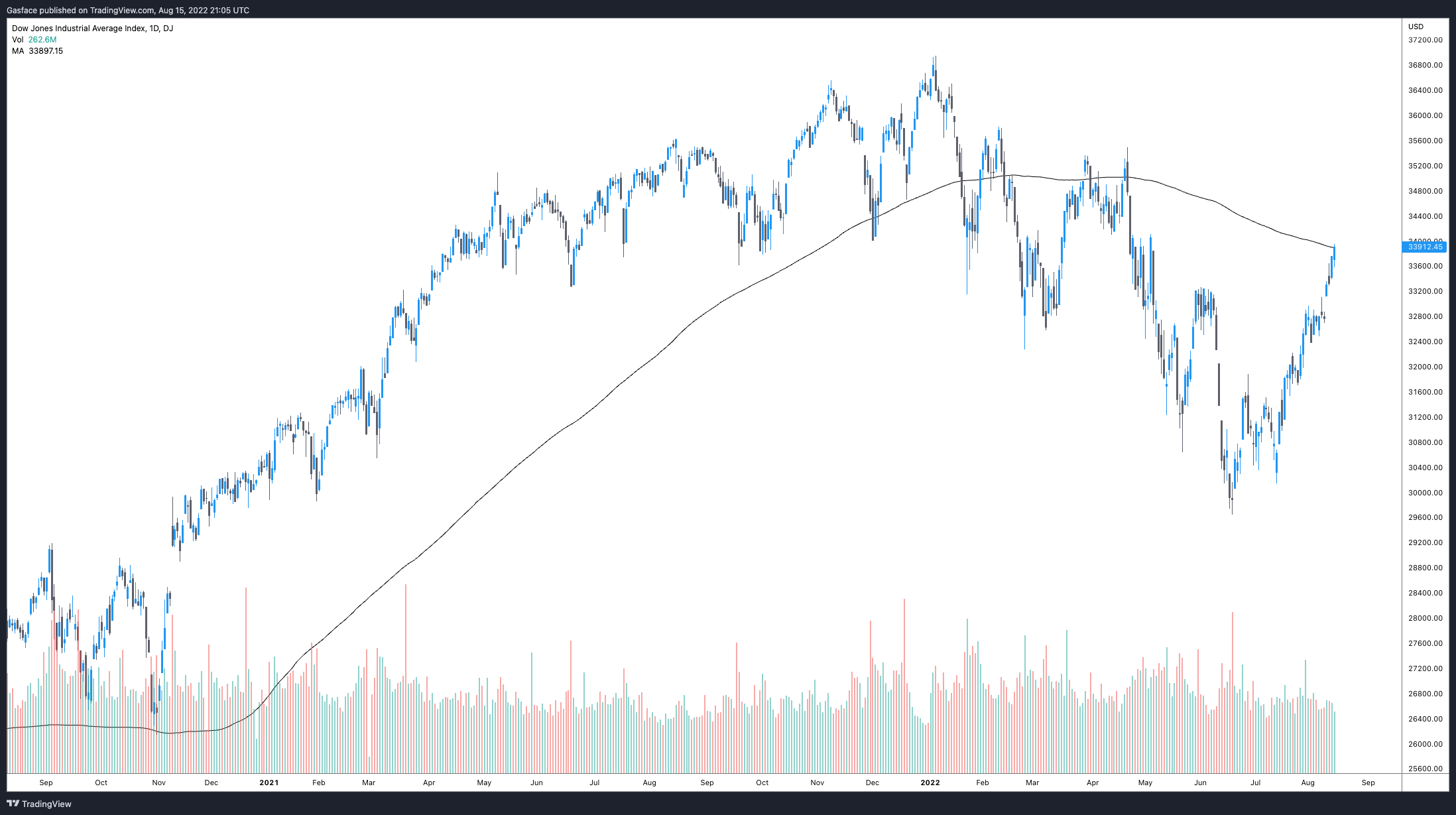

On August. 15, Bitcoin (BTC) cost and also the wider market remedied as the S&P 500 and Dow jones looked to construct on four-straight days of robust gains. Data from TradingView and CNBC show the Dow jones pushing through its 200-day moving average, an initial since April 21 and possibly an indication for bulls the market has bottomed.

While equities markets happen to be strikingly bullish when confronted with high inflation along with a steady schedule of great interest rate hikes, numerous traders fear the current 32-day upward trend within the Dow jones and S&P 500 might be a bear market rally.

This week’s (August. 17) discharge of minutes in the Federal Open Markets Committee (FOMC) should give more context towards the Federal Reserve’s current look at the healthiness of the U . s . States economy and possibly reveal how big the following rate of interest hike.

Within the last month, excessively bullish crypto traders on Twitter are also touting a story that emphasizes Bitcoin, Ether (ETH) and altcoins selling off just before FOMC conferences after which rallying afterward when the set rate aligns with investors’ forecasted figure.

In some way, this short-term dynamic also plays a role in investors’ thought that the Given will “pivot” from its financial policy of great interest hikes and quantitative tightening after “inflation peaks.” This can be a somewhat lucrative trade for savvy day-traders, but it’s worth noting that inflation is presently at 8.5% and also the Fed’s target is 2%, quite aways to visit.

Ultimately, Bitcoin cost keeps a high correlation towards the S&P 500 so investors would be advised to avoid tunnel vision-like narratives that align using their bias and keep close track of the performance of equities markets.

Bitcoin sells-off in a multi-month trendline resistance

Over the past weekend, Bitcoin designed a strong move in a multi-month climbing down trendline and broke with the $24,000 level, carrying out a path that lots of traders anticipated would trigger an upside move and also the VPVR gap fill towards the $28,000 to $29,000 level.

$BTC really appeared as if it would go yesterday – so we have 2x outdoors brewing pic.twitter.com/gkyLodiXi6

— Cheds (@BigCheds) August 15, 2022

Trader Cheds stated “BTC really appeared as if it would go last night” however the selling at resistance produced an “outside bar” where “the prior trend was challenged” and based on Cheds, this can be a sign that “the trend might be stalling and become looking for indications of further weakening.”

Bitcoin’s Bollinger Bands will also be limited, an indication that the directional move is imminent but we have already seen expansion in to the top band in the $25.6K trendline resistance. Is really a $22.4K retest next before $BTC tries to grind greater? Couple of have pointed out the falling wedge… pic.twitter.com/wi1VpGt2y7

— Big Smokey (@big_smokey1) August 15, 2022

Pseudonymous trader “Big Smokey” made an appearance to concur that the “strong directional move” might be around the cards, citing tightening within the Bollinger Bands and individually within the Super Guppy indicators as Bitcoin cost came near to the multi-month climbing down trendline.

There are several signs that the strong directional move is around the cards for Bitcoin: Super Guppy gets real tight, possibly provoking a 26% pop to $28K before more sideways chop or disadvantage to grab what’s going to be new liquidity in the $24K s/r re-test at that time… pic.twitter.com/1VgAkjj10o

— Big Smokey (@big_smokey1) August 15, 2022

Inside a separate chart, Big Smokey recommended when the climbing down trendline is damaged, Bitcoin often see “a 26% pop to $28K before more sideways chop,” leading to an eventual retest from the $24,000 level.

After hitting similar overhead resistance levels, most altcoins also adopted Bitcoin’s lead by posting single-digit losses, but individuals which were flashing bottoming signals continue to be rounding by helping cover their what seem to be reversal patterns.

Related: Shiba Inu eyes 50% rally as SHIB cost enters ‘cup-and-handle’ breakout mode

Every dog has its own day

Interestingly, on Sunday (August. 14) popular traders on Crypto Twitter prophesied the sharp gains from meme tokens like Shiba Inu (SHIB) and Dogecoin (DOGE) were a obvious sign the bull phase was over-extended and on the way to a correction.

Pulled this in the archives.

Twelve months apart, same sector, different breed.

Time is really a flat circle. pic.twitter.com/QplWWT43R5

— Hsaka (@HsakaTrades) August 14, 2022

Ultimately, following a 130% and 42.5% rally from Ether and BTC, each was poised for a little bit of profit taking, especially at resistance. Open Interest on assets remains near all-time highs, what it will require to trigger BTC to breakout or breakdown in the multi-month climbing down trendline is unknown.

Possibly singlePercent rate hike, stiffer crypto rules or perhaps a surprise turn-around in equities markets could send cost tumbling back toward yearly lows. Alternatively, a effective Ethereum Merge might be a positive catalyst that creates a higher volume surge above Bitcoin’s key level of resistance.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.