Bitcoin (BTC) going to multi-day highs following the August. 23 Wall Street open as U . s . States economic data tripped in the dollar.

Dollar suffers as data shows incomes “squeezed”

Data from Cointelegraph Markets Pro and TradingView adopted BTC/USD because it eyed $21,700 during the time of writing, near resistance in position since last week’s near-12% drop.

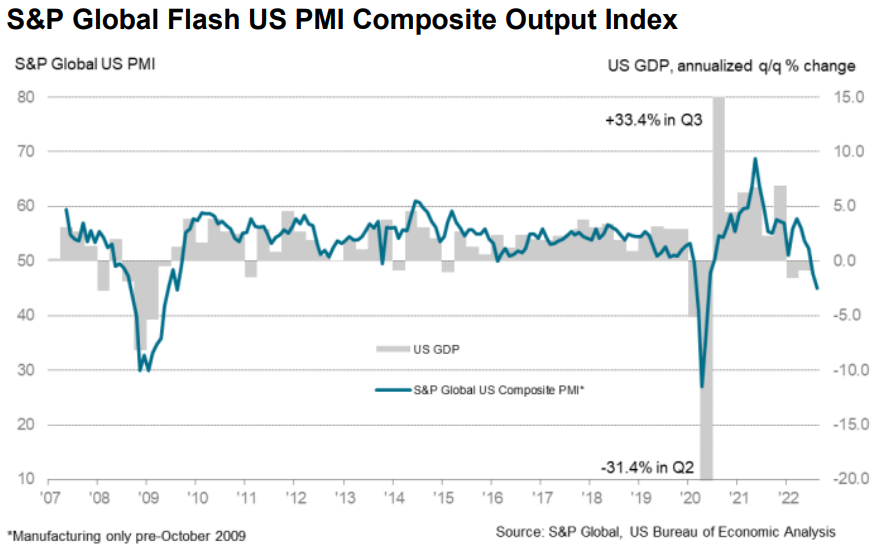

The happy couple acquired momentum as the U.S. Purchasing Managers Index (PMI) prints for August demonstrated a drop in comparison to the month prior, striking the cheapest levels since May 2020 in the height from the first round of COVID-19 lockdowns.

“The S&P Global Flash US Services Business Activity Index published at 44.one in August, lower from 47.3 in This summer, to point an additional decrease in overall services activity,” an announcement from curator S&P Global mentioned.

“The reduction in business activity was sharp overall and also the fastest since May 2020. Providers noted that hikes in rates of interest and inflation dampened customer spending as disposable incomes were squeezed.”

Yikes! The United States Composite #PMI just fell to 45.! That’s near #recession levels. The Help PMI is lower to 44.1, where a rise to 49.8 was expected. pic.twitter.com/GwSKfnOXS3

— jeroen blokland (@jsblokland) August 23, 2022

The implied slowdown sought after caused an instantaneous knock-on effect for dollar strength, using the U.S. dollar index (DXY) falling from new twenty-year highs.

The inversely-correlated DXY had on the other hand acquired quickly dads and moms prior, this coinciding with U.S. stocks facing resistance and Bitcoin seeing multiple journeys below $21,000.

“The August. PMI Composite Index fell to 45 from 47.7 in This summer. It had been likely to rise to 49.2,” gold proponent Peter Schiff reacted.

“The Services PMI tanked to 44.1, the cheapest since May 2020 and Mfg. sank to 51.3, the cheapest since This summer 2020. The U.S. PMI is less strong than any PMI in Europe or Asia.”

The S&P 500 and Nasdaq Composite Index were up a modest .25% and .45% during the time of writing, correspondingly

BTC bulls face $21,700 challenge

Analyzing what is next for risk assets, commentators wished for any rally in stocks on the rear of a declining dollar.

Related: Bitcoin addresses in loss hit 1-month high as BTC cost retests $21K

Popular Twitter account Bet on Trades known as the S&P 500 “extremely oversold within the short-term” according to relative strength index (RSI) data.

“Watch out for the potential bullish RSI divergences it’s selected up on the way,” a part of a brand new update read.

On Bitcoin, optimism from some likewise centered on coming back towards the range highs since June, having a “clean break” above $25,000 to be the deal breaker for $28,000 or even more to look.

Isn’t it time? pic.twitter.com/dZ0NI1JleS

— K A L E O (@CryptoKaleo) August 23, 2022

For on-chain analytics resource Material Indicators, meanwhile, it had been $21,700 that must be cracked like a initial step.

“When we aren’t seeing more BTC bids arriving above $21k, the down-side illiquidity (eye shadows) is going to be exploited,” it cautioned alongside a chart of support and resistance levels around the Binance order book.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.