Following a rebound above $15,500, Bitcoin cost conjecture remains neutral throughout the European session. Since that time, BTC continues to be buying and selling inside a narrow selection of $16,350 to $16,750. The market’s volatility is low a few days ago, and thin buying and selling keeps cost action limited.

Was $15,500 the underside? Let us discover.

Risk-off Triggered – Another Exchange Has Stopped Withdrawals

Yes, it’s happened again. Yet another cryptocurrency buying and selling platform has made the decision to prevent processing withdrawals, which makes it impossible for his or her people to receive their.

Staking platform Freeway is in the center of the debate because it claims that certain of their buying and selling techniques has tanked. For this reason it’s temporarily stopped processing withdrawals for purchasers.

Inside a statement, Freeway announced:

The buying and selling strategy was performed because it was programmed, however the market volatility caused an increase in margin utilization resulting in losing.

Within the last several several weeks, this is a recurrent theme within the cryptocurrency industry, though to become fair, this is actually the very first time an organization appears to become blaming itself for that outcome. Certainly one of Freeway’s investment methods apparently unsuccessful.

Other cases of withdrawal halts happen to be justified by firms as necessary safeguards from the continuous speculation and volatility within the markets. Within the most prominent installments of a withdrawal freeze this season, users of Celsius, a cryptocurrency loan company that has developed in the headlines within the last couple of days, saw their frozen.

When Celsius abruptly stopped withdrawals through the summer time, the eyebrows of their customers and outdoors observers alike were elevated in amazement and disgust.

But Celsius did not hold on there it fanned the flames by announcing it might be declaring personal bankruptcy, shielding its executives from law suit by angry customers, lenders, and other people with financial stakes in the organization.

Consequently, this may be a primary reason for that crypto industry’s slow recovery and large selling pressure.

Bitcoin HODLers Shifting BTC to Cold Storages

Hardly a big surprise, especially since withdrawals from well-known exchanges happen to be suspended, which is being a common practice. A brand new tweet by Santiment, dated November 27, claimed that Bitcoin HODLers were shifting their BTC from exchanges and into cold storage.

While 6.95% of Bitcoin was on exchanges during the time of the tweet, time has since elevated.

This chart implies that the amount of Bitcoins on exchanges has fallen to the cheapest level in 4 years. The present trend of BTC being taken off exchanges started in 2020, but has lately faster because of the FTX fallout.

A stop by Bitcoin’s exchange cost, however, doesn’t indicate waning consumer enthusiasm for BTC.

Bitcoin Price

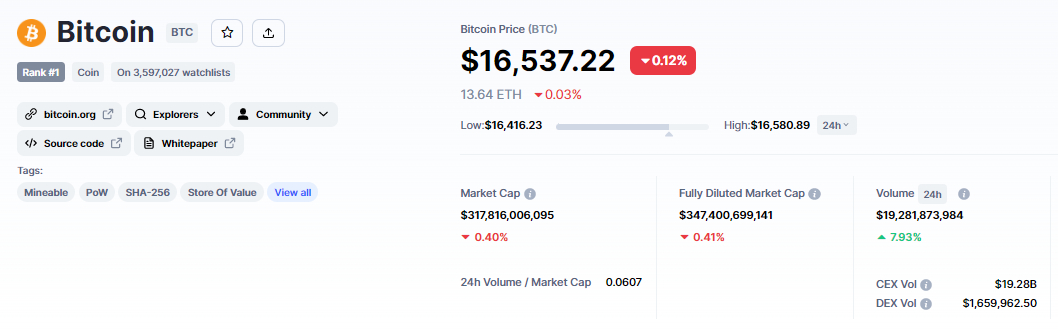

The present Bitcoin cost is $16,542, and also the 24-hour buying and selling volume is $19 billion. Bitcoin is mainly unchanged within the last 24 hrs, tossing in profits and losses which aren’t significant.

CoinMarketCap presently ranks first, having a live market cap of $317 billion. It features a maximum way to obtain 21,000,000 BTC coins along with a circulating way to obtain 19,217,300 BTC coins.

On Weekend, the BTC/USD is buying and selling choppy, having a narrow buying and selling selection of $16,300 to $16,800. To be able to forecast future trends, Bitcoin must first break with the formerly pointed out buying and selling range.

Within the 4-hour time-frame, the BTC/USD pair is presently holding over the 23.6% Fibonacci retracement degree of $16,400, along with a breakout of the level can determine the following buying and selling range.

If Bitcoin breaks underneath the 23.6% Fib level, it will likely be uncovered towards the 38.2% Fib degree of $16,275 and also the 61.8% Fib degree of $15,900.

Leading technical indicators, like the RSI and MACD, are oscillating between exchanging ranges, indicating investor indecision.

The 50-day moving average, however, is maintaining your BTC supported near $16,450, indicating a higher probability of an upward trend continuation.

If buyers go into the market, a bullish breakout from the $16,785 level could send BTC to $17,000 as well as greater to 17,850.

Cryptocurrency Pre-Purchase With Massive Profit

Regardless of the slowdowns from the market, a couple of coins have immense upside potential. Let’s take particular notice their way.

Dash 2 Trade (D2T)

Dash 2 Trade is definitely an Ethereum-based buying and selling intelligence platform that gives real-time analytics and social data to traders of abilities, letting them make smarter-informed decisions. The woking platform goes reside in the very first quarter of 2023, supplying investors with information to assist them to make positive buying and selling decisions.

Dash 2 Trade, a platform for crypto buying and selling intelligence and signals, has piqued investors’ interest after raising $seven million in only more than a month. Consequently, the D2T team has made the decision to it quits at stage 4 minimizing hard cap target to $13.4 million.

Dash 2 Trade has additionally been successful, with two exchanges (LBank and BitMart) promising to list out the D2T token when the presale concludes. 1 D2T is presently worth .0513 USDT, however this will rise to $.0533 within the final stage from the purchase.

D2T has to date elevated over $seven million by selling greater than 82% of their tokens.

RobotEra (TARO)

RobotEra (TARO) is really a Sandbox-style Metaverse by having an alpha version set to produce within the first quarter of 2023.

On its platform, gamers can play as robots which help build its virtual world, that will include NFT-based land, structures, along with other in-game products.

TARO has elevated greater than $240,000, and 1 TARO is generally offered for .020 USDT (it may be purchased with either USDT or ETH), however this cost increases to $.025 throughout the second stage of their presale, that will begin soon.

Calvaria (RIA)

Calvaria is a-new bitcoin gaming company using the possibility to dominate the play-to-earn market. The requirement of cryptocurrencies to be able to play has shown to be a substantial barrier to prevalent Web3 gaming adoption, based on Calvaria (RIA) developers.

Calvaria has more details available here.

Consequently, the sport may have both free-to-play and pay-to-win modes, using the free-to-play mode open to players without cryptocurrency.

Since its beginning, the presale has elevated nearly $two million and it is now in the final stages following the developers made the decision to finish it early. The presale ended up being to last ten stages and provide 300 million RIA tokens.

However, the developers have made the decision to alter the presale offering, meaning stage 5 would be the last chance for investors to buy RIA prior to being released towards the public market, where costs are likely to pump.

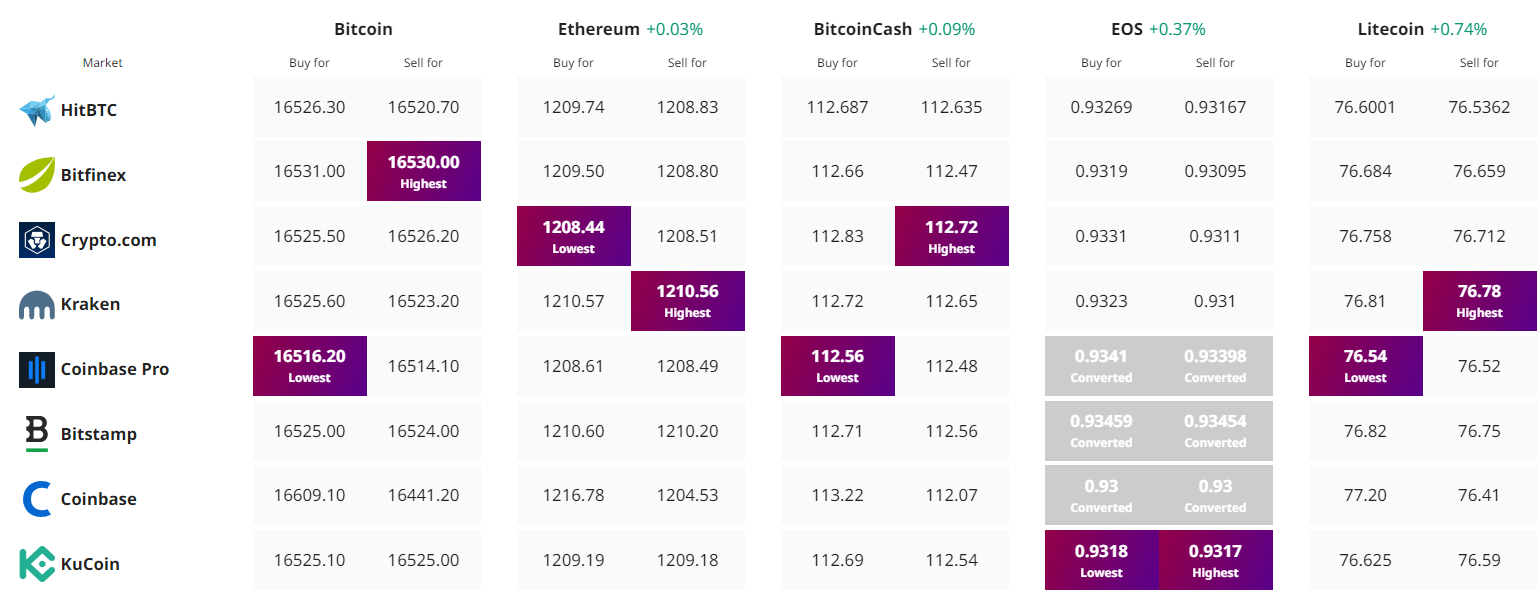

Get The Best Cost to purchaseOrMarket Cryptocurrency