, the Fed Board dicated to raise rates of interest by .5 percentage points, a smaller increase compared to recent several weeks. After an remarkable year that incorporated seven consecutive rate hikes included in a hostile push to try and bring lower the greatest inflation because the early 1980s, the central bank has made the decision to shift gears and lift rates.

The speed hike authorized by the Fed on Wednesday was smaller sized compared to four consecutive three-quarter point hikes approved at previous Given conferences, however it was still being two times the size of the central bank’s customary quarter-point increase, and it’ll likely worsen the financial damage for countless American companies and households by growing the price of borrowing.

Given officials have made the decision to boost the speed that banks charge one another for overnight lending to a variety of 4.25-4.5%, the greatest rate since 2007.

The Fed also released its lengthy-anticipated Review of Economic Projections, also referred to as the us dot plot. These projections reveal where all of its 19 leaders expects rates of interest to get in the long run, and investors seriously consider them for signals concerning the trajectory of rate hikes in next season and beyond.

The median “us dot” for federal fund rates in December predictions rose to a different height of 5-5.25% from 4.5-4.75% in September, indicating a far more aggressive tightening path for financial policy. That will imply the Fed Board now intends to raise rates of interest by .5 percentage points, up in the previous projection made three several weeks ago.

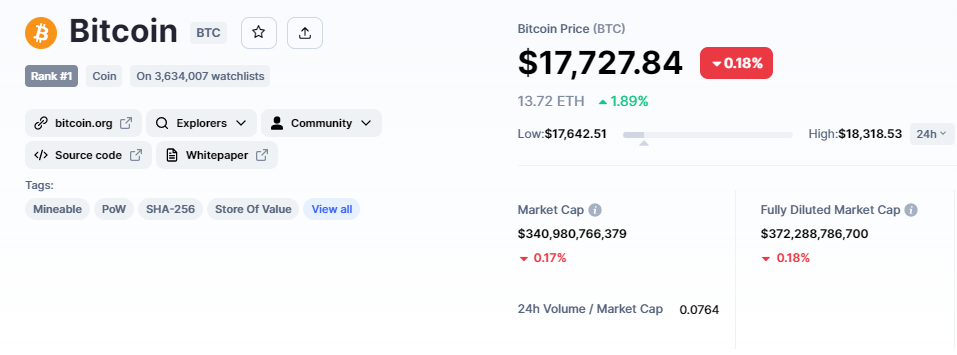

Bitcoin Price

Bitcoin’s current cost is $17,725, and also the 24-hour buying and selling volume is $26 billion. The BTC cost has stepped nearly .20% since yesterday.

Despite getting damaged via a critical level of resistance close to $18,150, Bitcoin is presently buying and selling bearish. However, following a announcement from the Given rate hike, Bitcoin fell underneath the $18,000 mark. This signifies the selling trend could continue.

Leading technical indicators, like the relative strength index (RSI) and also the moving average convergence divergence (MACD), are presently positive, implying that Bitcoin’s cost may rise after finishing the Fibonacci retracement at $17,440.

The following major level of resistance for Bitcoin is about $18,125, along with a break above this level can lead to further gains along with a cost of $18,600.

Around the downside, the amount of $17,440 is support for that cost of BTC. This level has formerly offered like a barrier, and chances are it will maintain BTC’s bullish trend. A bearish crossover below this level, however, can lead to a stop by the cost of BTC towards the $16,850 level.

Dash 2 Trade (D2T) – Presale within the final stage

The work mentioned today that the countdown to the initial listing on the centralized exchange would begin when the token purchase meets the $ten million milestone. When the $ten million goal is arrived at prior to the completing happens 4 presale, Dash 2 Trade can place DASH on CEX in the finish from the presale.

Changelly Pro, LBank, and BitMart are the initial centralized exchanges to accept list the token immediately when the presale concludes, which means this news follows the state confirmation from the third CEX listing contract produced by the crypto project

On Thursday, December 15 at 17:00 UTC, Trevor Primary, community manager for Dash 2 Trade, may have an AMA (ask me anything) around the Coinsniper Telegram.

Calvaria (RIA)

Calvaria (RIA) is really a blockchain-based game that enables players to gather, trade, and fight with NFT-based cards. It’s a play-to-earn game which enables users to experience without getting any cryptocurrency, which might let it achieve a broader audience.

RIA is going to be used within its ecosystem for getting in-game products as well as for staking, passing on a powerful use situation. The presale for that token has elevated approximately $2.4 million and it is presently in the fifth stage, which is its final stage.

RobotEra (TARO)

RobotEra (TARO), another Ethereum-based platform, is really a Sandbox-style Metaverse that will permit gamers to experience as robots and lead to the development of its virtual world. Including the development of NFT-based land, structures, along with other in-game products, along with the game’s objective of allowing players for connecting along with other metaverses and make an interoperable multiverse.

1 TARO is presently being offered for .020 USDT (it may be purchased with either USDT or ETH), however this cost will rise to $.025 within the second stage of their presale. It’s already elevated greater than $553,000.

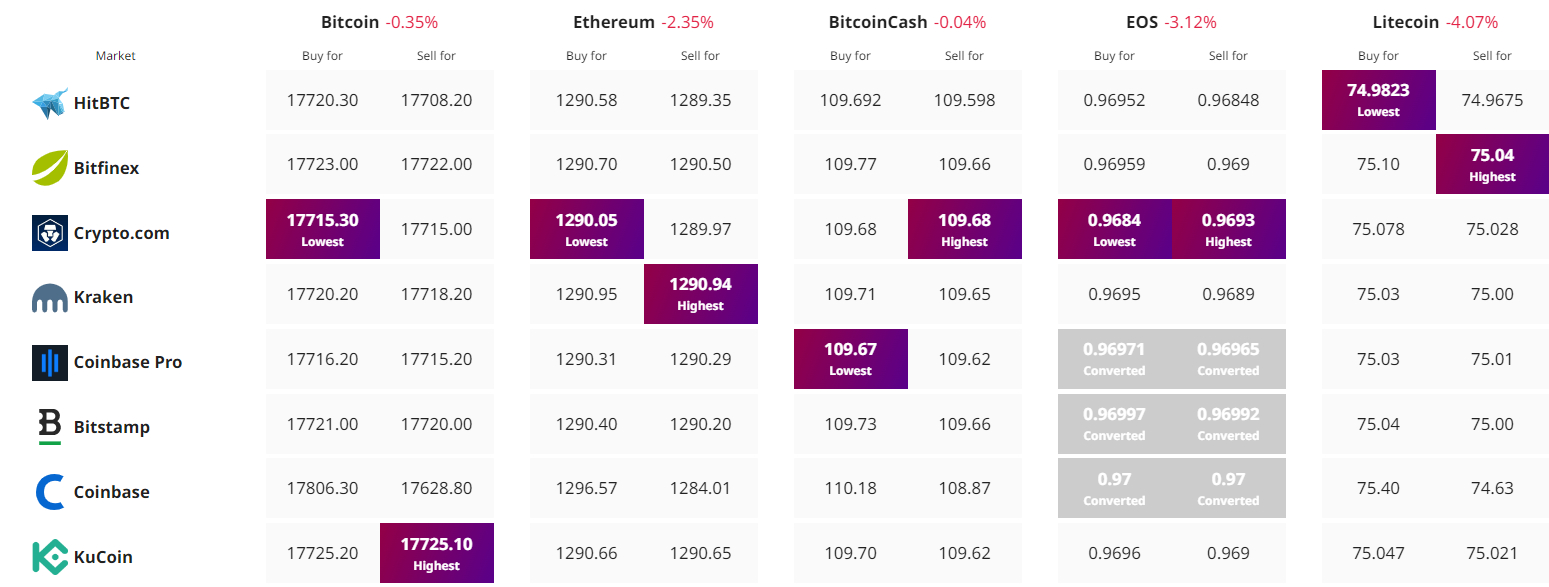

Get The Best Cost to purchaseOrMarket Cryptocurrency