Bitcoin (BTC) surged $1,000 in 5 minutes prior to the November. 10 Wall Street open as U . s . States inflation and jobs data boosted risk assets.

CPI is available in cheapest since the beginning of 2022

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD climbing to daily highs of $17,782 on Bitstamp.

The happy couple only agreed to be hrs from the more-than-two-year low below $15,700 at that time, taking its 24-hour low-to-high to 12.8%.

During the time of writing, BTC/USD circled $17,400 with volatility still rampant as U.S. markets opened up to digest economic data.

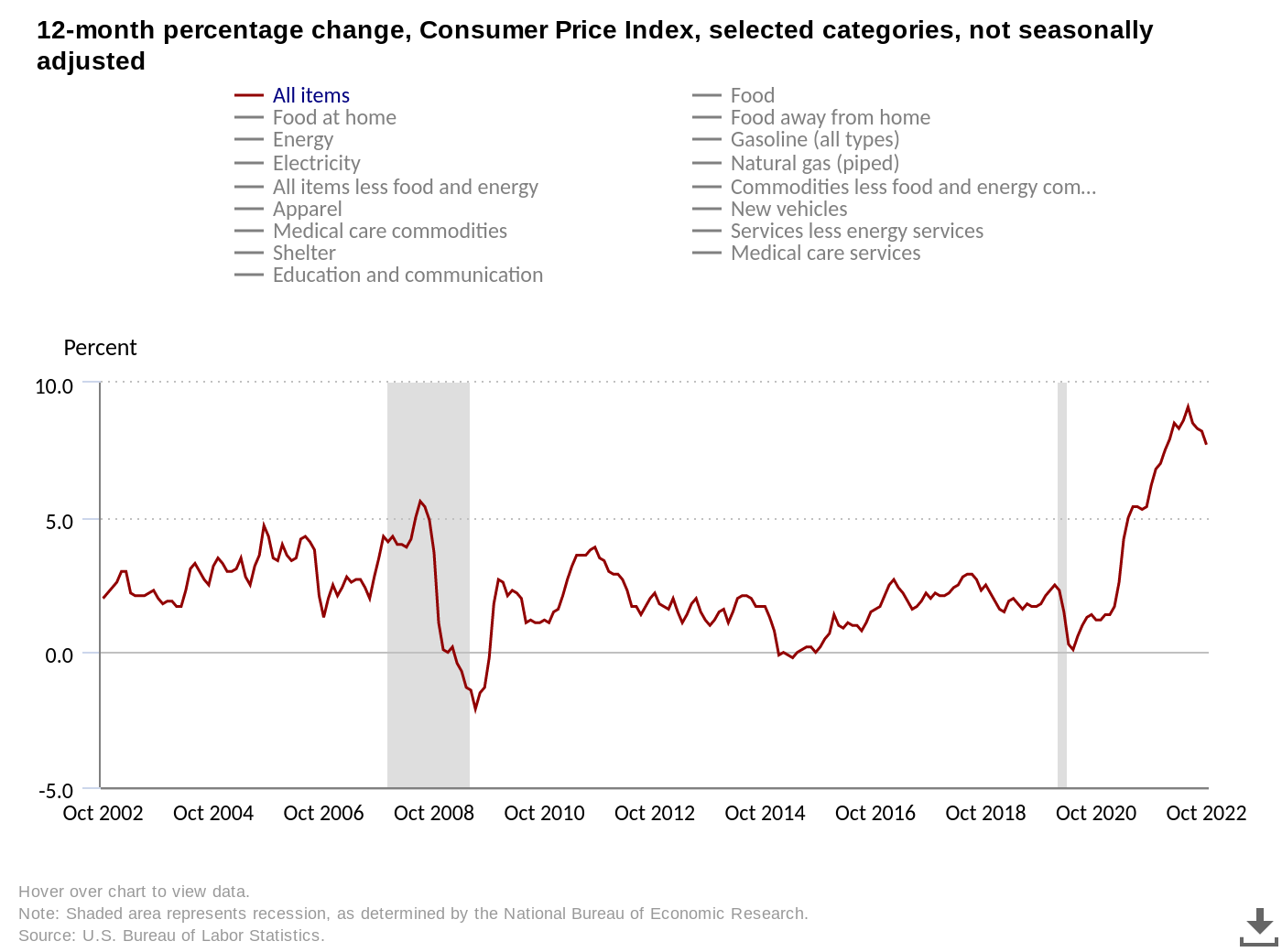

This had come by means of the customer Cost Index (CPI) print for October, together with unemployed claims.

Both offered an optimistic surprise, CPI arriving below expectations and unemployed claims above, both implying the Federal Reserve’s rate hikes were working which a pivot will come earlier than feared.

Analyzing Bitcoin’s response to the Binance order book, monitoring resource Material Indicators demonstrated the closest resistance hurdle at $18,500.

“Bear Market Rally continues to be alive,” a part of associated comments read.

Buying and selling account IncomeSharks being more positive, quarrelling that $20,000 may return included in the risk asset rebound.

“Bitcoin- Comes with an easy path to $20k as Stocks pushing up and positive CPI figures,” it told Twitter supporters.

At 7.7% year-on-year, the October CPI readout marked the cheapest since The month of january, an associated press release confirmed.

“The all products less food and index rose 6.3 % during the last 12 several weeks. The power index elevated 17.6 % for that 12 several weeks ending October, and also the food index elevated 10.9 % within the this past year many of these increases were smaller sized compared to the time ending September,” it mentioned.

DXY tanks 2% on economic figures

Meanwhile, a previously weakened U.S. dollar index (DXY) felt instant discomfort in the release, shedding over 2% for that second amount of time in recent days.

Related: Analysts urge calm as Tether depegs from USD, Bitcoin loses $17K rebound

DXY circled 108.6 during the time of writing, its cheapest since Sept. 13.

Simultaneously, stocks opened up markedly greater, using the S&P 500 up 3.5% and Nasdaq Composite Index gaining 4.6%.

Popular analyst John Wick, like others, nevertheless advised caution.

“Dollar falling from the up-funnel because of CPI figures. This giving relief to assets,” he tweeted alongside a DXY chart.

“Just because an up-funnel is damaged does not necessarily mean a sustained downtrend always happens. Frequently another funnel may form in a slower rate of assent, or may jump to original funnel.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.