Bitcoin (BTC) liquidated $200 million of lengthy positions on November. 8 as BTC cost briefly tumbled to 2-year lows.

BTC cost sets new two-year low

Data from Cointelegraph Markets Pro and TradingView revealed carnage across crypto cost charts as exchange FTX stored the atmosphere low.

After initially rebounding over $20,000 on news the embattled FTX may be purchased by competitor Binance, panic came back following the Wall Street open.

BTC/USD lost $2,000 within two hrs, visiting a sudden plunge that set a minimal of $17,120 on Bitstamp.

The final time the happy couple traded at this level is at late November 2020, meaning Bitcoin were able to beat the previous macro lows of $17,600 occur June this season.

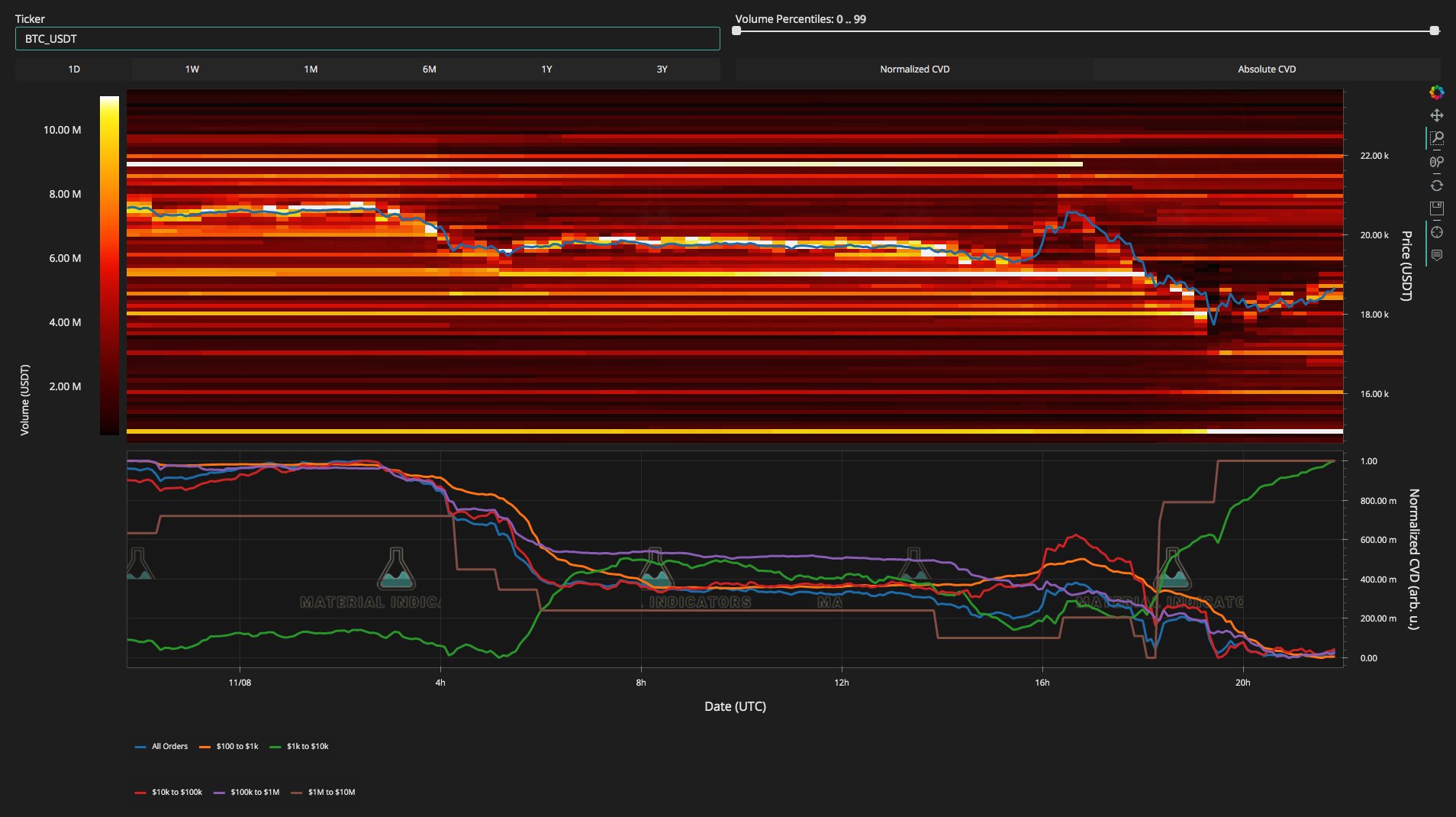

Data in the Binance order book demonstrated the sudden cascade downward puncturing solid buy support at $18,000.

In the November. 8 daily close, an market for trade volume was around $18,400 — a zone still in play during the time of writing nearly 12 hrs later.

Figures from on-chain monitoring resource Coinglass, meanwhile, tracked major discomfort for lengthy investors trapped in the wrong time.

BTC lengthy liquidations across exchanges totaled $214 million for November. 8, while mix-crypto longs were liquidated towards the tune of $670 million.

Coupled with shorts, total liquidations during the day were $915 million.

“Important days ahead”

Analyzing the problem, popular crypto commentators were careful about calling an finish to cost turmoil.

Related: Exactly why is Bitcoin cost lower today?

“Way too early to understand how this resolves, however the fact there has been another exchange-driven liquidity crisis at this time within the macro structure is actually quite something,” a normally positive TechDev tweeted:

“Important days ahead.”

Others acknowledged they themselves had fallen foul of volatility, while beyond crypto, case study searched for potential silver linings.

For buying and selling account IncomeSharks, weakness within the U . s . States dollar within the ongoing midterm elections would be a promising sign for risk assets.

“Looks prepared to drop below support,” it authored concerning the U.S. dollar index (DXY) at the time:

“Stocks searching good. Nasty black swan event destroyed the cost action for Crypto but when that taste has run out of people’s mouths we ought to see $BTC and $ETH set up just a little rally. Once more the problem is avoid the assets themselves.”

November. 10 had been due to become a volatile day for that week, with U.S. Consumer Cost Index (CPI) inflation data due for that month of October.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.