Bitcoin (BTC) dropped volatility around the a week ago of This summer because the monthly close came near.

200-week moving average in focus for This summer close

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD retaining $24,000 as resistance into This summer 30.

The happy couple had benefitted from macro tailwinds across risk assets within the other half each week, these together with a flush finish for U . s . States equities. The S&P 500 and Nasdaq Composite Index acquired 4.1% and 4.6% within the week, correspondingly.

With off-speak buying and selling likely to spark volatile conditions into weekly and monthly closes because of thinner liquidity, however, analysts cautioned that anything might happen between now and This summer 31.

“Just gonna relax watching the marketplace up to the weekly close like always,” Josh Rager summarized.

“Hard to get involved with any trades all joking aside they might be a couple of outliers in market condition that still succeed over the past weekend.”

Others centered on the value of current place cost levels, which lay over the key 200-week moving average (MA) at $22,800. Finishing a few days above that trendline will be a first for Bitcoin since June.

#BTC is not far from conducting a Weekly Close over the 200-week MA

Technically, it appears as though BTC does well to reclaim the 200-week MA as support$BTC #Crypto #Bitcoin pic.twitter.com/ue00XDT9O0

— Rekt Capital (@rektcapital) This summer 29, 2022

Adopting a conservative short-term view, however, popular trader Roman known as for any go back to a minimum of $23,000 because of “overbought” conditions.

$BTC H4

To date seeing deviation for that potential double top call from yesterday.

PA – vol lower / cost up is bearish. MACD moving over. RSI overbought.

I expect a pullback to 23k at least. DT confirms on the close below 20.7k.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/aOahZDdYyC

— Roman (@Roman_Buying and selling) This summer 29, 2022

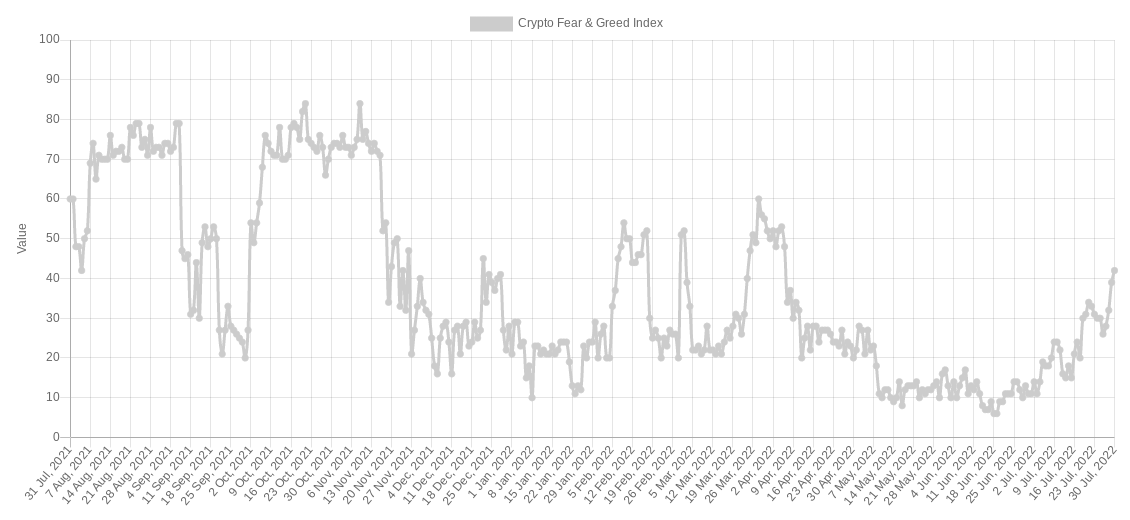

Optimism ongoing to improve across crypto markets with the week, the Crypto Fear & Avarice Index hitting its greatest levels since April 6 after exiting its longest-ever duration of “extreme fear.”

At 45/100, the Index was formally in “neutral” territory at the time.

Bullish continuation slated for Au

Searching to the following month, meanwhile, Cointelegraph contributor Michaël van de Poppe stated that stocks performance would still provide fertile conditions for any crypto rebound.

Related: Bitcoin bear market over, metric hints as BTC exchange balances hit 4-year low

“Seems like we are getting that continuation in August, including with crypto and Bitcoin,” a part of a Twitter on This summer 29 mentioned.

“Summer time relief rally it’s!”

August was set to become a quiet month for U.S. macro triggers, using the Fed not because of alter policy inside a scheduled manner until September.

The chance of evolving inflation nevertheless continued to be, using the next Consumer Cost Index (CPI) print due August 10. Now, the Eu reported its greatest-ever monthly inflation estimate for that Eurozone at 8.9%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.