Bitcoin (BTC) dropped to weekly lows in the August. 17 Wall Street open as approaching Fed comments unsettled risk assets.

Dollar climbs as Given minutes due

Data from Cointelegraph Markets Pro and TradingView tracked a far more than 2% daily loss of BTC/USD, which hit $23,325 on Bitstamp.

Already showing indications of weakness, the happy couple slid further as U . s . States equities started buying and selling, hrs prior to the Federal Open Markets Committee (FOMC) was because of release minutes from the latest meeting.

Whilst not involving a choice on rates of interest, the meeting was cued to provide a look in to the Fed’s thinking with regards to the next rate tweak due in September.

“The important event tonight using the FOMC minutes, by which information could be received if the Given will probably be hawkish or dovish,” Cointelegraph contributor Michaël van de Poppe summarized in the latest Twitter.

“I don’t believe it’ll have an enormous impact, however, crypto tends allow it a lot of value and, therefore, plenty of volatility.”

Stocks had hit major resistance consistent with crypto throughout the week, leading some concerned sources to carry on to calculate an additional major retracement overall.

Justin Bennett, the founding father of crypto education platform Crypto Academy, cautioned the S&P 500 was copying behavior from immediately before the 2008 Global Financial Trouble.

“This is mind-blowing. The S&P 500 is mimicking the 2008 crash. The timing because the ATH is almost identical,” he commented on the comparative chart.

“The bottom isn’t set for stocks or crypto.”

A telltale sign at the time came by means of an evolving U.S. dollar, using the U.S. dollar index (DXY) trying to attack resistance in position throughout August.

“$DXY might be coming to 112-113 following the fakeout below 105.50. That will weigh on stocks and crypto,” Bennett added.

Buyers eye lower bids

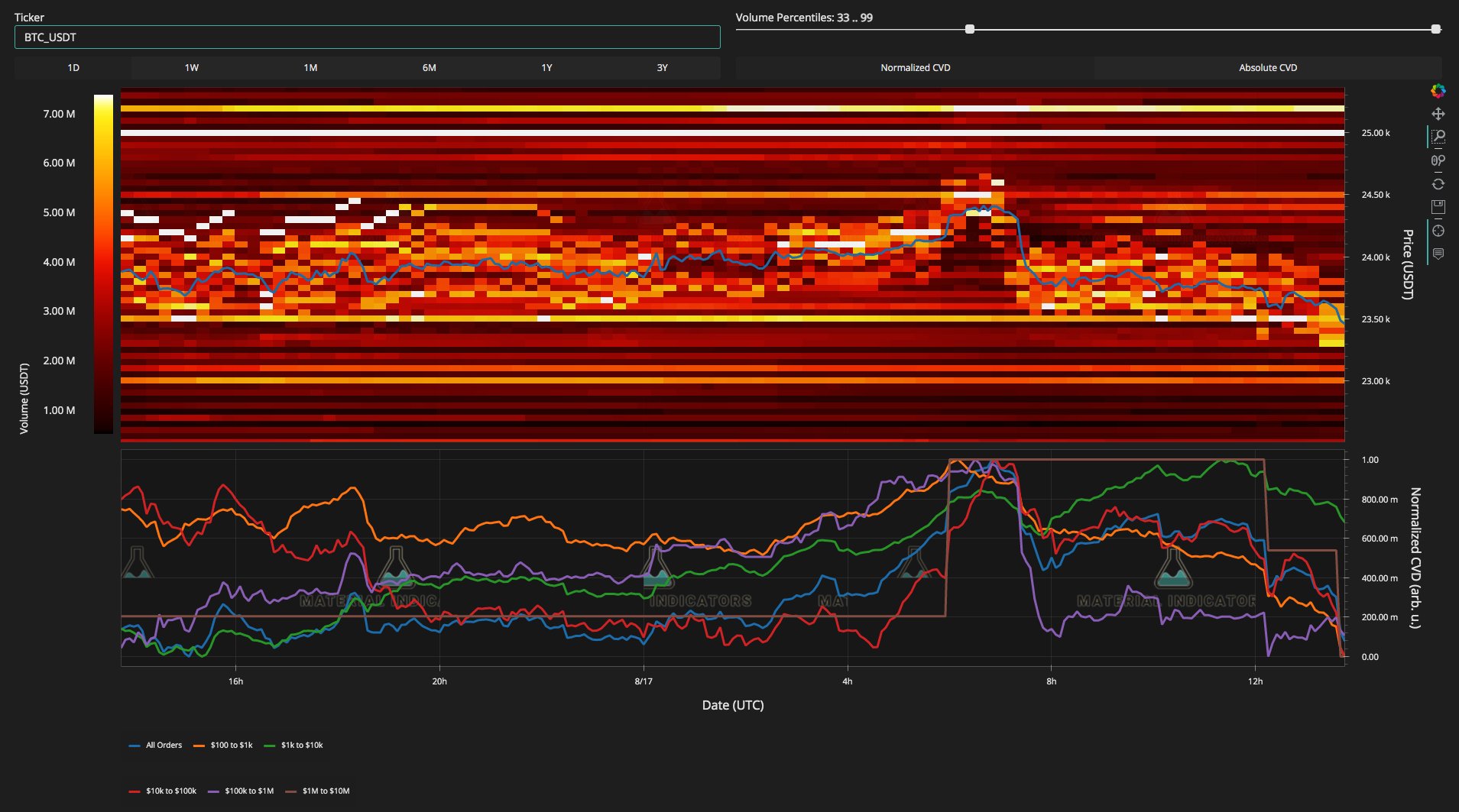

On shorter timeframes, the popularity on Bitcoin seemed to be quickly losing steam as bid support inched lower the Binance order book.

Related: Bitcoin cost sees firm rejection at $24.5K as traders doubt strength

On-chain monitoring resource Material Indicators taken the experience, concluding that “even when we get another pump, still believe the Bear Market Rally is losing momentum.”

An upside target could come by means of the 100-day moving average, another publish described, laying at $24,544 during the time of writing.

“Been warning relating to this breakdown for Bitcoin yesteryear couple of days,” commentator Matthew Hyland concluded.

“Structure has shifted overall weak lately. Market appeared to possess its first indications of existence just a week ago. That appears to become short resided.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.