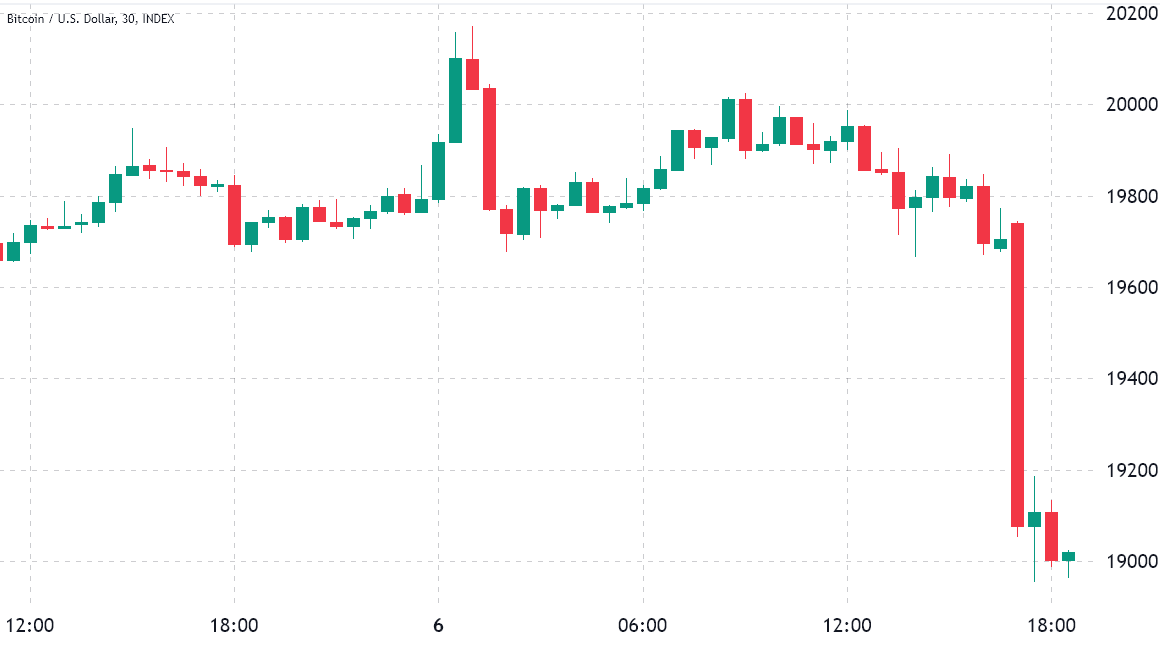

An $860 surprise cost correction on Sept. 6 required Bitcoin (BTC) from $19,820 to $18,960 in under two hrs. The movement caused $74 million in Bitcoin futures liquidations at derivatives exchanges, the biggest in almost three days. The present $18,733 level may be the cheapest since This summer 13 and marks a 24% correction in the rally to $25,000 on August. 15.

It’s worth highlighting that the 2% pump toward $20,200 happened in early hrs of Sept. 6, however the move was rapidly subdued and Bitcoin started again buying and selling near $19,800 inside the hour. Ether’s (ETH) cost action was more interesting, gaining 7% within the 48 hrs preceding the marketplace correction.

Any conspiracy theories regarding investors altering their position to favor the altcoin could be ignored as Ether dropped 5.6% on Sept. 6, while Bitcoin’s $860 loss represents a 3.8% change.

The marketplace has been around a rut since August. 27 comments from U.S. Fed Chair Jerome Powell was adopted with a $1.25 trillion loss in U.S. stocks right away. In the annual Jackson Hole Economic Symposium, Powell stated that bigger rate of interest hikes remained as firmly up for grabs, resulting in the S&P 500 to shut lower 3.4% on that day.

Let’s check out crypto derivatives data to know whether investors happen to be prices greater likelihood of a downturn.

Pro traders happen to be bearish since a week ago

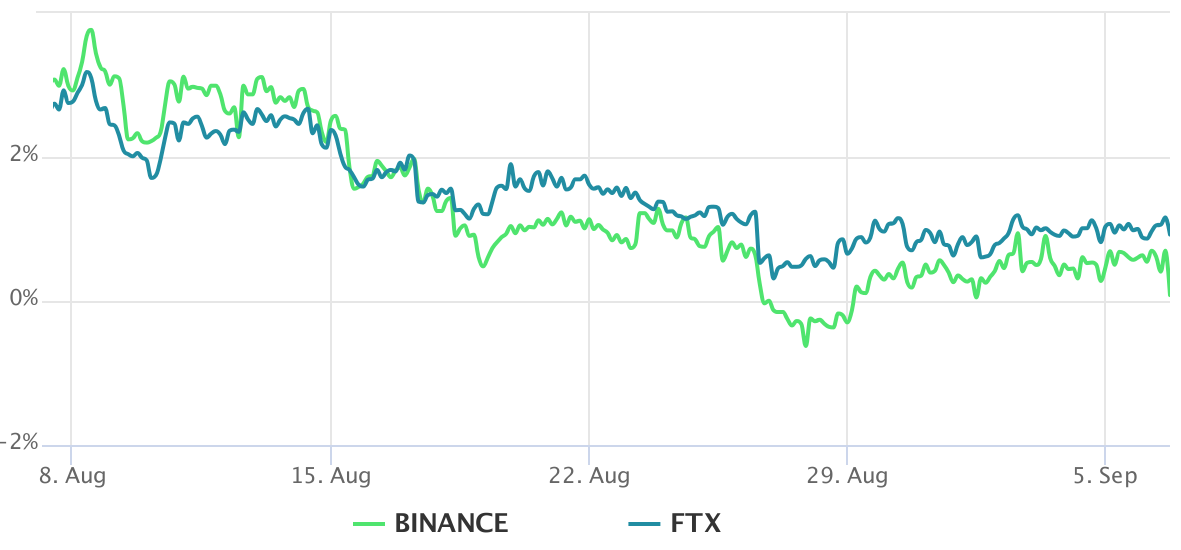

Retail traders usually avoid quarterly futures because of their cost difference from place markets. Still, they’re professional traders’ preferred instruments simply because they avoid the fluctuation of funding rates that frequently happens in a continuous futures contract.

In healthy markets, the indicator should trade in a 4% to eightPercent annualized premium to pay for costs and connected risks. So it’s possible to securely state that derivatives traders have been neutral to bearish within the last month since the Bitcoin futures premium continued to be below 3% the whole time. This data reflects professional traders’ unwillingness to include leveraged lengthy (bull) positions.

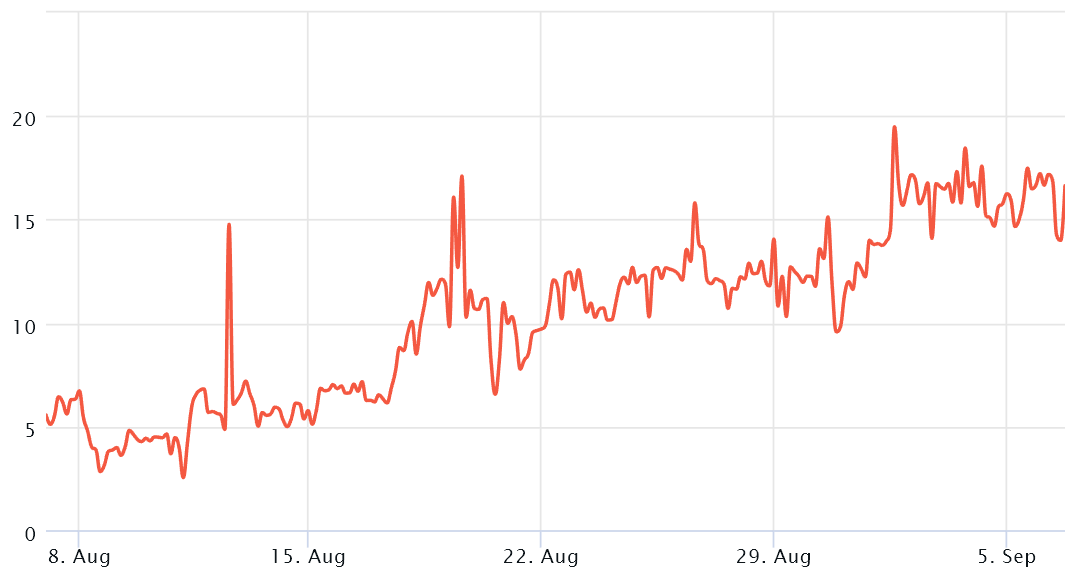

You have to also evaluate the Bitcoin options markets to exclude externalities specific towards the futures instrument. For instance, the 25% delta skew is really a telling sign when market makers and arbitrage desks are overcharging for upside or downside protection.

In bear markets, options investors give greater odds for any cost dump, resulting in the skew indicator to increase above 12%. However, bullish markets have a tendency to drive the skew indicator below negative 12%, meaning the bearish put choices are discounted.

The 30-day delta skew have been over the 12% threshold since Sept 1, signaling options traders were less inclined to provide downside protection. Both of these derivatives metrics claim that the Bitcoin cost dump on Sept. 6 may have been partly expected, which is the reduced effect on liquidations.

Compared, the $2,500 Bitcoin drop on August. 18 caused $210 million price of leveraged lengthy (buyers) liquidations. Still, the current bearish sentiment doesn’t always mean adverse cost action. Therefore, you ought to tread carefully when whales and market markers are less inclined to include leverage longs and provide downside protection using options.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.