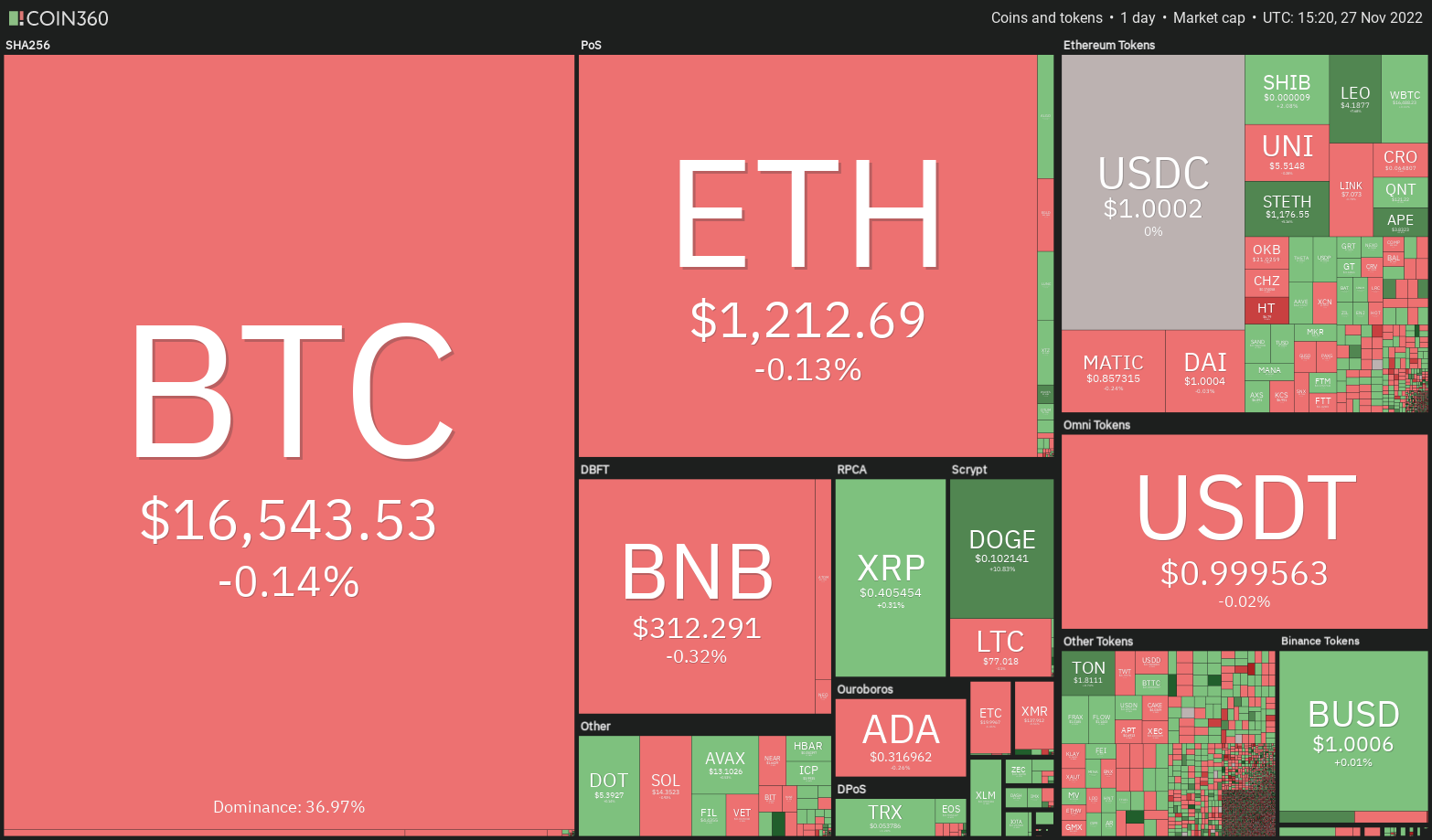

Bitcoin (BTC) continues to be buying and selling inside a tight range since Thanksgiving November. 24, as traders are uncertain concerning the next directional move. Usually, inside a bear market, analysts have a tendency to become uber-bearish and project targets that have a tendency to discourage investors.

The failure of Bitcoin to begin a powerful recovery has boosted several bearish targets, which extend as much as $6,000 around the downside.

Although anything can be done inside a bear market, traders who’ve a lengthy-term view could attempt to accumulate essentially strong coins in a number of tranches. Just because a bottom are only confirmed in hindsight and seeking to time it is almost always a useless exercise.

Inside a bear market, all coins don’t bottom simultaneously. Hence, together with keeping track of the broader cryptocurrency market, traders should carefully stick to the coins of the choice.

The cryptocurrencies contributing the marketplace from the bear phase tend to complete well once the next bull market begins. Let’s consider the charts from the cryptocurrencies that are attempting to start an up-move for the short term.

BTC/USDT

Bitcoin continues to be consolidating between $15,588 and $17,622 within the last couple of days. The relative strength index (RSI) has created a bullish divergence, suggesting the selling pressure might be reducing.

The relief rally could face stiff resistance within the zone between your 20-day exponential moving average ($17,065) and $17,622. When the cost turns lower in the overhead zone, the BTC/USDT pair could extend its stay within the range for many additional time.

If buyers catapult the cost over the overhead zone, it’ll claim that the downtrend might be ending. The 50-day simple moving average ($18,600) may behave as a small hurdle but when entered, the up-move could achieve the mental degree of $20,000.

Alternatively, when the cost turns lower in the overhead resistance and breaks below $15,588, it might signal the resumption from the downtrend. The happy couple could then drop to $13,554.

The moving averages around the 4-hour chart have flattened out and also the RSI is close to the midpoint, indicating an account balance between demand and supply. This balance could tilt in support of the bulls when they push the cost above $17,000. The happy couple could then rise towards the overhead resistance at $17,622.

Rather, when the cost slips below $16,000, the happy couple could drop towards the critical support zone between $15,588 and $15,476. A rest below this zone could accelerate selling and begin the following leg from the downtrend.

DOGE/USDT

Dogecoin (DOGE) broke over the overhead resistance at $.09 on November. 25 however the bears pulled the cost back underneath the level on November. 26. Buyers regrouped and pressed the cost over the 38.2% Fibonacci retracement degree of $.10 on November. 27.

The bears may again attempt to steer clear of the recovery near $.10 but when bulls do not let the cost to interrupt below $.09, the DOGE/USDT pair could get momentum and rally toward the 61.8% Fibonacci retracement degree of $.12. If the level can also be scaled, the happy couple may continue its upward trend toward $.16.

However, when the cost turns lower in the current level, it’ll claim that bears still see the rallies like a selling chance. The happy couple could then decline to $.09. If the support gives way, the 50-day SMA ($.08) might be challenged.

Buyers have pressed the cost over the range, which implies the beginning of an up-move. The strong rally pressed the RSI into deeply overbought levels, suggesting a small correction or consolidation soon.

When the cost turns lower in the 38.2% Fibonacci retracement of $.10 but rebounds from the breakout level, it’ll claim that the sentiment has switched positive and traders are purchasing on dips. The bulls will attempt to resume the upward trend. The prospective purpose of the breakout in the range is $.12.

This positive view could invalidate soon when the cost turns lower and re-enters the number. The happy couple could then drop towards the 50-SMA.

LTC/USDT

Litecoin’s (LTC) breakout over the overhead resistance at $75 may be the first symbol of a possible trend change. The bears attempted to drag the cost back below $75 and trap the aggressive bulls however the buyers held their ground.

The bulls will attempt to propel the cost over the overhead resistance at $84. When they succeed, it might signal the beginning of a brand new upward trend. The increasing 20-day EMA ($67) and also the RSI close to the overbought zone indicate the road of least resistance would be to the upside. The LTC/USDT pair could then rally toward the prospective purpose of $104.

On the other hand, when the cost turns lower from $84, the happy couple could slide towards the $73 to $75 support zone. If the zone breaks lower, the happy couple could slide towards the 20-day EMA. The bears will need to pull the cost below this support capture the aggressive bulls.

When the cost rebounds from the 20-day EMA, the bulls will again attempt to kick the happy couple above $84 and begin the upward trend.

Some-hour chart implies that the cost broke and closed underneath the 20-EMA however the bears couldn’t build this advantage. The bulls purchased this dip and nudged the cost back over the 20-EMA. Both moving averages are sloping up and also the RSI is simply over the midpoint, indicating that buyers possess a slight edge.

There’s a small resistance at $80, but when bulls thrust the cost above this level, the happy couple could rise to $84. The happy couple could then chance a rally to $96. If bears wish to invalidate this view for the short term, they’re going to have to drag the happy couple below $73.

Related: Bitcoin mining revenue cheapest in 2 years, hash rate decreasing

LINK/USDT

Chainlink (LINK) continues to be range-bound between $5.50 and $9.50 within the last many days. The strong rebound from the support at $5.50 on November. 21 shows that bulls are strongly purchasing the dips for this level.

The 20-day EMA ($6.74) has began to show up and also the RSI has risen in to the positive territory, indicating a small benefit to the bulls. When the cost sustains over the 50-day SMA ($7.15), the probability of a rally to $8.50, and after that to $9.50, increases.

Unlike this assumption, when the cost turns lower and breaks underneath the 20-day EMA, it’ll claim that bears are active at greater levels. The HyperlinkOrUSDT pair could on the other hand drop toward the support at $5.50 and consolidate near it for any couple of more days.

The strong rebound from the $5.50 level is nearing the overhead resistance at $7.50. When the cost turns lower out of this level and breaks underneath the 20-EMA, the happy couple could drop towards the 50-SMA. A rest below this support can keep the happy couple stuck between $5.50 and $7.50 for a while.

Another possibility would be that the cost turns lower from $7.50 but rebounds from the 20-EMA. The bulls will on the other hand attempt to drive the cost above $7.50 and begin the northward march toward $8.50.

APE/USDT

ApeCoin (APE) continues to be consolidating in a wide range between $3 and $7.80 within the last several several weeks. The bears attempted to sink the cost underneath the support from the range but tend to not sustain the low levels. This means strong demand at ‘abnormal’ amounts.

Sustained buying pressed the cost over the 20-day EMA ($3.47) on November. 26, indicating the bulls take presctiption a comeback. There’s a small resistance in the 50-day SMA ($4.06), but when bulls obvious this roadblock, the APE/USDT pair could rise towards the downtrend line.

When the cost turns lower in the downtrend line, the happy couple could decline towards the 20-day EMA. When the pair rebounds off this level, it’ll claim that the sentiment has shifted from selling on rallies to purchasing on dips. That may enhance the prospects of the break over the downtrend line. The happy couple could then climb to $6.

On the other hand, when the cost turns lower in the downtrend line and breaks underneath the 20-day EMA, the happy couple could again slide towards the strong support at $3.

The moving averages around the 4-hour chart have began to show up and also the RSI has leaped in to the overbought territory, indicating that bulls possess a slight edge. The recovery could face resistance at $4 but when bulls do not let the cost to dip underneath the moving averages, the up-move may achieve the downtrend line.

This positive view might be invalidated soon when the cost turns lower and breaks underneath the 50-SMA. This type of move will claim that bears still sell on rallies. The happy couple could then drop to $3.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.