Bitcoin (BTC) offered off in to the June 27 Wall Street open as U . s . States equities fell.

$25,000 eyed as bulls’ line within the sand

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD following stock markets downhill because the a week ago of June started.

During the time of writing, the happy couple traded below $21,000, getting hit its cheapest in 72 hours following a broadly stable weekend.

Among an over-all insufficient bullish conviction among traders, expectations for any further drop remained present, with Bitcoin still underneath the crucial 200-week moving average (WMA) at $22,430.

“Bitcoin states NO against $21K support. That’s all fine. We’ve got levels structured,” Cointelegraph contributor Michaël van de Poppe authored inside a Twitter debate at the time.

An additional publish contended that further lows will come to lure traders to spread out lengthy positions. Support lay at $20,325 and around $20,100, and really should neither hold, a dip toward $19,000 could result.

Fellow trader and analyst Credible Crypto, meanwhile, set the needs to make sure that this month’s $17,600 lows wouldn’t be challenged. For him, a visit to the low $30,000 range will have to ensue.

“When we have the ability to reclaim $25,000, push to the low $30,000s — $28, $29, $30,000 — at that time, I do not think we are likely to see new lows,” he stated inside a video update.

“Therefore if we are likely to see new lows, I’d expect it to occur before we reclaim $25,000.”

Bitcoin continued to be on the right track to shut its first month ever underneath the 200WMA at the time, singling the current bear market among previous ones.

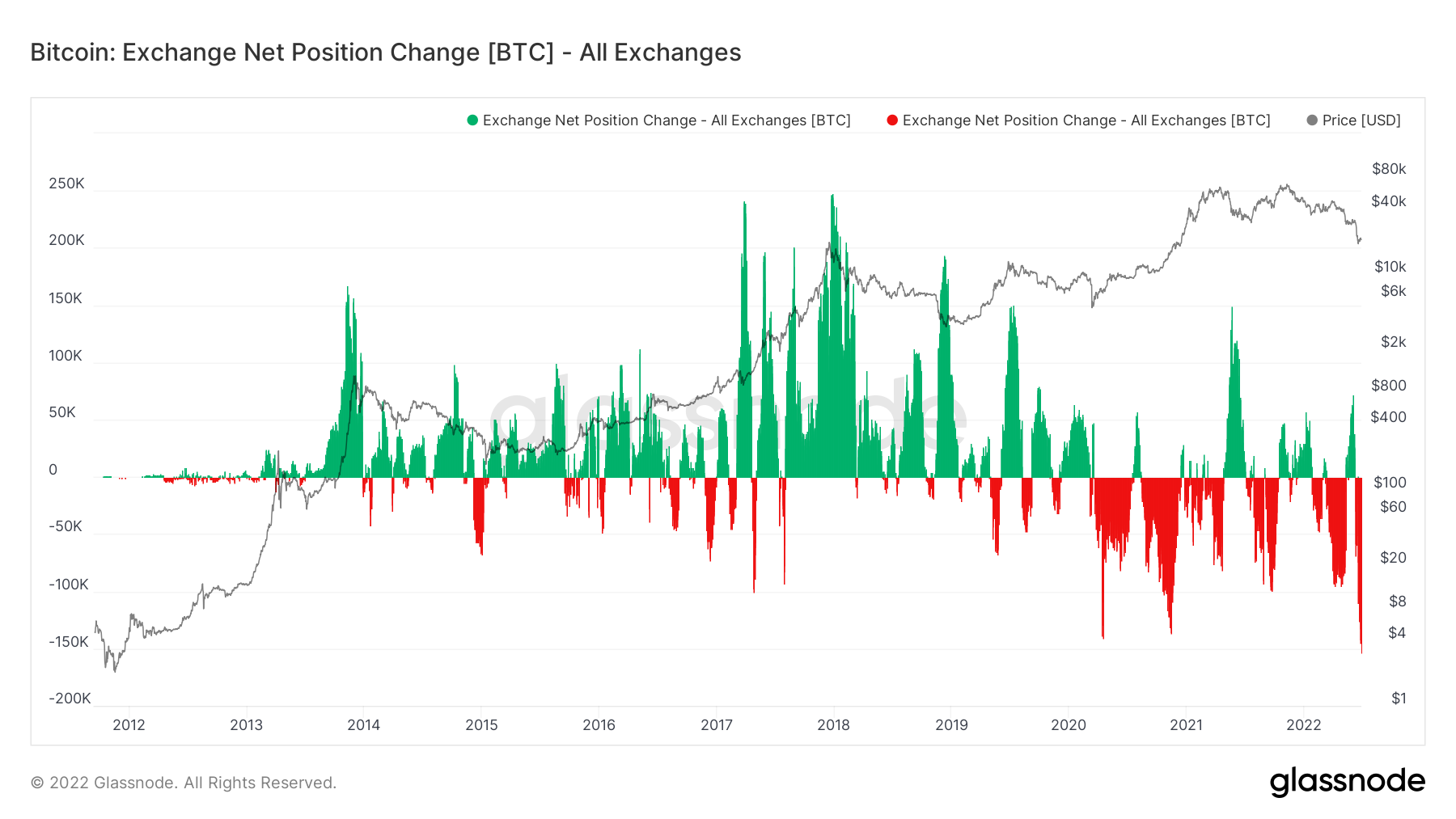

BTC drains from exchange wallets

Meanwhile, proof of investors purchasing the dip ongoing to mount.

Related: Google users think BTC is dead — 5 items to know in Bitcoin now

After whales made the headlines for adding coins around $20,000, exchanges more broadly saw major decreases in BTC supplies in recent days.

According to data from on-chain analytics firm Glassnode, June 26 saw the biggest cumulative alternation in BTC not stored on exchanges.

The 30-day average alternation in supply stored on exchanges was lower 153,849 BTC as funds moved elsewhere.

As Cointelegraph reported, metrics like the Mayer Multiple still show the opportunity of outsized gains by purchasing BTC at current levels.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.