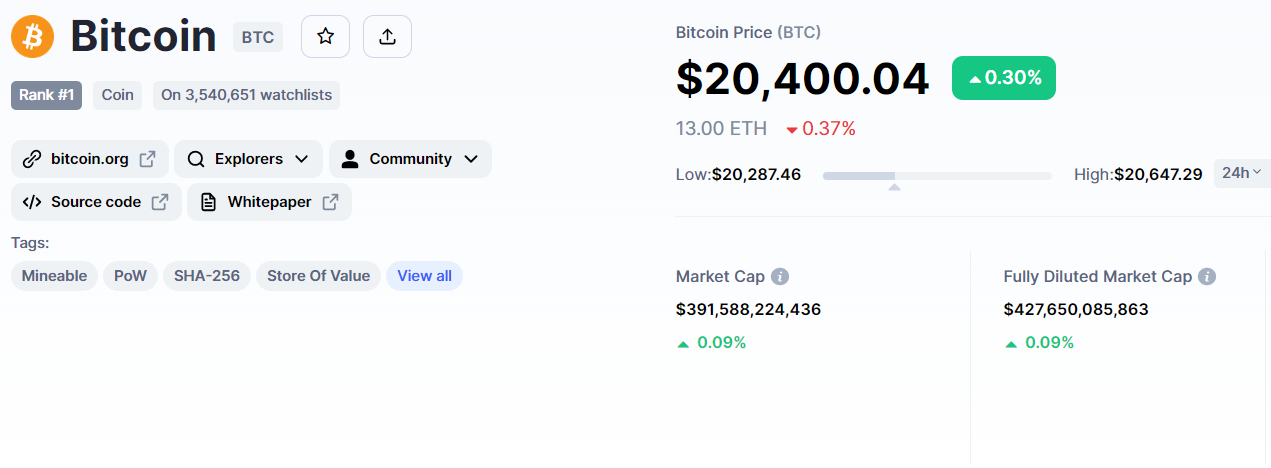

Throughout the European session, Bitcoin is buying and selling sideways near $20,400, tossing among a narrow selection of $20,350 to Twenty Dollars,800. Not surprisingly, the customer-seller tug-of-war continues in front of the FOMC and Given Fund rate decision on November 2.

As Bitcoin (BTC), the industry’s flagship asset, has proven resilience lately, bullish sentiment among crypto investors and analysts has came back because the cryptocurrency sector obtained its $1 trillion market price.

El Salvador’s Bitcoin Purchases are Private: Trustee

BANDESAL, El Salvador’s development bank, generate a $150 million trust fund to guarantee the convertibility from the local currency to all of us dollars to be used by consumers and companies.

Since Bitcoin grew to become legal money in El Salvador, President Nayib Bukele makes frequent Twitter bulletins concerning the country’s BTC purchases. However, the non-governmental anti-corruption bureau ALAC El Salvador was lately declined use of data in the condition development bank BANDESAL regarding Bitcoin transactions in El Salvador.

El Salvador’s development bank, BANDESAL, generate a trust fund with $150 million to guarantee the country’s occupants and companies would always get access to $ $ $ $.

El Salvador’s Bitcoin purchases are private, thus their request disclosure was denied.

To explain their official statement:

The confidentiality limits the chance for citizens to gain access to and receive info on the operations transported by helping cover their public funds by BANDESAL.

As a result of the denial, ALAC El Salvador noticed that the cash accustomed to buy bitcoins originated from the government’s coffers.

FOMC Meeting & Given Rate Decision Ahead

A choice on rates of interest in the Federal Open Market Committee and also the Fed is anticipated tomorrow, November 2. The marketplace expects the Fed to boost rates of interest by 75 basis points (bp). What can be significant is that if the hawks’ concentrate on core inflation momentum resulted in there will be a fifth 75bp hike in December.

Next week’s meeting from the Federal Open Market Committee (FOMC) is broadly likely to increase the risk for FOMC’s approval of their 4th consecutive 75bp rate hike. Job creation is happening in a rapid clip, with the amount of job vacancies presently surpassing the amount of unemployed Americans with a ratio of 4.

The economy has came back to growth after two consecutive quarters of falling GDP.

An interest rate hike of 75 basis points has already been included in market prices. Although the Fed’s attitude on future rate increases could be more consequential than tomorrow’s rate hike, the second will nevertheless affect the marketplace for cryptocurrencies.

Bitcoin Cost Conjecture – How High Can BTC Go because it Pumps Past $20,000?

Having a 24-hour buying and selling amount of 44 billion, Bitcoin is presently worth $20,391. Within the last 7 days, Bitcoin has risen under 5%. CoinMarketCap is presently first, having a $427 billion live market capital, lower from $431 billion throughout the Asian session.

The BTC/USD pair is buying and selling within an upward funnel within the 4-hour time-frame, with support near $20,300 and resistance near $20,700. The 50-day moving average is extending support close to the $20,400 level, and candle lights closing above this line indicate a bullish trend in Bitcoin.

The RSI and MACD continue being bearish, indicating a small weakness within an upward trend. Consequently, a bearish breakout from the $20,300 support level could extend the selling trend before the next support level at $19,950.

Around the plus side, elevated interest in Bitcoin may let it break with the $20,800 resistance zone and achieve the $21,000 level. An additional bullish breakout over the $21,000 level might take BTC to $21,450.

Top Gold coin Alternative – Dash 2 Trade

In recent days, numerous new altcoins have outperformed the marketplace, with pre-purchase tokens showing especially advantageous for traders who may be unable to wait a couple of more several weeks for big returns.

Dash 2 Trade, a cryptocurrency analytics and intelligence platform for traders and investors, is presently in pre-purchase. It’s best referred to as something like a Bloomberg terminal for individuals thinking about cryptocurrencies.

D2T has piqued the eye of crypto investors worldwide, raising over $4 million per week during its pre-purchase. Furthermore, pre-sales happen to be brisk lately, and D2T is well-positioned to take advantage of the popularity.

Get The Best Cost to purchaseOrMarket Cryptocurrency