Markets briefly exhibited eco-friendly on Sept. 27 as equities markets bounced away from Sept. 26’s pullback, getting the Bitcoin (BTC) cost to the lengthy-term climbing down trendline resistance, which presently resides at $20,100.

Regrettably for bulls, the positive momentum for stocks and cryptocurrencies quickly eroded and Bitcoin cost threw in the towel most the intraday gains because it tucked back below $19,000.

As continues to be the situation since March 25, BTC cost continues to be not able to kick over the resistance for over a couple of hrs and also the Sept. 27 breakdown in the trendline continues the popularity of successive bear flags that visit a continuation towards the downside.

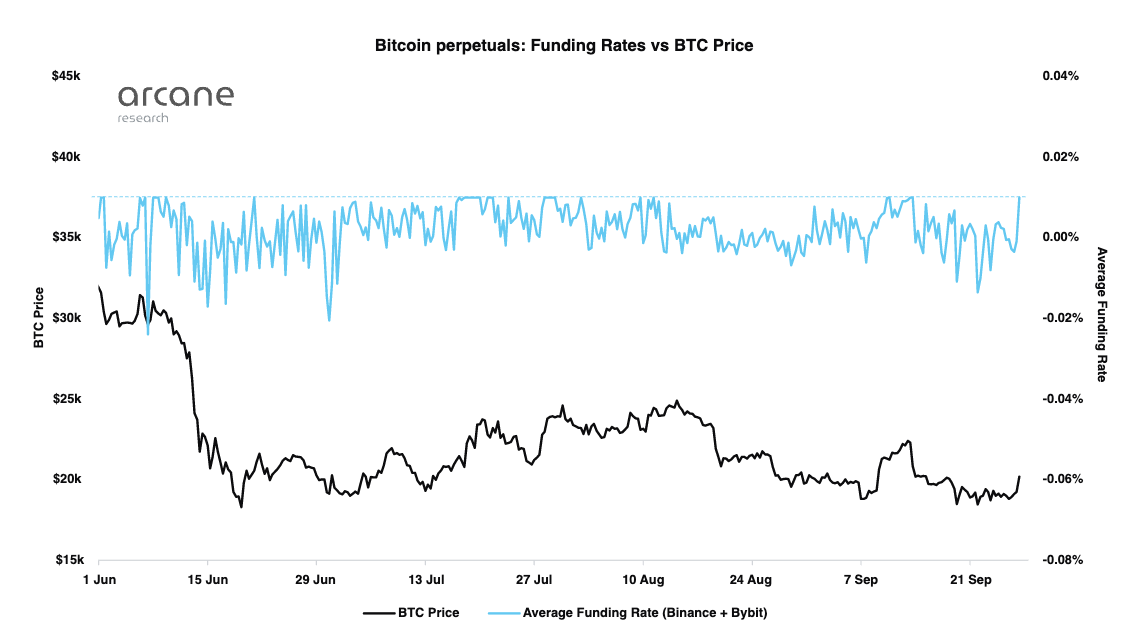

Based on Arcane Research, Bitcoin’s tight rally above $20,000 is comparatively minor, considering that futures premiums continue to be low also it “contributes little to increasing the market risk appetite.”

Additional data from Arcane Research shows funding rates flipping neutral the very first time since Sept. 13, but generally, traders are unwilling to add longs, because of the concerns over macro challenges and also the continuous threat of unfriendly crypto regulation.

There’s a silver lining

As pointed out in the past analysis, regardless of the breakouts and breakdowns, BTC cost is just buying and selling within the very same $24,300 to $17,600 range of history 103 days. Up to now, a catalyst to create off a failure below swing lows in order to push cost above resistance and ensure the previous hurdle as support has yet to happen.

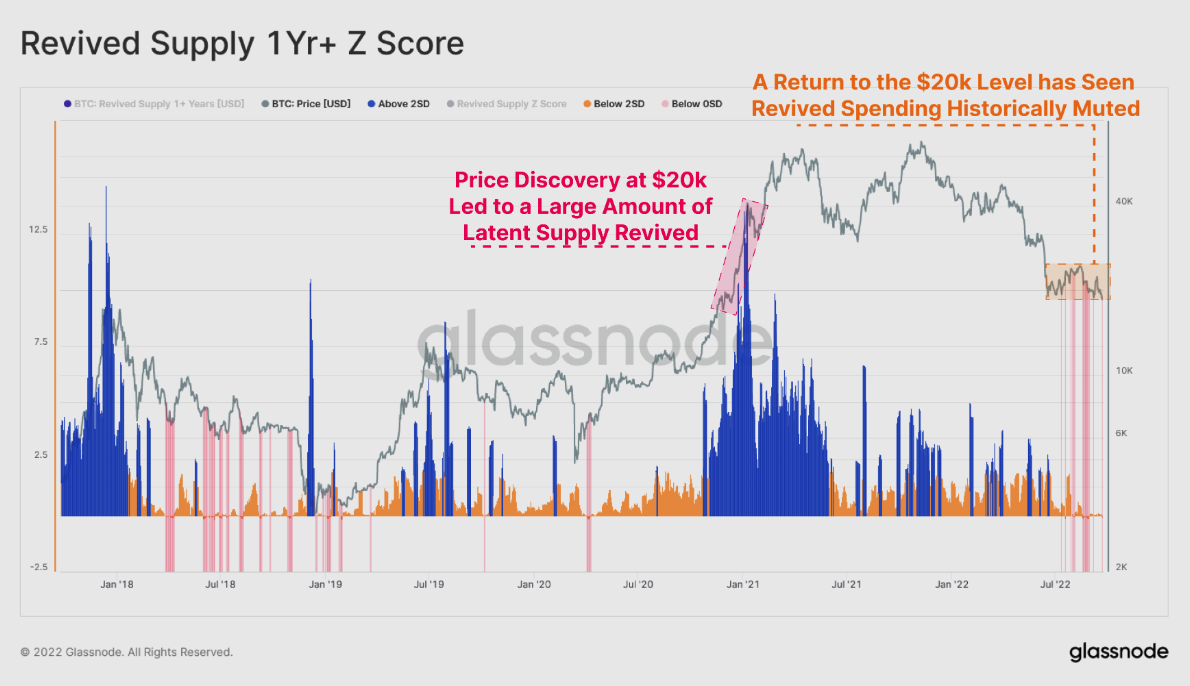

Fortunately, it isn’t all disaster and gloom for Bitcoin. An optimistic little bit of news originates from on-chain analytics provider Glassnode, who noted more mature investors have made the decision to hunker lower and hold their positions instead of sell in the current cost.

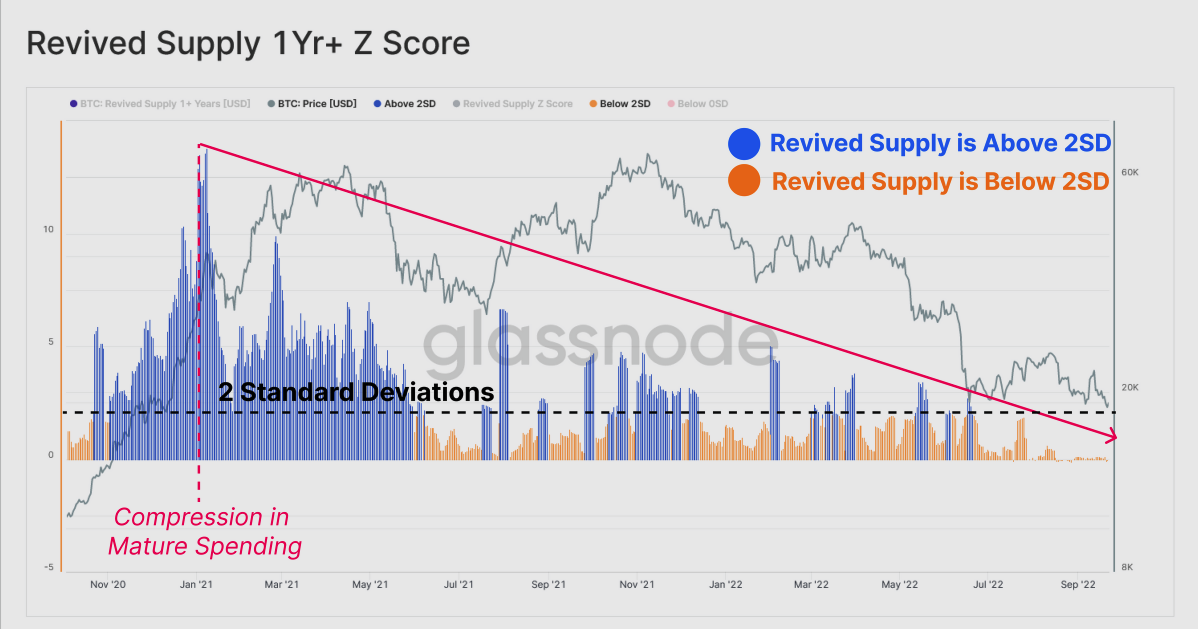

Based on the Elevated Supply 1+ Years metric, an indication that tracks the “total quantity of coins which come back to circulation after being untouched not less than 12 months,” the flow of latent supply shifting into the active supply pool is “extremely low.”

The compression in mature spending seen within the last stages from the 2018 bull marketplace is not present during the newest revisits below $20,000, suggesting that lengthy-term holders are very well familiar with volatility and reluctant to market in the current prices.

Considering that BTC is 72% lower from the all-time high along with a part of investors expect prices to crumble toward $10,000 within the next unpredicted capitulation event, you could interpret the possible lack of panic selling from mature investors as positive.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.