Bitcoin was last buying and selling lower by over 3.% on Friday within the low $23,000s, with BTC/USD falling back under its 21DMA the very first time in nearly two days in wake of the hotter-than-expected US Core PCE inflation report that enhances the risk the united states Fed lifts rates of interest to greater levels for extended. Mother and YoY cost pressures both suddenly rose in The month of january, based on the latest report, to .6% and 4.7% correspondingly.

Which has led to US money markets prices inside a 40% chance the Given will lift rates of interest by a minimum of 25 bps at its next four conferences. Just before Friday’s data, the cash market-implied odds not less than another four 25 bps in rate hikes during the period of the following four conferences was 30%. Last month, markets assigned the probability of another 100 bps in rate hikes at roughly zero.

Consequently, the united states dollar is obtaining, US yields are rising and US stocks came under fresh selling pressure, a bearish combination for that risk-sensitive crypto asset class. Bitcoin traders continuously monitor approaching major US data releases and also the tone of commentary from Given officials because they still measure the outlook for all of us financial policy.

However it appears that Given tightening fears continuously behave as an almost-term headwind for crypto. Indeed, Given tightening fears have likely been the primary factor behind Bitcoin’s recent pullback from earlier monthly highs within the low-$23,000s. But because the threat of a dip back for the 50DMA within the $22,000 area and possibly a retest of latest lows within the $21,400 area looms, Bitcoin bulls may take solace inside a couple of recent options market developments that suggest the 2023 bull market likely remains intact.

Bullish Options Market Signals

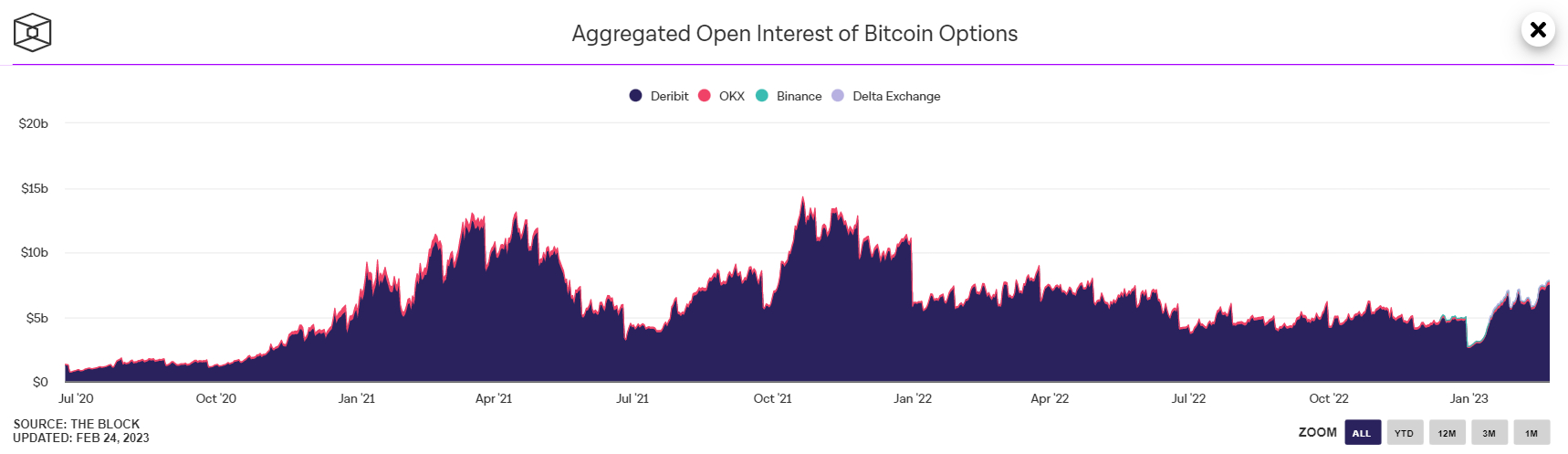

Aggregated Open Interest of Bitcoin Options (i.e. the mixture worth of existing options contracts) across major crypto derivative exchanges lately hit its greatest level in nearly 10 several weeks at $7.83 billion on Wednesday. Choices are a far more complex investment tool, typically utilized by a far more “sophisticated” investor base for hedging and making cost direction bets.

Hence, many view a boost in outdoors Interest of Bitcoin Options like a sign that institutions are involved in the marketplace once more. Institutional adoption continues to be an essential narrative in past Bitcoin bulls markets which narrative could certainly become popular once more if Open Interest makes further progress to its 2021 record highs above $14 billion.

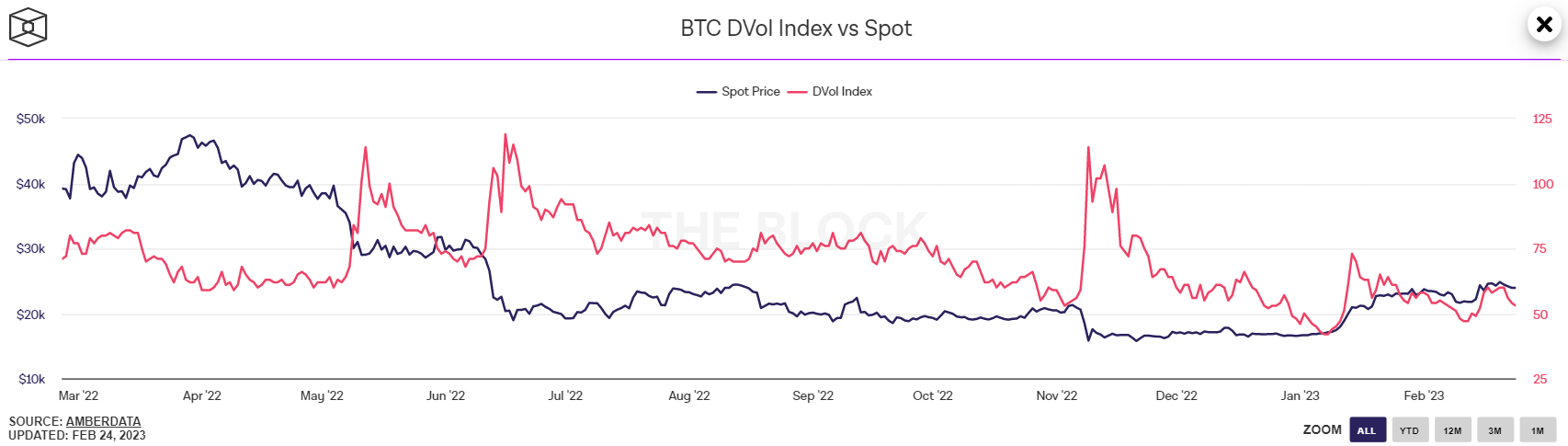

Elsewhere, Deribit’s Bitcoin Volatility Index (DVOL) remains near to all-time lows. It had been last at 53 on Friday, lower from earlier weekly highs at 60. It is not too much over the record lows it printed earlier around at 43. The DVOL has a tendency to spike at occasions of bearishness within the cryptocurrency market. Its ongoing stability is thus a reassuring signal.

Meanwhile, the 25% Delta Skew of Bitcoin Options expiring in 7, 30, 60, 90 and 180 days all continued to be slightly above zero on Friday, implying a still modestly positive market bias. Indeed, the 180-day 25% Delta Skew, last at 2.74, is just just below recent highs (the three.28 printed in The month of january) and it is thus a little way below its greatest level in at least a year.

The 25% delta options skew is really a popularly monitored proxy for that degree that buying and selling desks are gone or undercharging for upside or downside protection through the put and call options they’re supplying investors. Put options give a trader the best although not the duty to market a good thing in a predetermined cost, while a phone call option gives a trader the best although not the duty to purchase a good thing in a predetermined cost.

A 25% delta options skew above shows that desks are charging more for equivalent call options versus puts. This means there’s greater interest in calls versus puts, which may be construed like a bullish sign as investors tend to be more wanting to secure protection against (or bet on) a boost in prices.

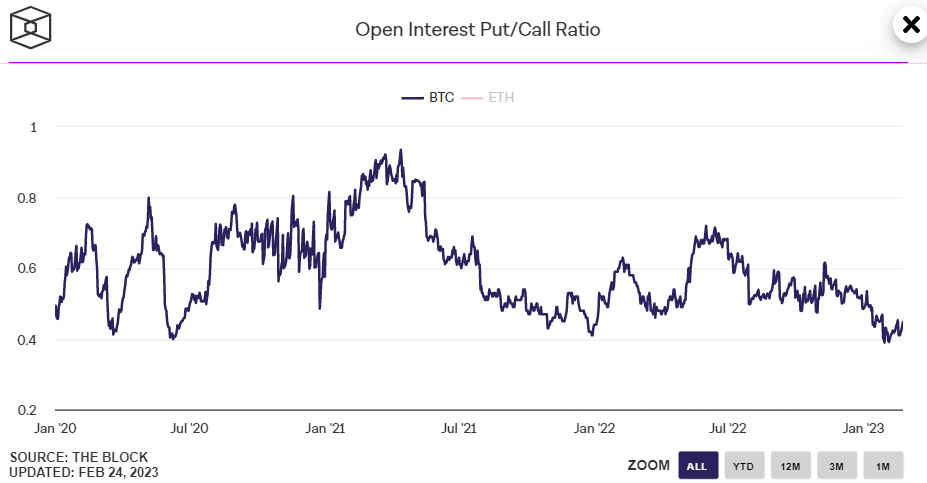

Finally, the number of Open Interest Put (bets on the cost fall) versus Call (bets on the cost rise) Choices on Deribit continued to be near to its record have less Friday at .45. An archive low what food was in the finish of The month of january under .40.

Elsewhere, as discussed in recent articles, a growing laundry listing of on-chain and technical indicators all suggesting the bear marketplace is over. So although Bitcoin might be unable to keep up with the pace of January’s rally, you may still find lots of good reasons to believe that coming back to 2022’s lows remains unlikely.