Bitcoin is buying and selling slightly bullish at $19,223 throughout the European session, getting bounced from the support section of $19,000. On October 22, the BTC/USD began your day at $19,175 and fluctuated between unparalleled combination of $19,191.00 along with a low worth of $19,125.

A slew of fundamentals appear to become under BTC demand. Are we able to expect BTC to surge by 20%? Let us discover.

Mobile Bank N26 Begins Trading Cryptocurrencies

The German fintech N26, that is worth $9 billion, has added cryptocurrency buying and selling to the mobile application. N26 Crypto’s users can buy and trade 200 cryptocurrencies, including Bitcoin and Ether, starting in Austria and expanding abroad within the coming several weeks.

Based on the Berlin-based fintech, the Austrian launch reacts to “high local demand,” with 40% of N26 customers positively buying and selling or expressing curiosity about cryptocurrencies.

Within the next six several weeks, N26 intends to expand its cryptocurrency buying and selling plan to numerous untouched markets. Customers with verified identities have access to N26 Crypto through the “Buying and selling” portion of their N26 app’s brand-new “Finances” tab.

Consequently, users can purchase cryptocurrency using their fiat banking account. Standard accounts possess a transaction fee of just one.5% for Bitcoin and a pair of.5% for other currencies, with a lot more discounts open to proprietors of N26 metallic cards. This news will work for the whole cryptocurrency market, especially BTC.

Bitcoin Miners Struggle among Low Hash Rate & Rising Energy Prices

Energy issues in The United States and Europe, combined with current condition from the market, predict another disappointing quarter for Bitcoin mining companies on continents. The Hashrate Index’s newest Q3 mining report identified several variables adding to some considerably lower hash cost and greater cost to mine 1 BTC.

Due to the stop by hash cost, several miners using mid-range equipment find it difficult to pay the bills. Retail miners have formerly offered or abandoned rigs that may not be found profitably.

Based on Hashrate Index, heat waves from the American summer time caused a stop by the hash rate, which coincided having a minor recovery within the cost of BTC. In the center of Q3, it provided some respite for Bitcoin’s hash cost.

Fed’s Attitude on Rate Hikes Might Change

Bitcoin’s buying and selling bias remains bearish as analysts claimed the Given was altering its stance on rate hikes in front of the Federal Open Market Committee (FOMC) meeting on November 1-2.

They speculated the November increase may be the final 75-basis-point adjustment, with smaller sized ones to follow along with, citing mainstream media quotes from Given officials.

“Some officials tend to be more prepared to adjust their rate setting to prevent overtightening,” writes Nick Timiraos, the Wall Street Journal’s top financial aspects correspondent.

Following his remarks, Timiraos was chastised, with a few accusing him of dripping market-sensitive information.

But after disagreements about how exactly the Given should raise rates of interest, the cost of BTC drops with a lot, however it rapidly recovers its lost position. However, a substantial drop occurs following disagreements over Given rate hike policies, with BTC cost action reclaiming its lost position.

Bitcoin Cost Conjecture – Can BTC Surge 20% Today?

Bitcoin is anticipated to manage immediate resistance close to the $19,300 level, that is supported with a symmetrical triangular pattern. Additionally, the 50-day moving average (MA) keeps BTC below $19,250.

A bullish breakout from the $19,300 level could expose BTC to another level of resistance of $19,650 or $19,950. A rest below $18,920 support, however, may push BTC to $18,600 or $18,400 levels.

Alternative – Dash 2 Exchange the Highlights

Since BTC is buying and selling choppily, we are able to put our money into projects rich in returns as the cost is low. Cryptocurrency traders, for instance, will quickly get access to real-time market data, insights, and analysis through the Ethereum-based Dash 2 Trade platform.

The Dash 2 Trade presale, which began on October 20, has rapidly arrived at significant milestones, surpassing $a million. It is over $a million, and it is on the right track to achieve a couple of higher milestones within the coming hrs.

While forecasting the long run is tough, D2T seems to possess a very vibrant future given its strong fundamentals.

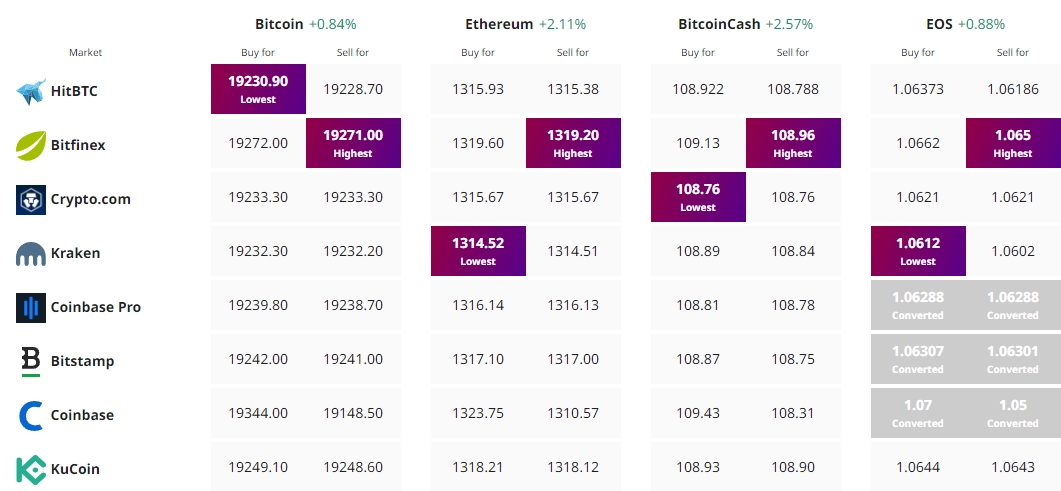

Get The Best Cost to purchaseOrMarket Cryptocurrency