On Sunday, Bitcoin cost conjecture remains neutral, as BTC has unsuccessful to get out of a narrow selection of $16,850 to $17,250. Bitcoin miners have the symptoms of abandoned the lengthy-term profitability of holding any tremendous amount from the pioneer crypto and therefore are rather selling off enormous amount of Bitcoin.

CryptoQuant has says on December first, Bitcoin miners dropped 10,000 BTC. When compared to 2,569 units that joined the marketplace and were subsequently offered by miners on November 26th, this amount is a lot lower.

Joaowedson, a CryptoQuant analyst, considered in about them, citing the cost of Bitcoin mining and also the precipitous loss of worth of the crypto asset as causes.

Joaowedson added:

“Miners are now being compelled to market their stakes due to the present cost of Bitcoin and the cost of mining in a variety of countries.”

The “makers” from the largest cryptocurrency by market cap and also the asset itself are generally condemned within their current states. Due to the recent stop by Bitcoin’s value and the cost connected with developing a single Bitcoin, Bitcoin miners might no longer earn profits using their efforts.

The cost from the cryptocurrency could fall and it is volatility could increase when they keep dumping the outcomes of the labor in to the market. Past market selloffs also have had an effect on mining industry earnings.

Glassnode reports that miners made 814.28 BTC at that time this short article was written. With all this, you can observe how you can conclude that Bitcoin does not provide anything when it comes to rewards or transaction charges because of its miners.

US Dollar Fell Multi-Month Low

Another key reason supporting BTC prices was nov the united states dollar, which touched a 3-month low.

Investors required benefit of suddenly favorable job data, that was considered among the primary motorists in restricting the dollar’s falls.

The dollar acquired some ground, meanwhile, when data demonstrated that personal-sector employers elevated payrolls by 263,000 in November, more than the 200,000 predicted.

However, the declines were short-resided, because they fell to some three-month low among a dovish stance.

Putin Requires Digital Currency Settlements

Russian President Vladimir Putin has recommended for any new worldwide settlements system that’s unconstrained by banks along with other intermediaries. The Russian leader was quoted as stating that you’ll be able to construct this type of system using digital currency technologies and distributed ledgers.

Russian financial powerhouse Sberbank located Putin in a conference centered on AI. Throughout his talk, he stressed that financial flows and payments between states are presently threatened by among tight relations between Russia and also the West.

Obama Putin elaborated:

“We are all aware perfectly that under today’s illegitimate limitations, among the lines of attack is thru settlements. And our banking institutions know this much better than anybody since they’re uncovered to those practices,”

Putin was talking about the worldwide sanctions which have seriously restricted the Russian Federation’s use of global financial and market institutions following a country’s invasion of neighboring Ukraine.

The Best news agency claims he also pointed out:

Today, the machine of worldwide payments is costly, with correspondent accounts and regulation controlled with a small club of states and financial groups.

Bitcoin Cost

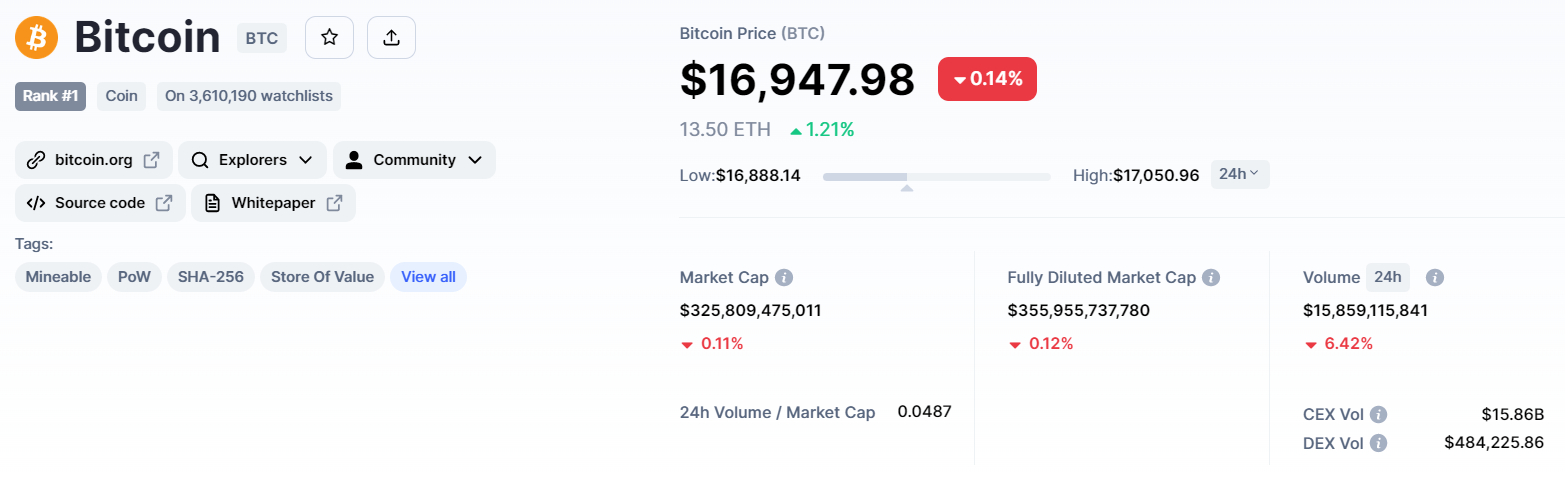

The present Bitcoin cost is $17,010, having a 24-hour buying and selling amount of $15 billion. The BTC/USD pair has surged over .10% within the last 24 hrs. Furthermore, its value has elevated by around 2.75% previously week.

The BTC/USD pair has battled to interrupt over $17,250, which is presently buying and selling sideways inside a narrow buying and selling selection of $16,800 to $17,250.

Bitcoin has completed a 23.6% Fibonacci retracement at $16,900, and shutting candle lights below $16,950 may prompt new selling before the $16,750 level of resistance is achieved.

Further lower, Bitcoin can strive for the $16,600 level, that is a 50% Fib extension, along with a break below this level will expose BTC towards the $16,450 level, that is a 61.8% Fib extension.

A bullish breach from the $17,250 level of resistance, however, might expose BTC to levels up to 17,650 and $18,100.

Coins with Massive Potential

Regardless of the market collapse, some coins have outperformed, garnering the eye of crypto whales.

One of these simple is IMPT, whose presale leads to under per week.

IMPT: 7 days to purchase This $13.5 Million Eco-friendly Crypto

Another Ethereum-based platform, IMPT, is really a carbon-credit marketplace which will compensate customers for using the services of eco advantageous companies. These benefits is going to be delivered by means of the business’s IMPT token, that you can use to buy NFT-based carbon offsets which may be offered or upon the market.

Since its dpo in October, IMPT has elevated greater than $13.six million, with 1 IMPT now buying and selling at $.023. Because of its phenomenal success, IMPT.io, a brand new platform for carbon offsetting and carbon credits buying and selling, will finish its token presale on December eleventh.

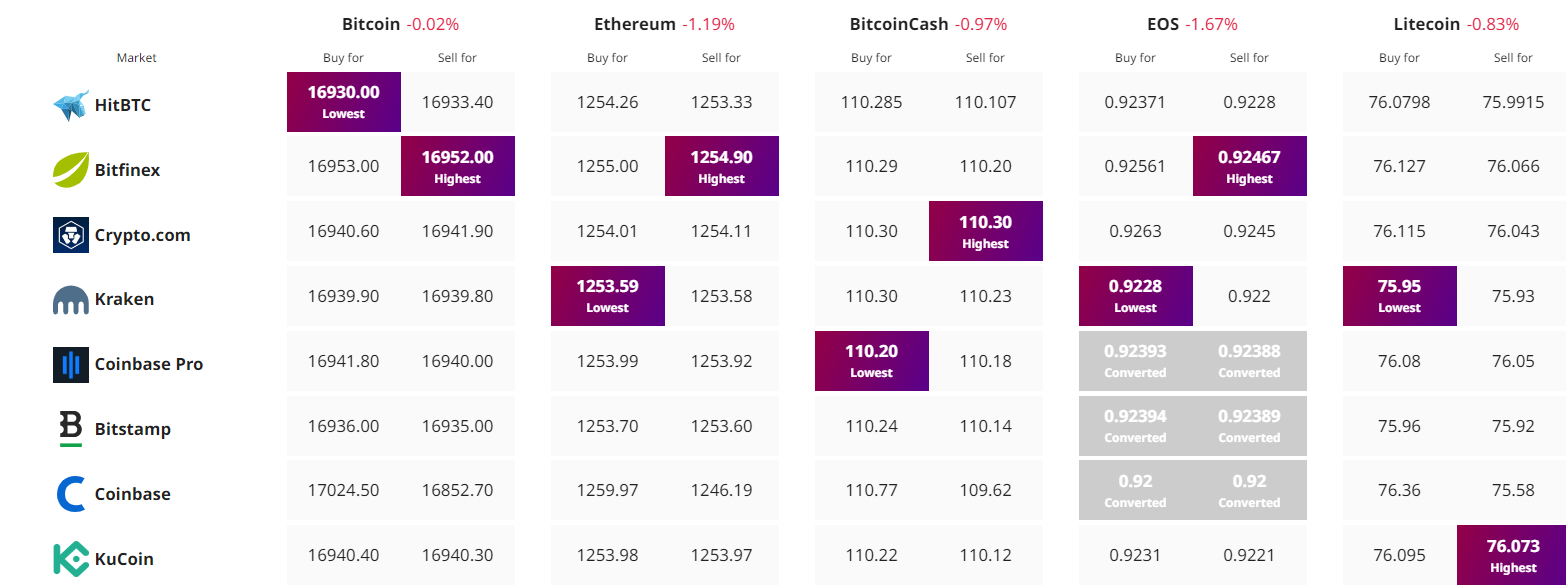

Get The Best Cost to purchaseOrMarket Cryptocurrency