Bitcoin (BTC) headed toward $20,000 as U . s . States equities acquired in the March. 17 Wall Street open.

Stocks climb as U.S. dollar heads lower

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD reaching $19,672 on Bitstamp, up 3.5% in comparison to the weekend’s lows.

The happy couple rose consistent with stocks, using the S&P 500 and Nasdaq Composite Index gaining 2.7% and three.2%, correspondingly within thirty minutes’ buying and selling.

The experience coupled with weak U.S. economic data by means of the Empire Condition Manufacturing Index, which fell to -9.1 for October, heavily underneath the forecast -4.3 and September’s -1.5 studying.

“Manufacturing activity declined in New You are able to Condition, based on the October survey,” the brand new You are able to Fed summarized in commentary around the data.

“The general business conditions index fell eight suggests -9.1. Twenty-3 % of respondents reported that conditions had improved within the month, and thirty-2 % reported that conditions had worsened.”

Responding, Michaël van de Poppe, founder and Chief executive officer of buying and selling firm Eight, known as the outcomes “way worse than expected.”

“Top on Yields & $DXY coming. Bitcoin to rally,” he predicted.

With this, the U.S. dollar index (DXY) ongoing retracing recent gains at the time, targeting 112 and lower .65%.

“Risk asset deflation in 2022 and Given tightening regardless of the world leaning toward recession portend an elusive finish game,” Mike McGlone, senior commodity strategist at Bloomberg Intelligence, authored while summarizing fresh macro analysis.

“The lower-cost cure might be necessary in goods to curtail Given restraint and plunging money supply. Cooling oil might be refuel Bitcoin and gold.”

Research reinforces impending volatility

While traders were already predicting some respite hitting crypto markets on weekly timeframes, other perspectives reiterated the truth that lengthy term, nothing had altered for Bitcoin for a lot of several weeks.

Related: ‘Get ready’ for BTC volatility — 5 items to know in Bitcoin now

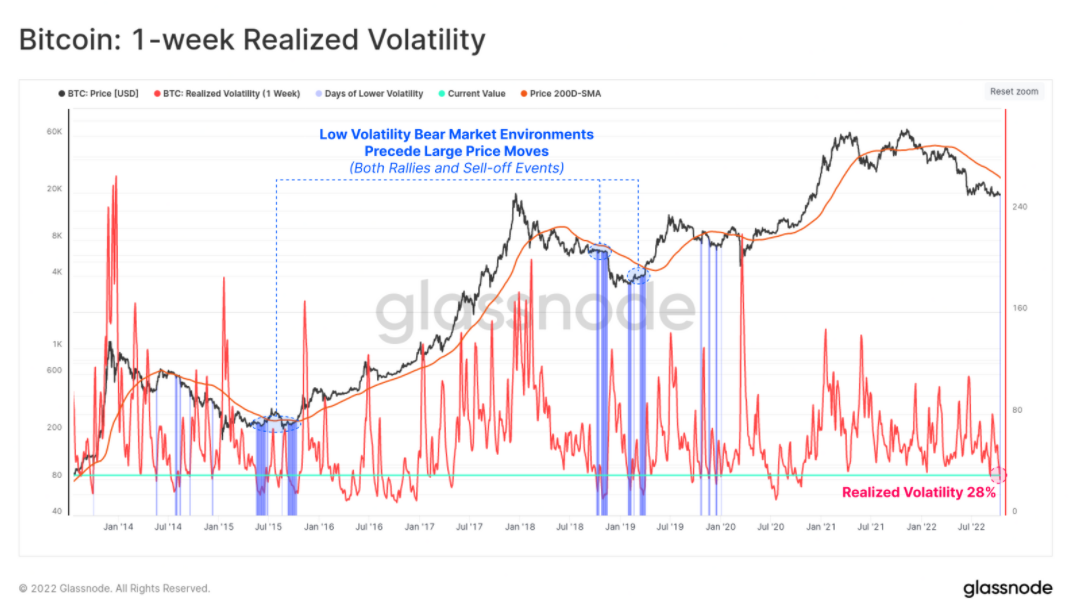

“It is extremely uncommon for BTC markets to achieve periods of these low recognized volatility, with just about all prior instances preceding a very volatile move,” on-chain analytics firm Glassnode demonstrated within the latest edition of their weekly e-newsletter, A Few Days On-Chain.

Alongside a chart of Bitcoin’s recognized volatility, researchers including lead analyst Checkmate contended the market had arrived at a pivotal point.

“Historical examples with 1-week moving volatility underneath the current worth of 28% inside a bear market have preceded significant cost moves both in directions,” they ongoing.

Concluding, Glassnode acknowledged that regardless of the fuel for any potential cost breakout being there, for instance in BTC-denominated futures open interest hitting new all-time highs, there is “little discernible directional bias in futures markets.”

“Volatility is probably coming, and Bitcoin costs are unfamiliar to sit down still for very lengthy,” the e-newsletter mentioned.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.