“When it rains, it pours” is definitely an saying finding new relevance within the cryptocurrency markets on May 9 as traders face a later date of discomfort and also the current cost decline brings Bitcoin (BTC) to the cheapest level in 2022.

Data from Cointelegraph Markets Pro and TradingView implies that the BTC selloff on May 9 intensified because the buying and selling day progressed with Bitcoin hitting a regular low of $31,000 as bulls scrambled to mount what amounted to some weak defense.

Here’s a glance at a few of the developments that brought as much as May 9’s cost declines and just what traders look as the crypto market heads much deeper into bear territory.

Further bad thing is possible

Bitcoin bulls have battled to determine a good floor of support in the last handful of several weeks because bears happen to be persistent within their drive to push the cost lower.

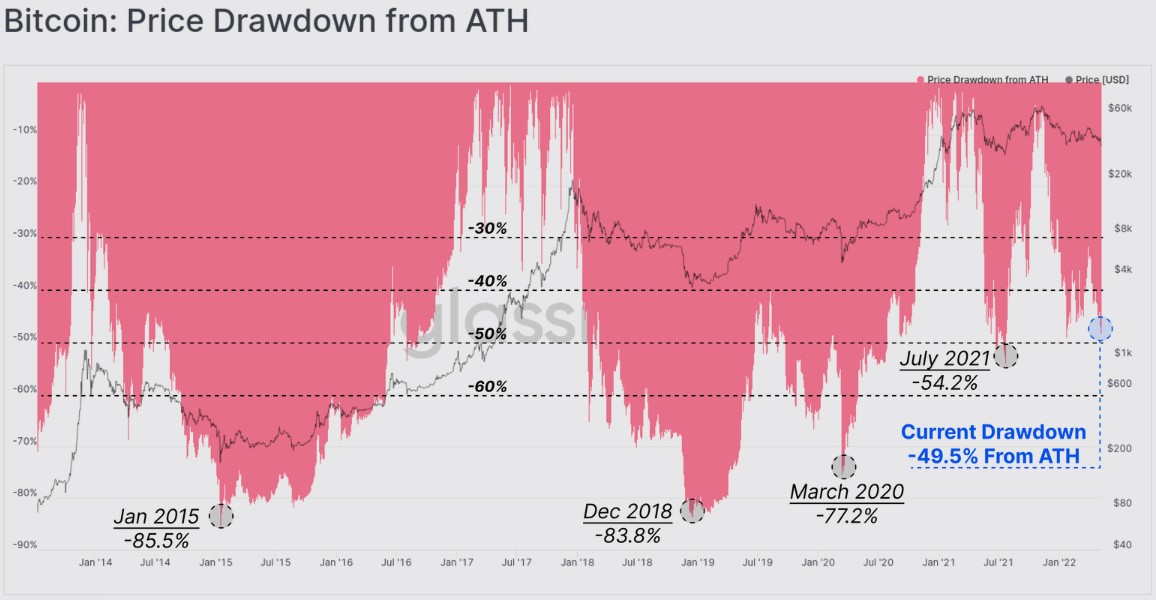

Presently, BTC cost lower 50% from the all-time full of November as well as on-chain analysis firm Glassnode noted inside a recent are convinced that this decline “remains modest in comparison to the ultimate lows of prior Bitcoin bear markets.”

As proven within the graphic above, the drawdown in This summer 2021 arrived at an optimum of -54.2% as the “bear markets of 2015, 2018 and March 2020 capitulated at lows between -77.2% and -85.5% from the all-time high.”

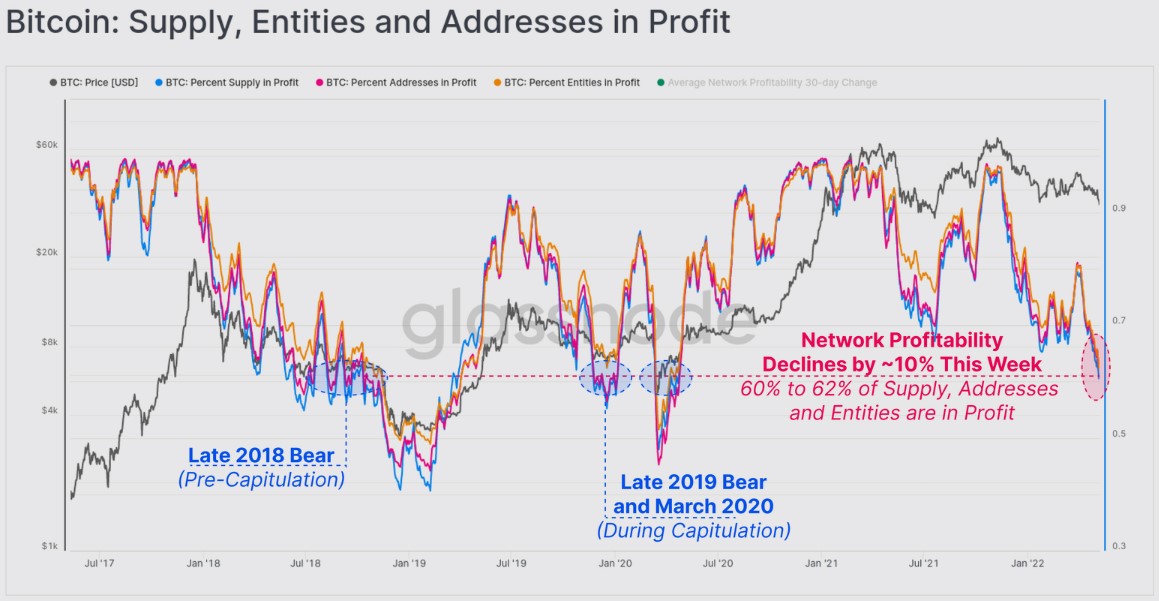

Network profitability has additionally declined to levels that act like that which was seen throughout the late-2018 and late 2019–2020 bear markets.

Glassnode stated,

“It ought to be noted that both instances were before the final capitulation eliminate event. As a result, further downside remains a danger, and could be inside the arena of historic cycle performance.”

Traders are taking a chance-off approach

A much deeper dive in to the on-chain data implies that the capitulation by Bitcoin holders has intensified in recent days because the cost has ongoing to trend lower.

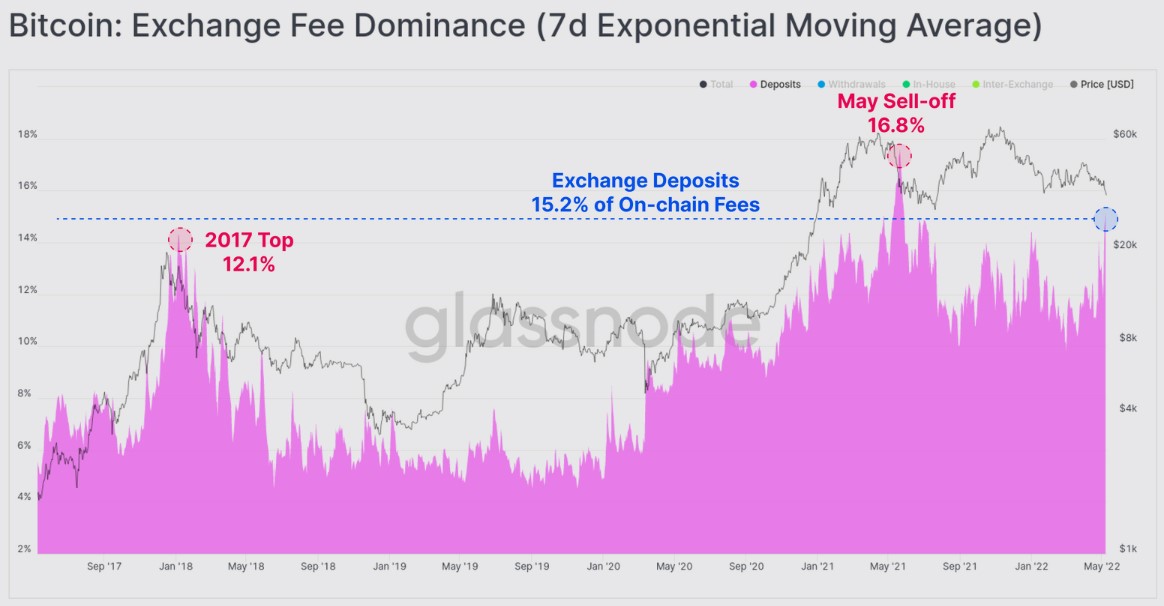

Evidence with this capitulation are available searching in the Bitcoin exchange fee dominance, which measures what number of the charges around the Bitcoin network was compensated to deposit BTC for an exchange.

Based on Glassnode, the sudden spike within the Bitcoin exchange fee dominance to fifteen.2% may be the second-greatest level ever and “further props up situation that Bitcoin investors were trying to de-risk, sell and/or add collateral to margin as a result of market volatility.”

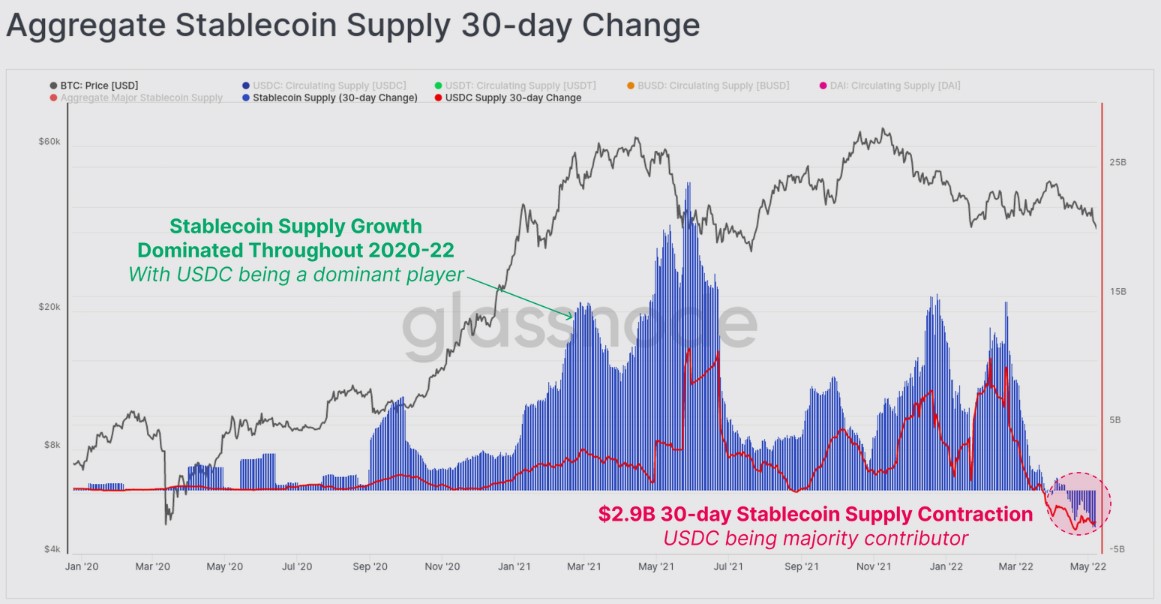

Additional proof of a boost in risk-off sentiment are available searching at stablecoin supplies, that have declined in the last two several weeks after growing from $5.33 billion to $158.25 billion because the market selloff in March 2020.

After reaching an optimum of $161.53 billion at the begining of April, the mixture stablecoin supply has declined by $3.285 billion being an uptick in redemptions of USD Gold coin (USDC) has outpaced inflows across all stablecoin tokens.

Glassnode stated,

“Overall, there are a variety of signals of internet weakness within the space, a few of which indicate that risk-off sentiment continues to be the core market position at the moment.”

Related: Bitcoin sets new 2022 lows as analyst states visit to $24K recognized cost ‘entirely possible’

The potential of holding above $30,000

The current weakness over the market has brought many crypto traders to switch bearish and accept the potential of a decline to $28,000, that has began to pique the contrarian perspectives of some analysts including futures trader Peter Brandt, who published the next tweet addressing the modification in sentiment.

Since 28,000 is really broadly recognized as downside target I’m made to change my view. Either cost holds above 30,000 or tanks through 28,000

— Peter Brandt (@PeterLBrandt) May 8, 2022

It remains seen what comes next for BTC, but it is best to get ready for more volatility because macro global occasions still put pressure on markets.

Glassnode stated,

“Bitcoin remains highly correlated towards the broader economic conditions, which implies the street ahead may regrettably be considered a rocky one, a minimum of for the moment.”

The general cryptocurrency market cap now is $1.467 trillion and Bitcoin’s dominance rates are 41.7%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.