Bitcoin (BTC) rose quickly afterwards August. 26 as fresh economic data in the U . s . States furthered about a pivot in the Fed.

Bitcoin bounces but preserves intraday trend

Data from Cointelegraph Markets Pro and TradingView tracked a 3.55% rise for BTC/USD at the time, allowing the happy couple to complement highs from earlier within the week.

The move marked an unexpected about-turn for Bitcoin, which hrs before saw selling pressure as markets anticipated cues from Given Chair Jerome Powell’s Jackson Hole symposium speech.

With this speech still in the future during the time of writing, abullish catalyst came by means of the most recent Personal Consumption Expenses Cost Index (PCE) readout, that was less than expected.

Analysts reacted positively, because the figures added weight to the concept that U.S. inflation had already peaked — a story already based on the customer Cost Index (CPI).

This is how the #crypto market reacted to higher than expected PCE report. #BTC liquidity is on the go. A rip with the range before #JPow speech at 10am ET isn’t unthinkable. In the end it’s #Given #FuckeryFriday #NFA pic.twitter.com/32jU1WNPGm

— Material Indicators (@MI_Algos) August 26, 2022

Caleb Franzen, senior market analyst at Cubic Analytics, nevertheless noted the hourly structure on BTC/USD continued to be in position regardless of the uptick. Bitcoin traded inside a range unchallenged because the August. 19 drop from greater levels.

#Bitcoin 1hr structure continues to be intact following the PCE data.

Facing resistance at a negative balance range as well as retesting the previous support trendline (teal), that is threatening to do something as resistance too. pic.twitter.com/bTZF9rxVsa

— Caleb Franzen (@CalebFranzen) August 26, 2022

Analyst Kevin Svenson was equally conservative in the look at the possibility knock-on effects for Bitcoin.

“PCE information is bullish. Given uses that data, now speculators are betting up,” he described.

“But when Powell stays the program only then do we could easily dump back lower, so you need to be careful. A gold coin switch now.”

During the time of writing, BTC/USD traded around $21,500, a vital area that contains Bitcoin’s recognized cost.

“Most participants” in Bitcoin are sleeping

Analyzing longer-term trends, meanwhile, BlockTrends analyst Caue Oliveira had some not so good news for individuals wishing for any more seismic go back to form for BTC cost action.

Related: CME Bitcoin futures see record discount among ‘very bearish sentiment’

Network usage, he noted inside a blog publish at the time, was still being trending lower, departing little room for just about any bull runs to become based on strong volume.

“Bitcoin’s New Bull Market Canceled, For Now At Least,” he accepted.

“Without any indications of a rise in interest in the network, the resumption within the cost of Bitcoin continues to be not even close to happening, pointing to some moment of accumulation.”

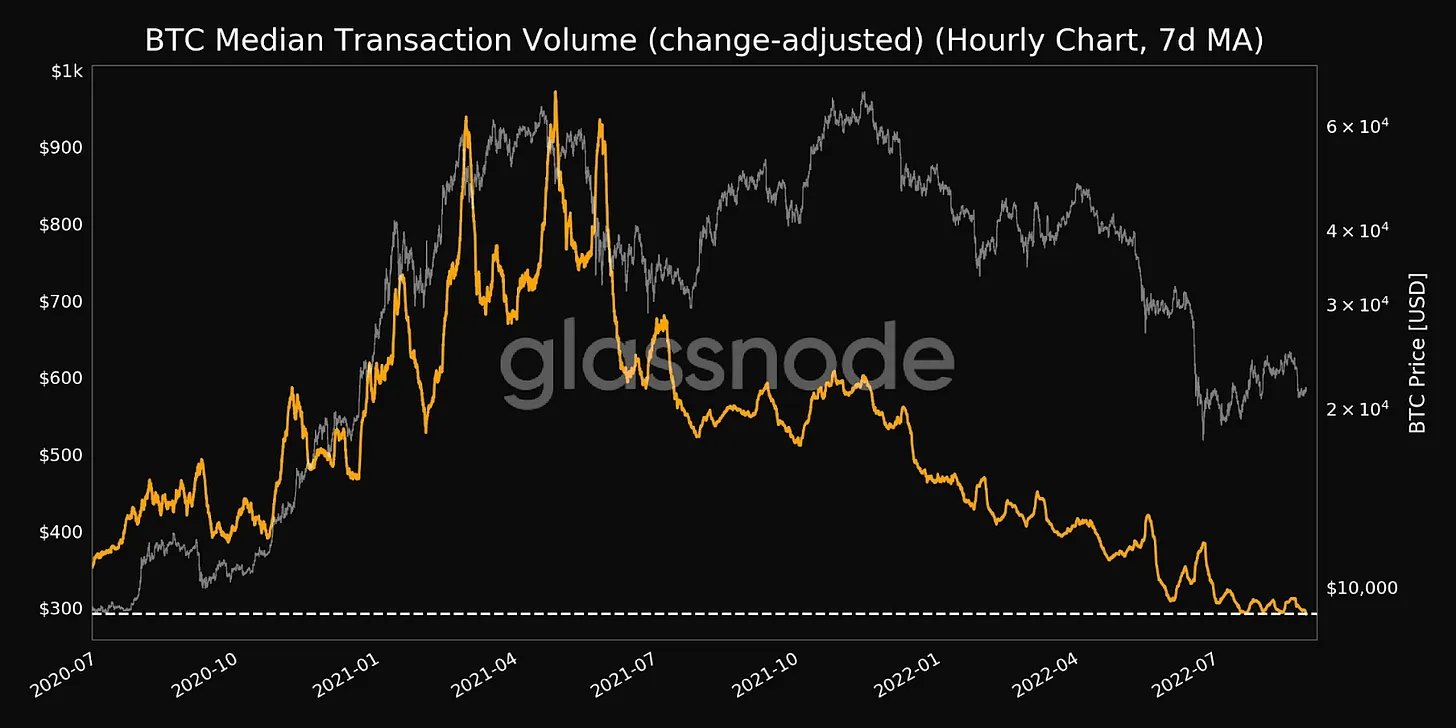

An associated chart from on-chain analytics firm Glassnode demonstrated median on-chain transaction volume at two-year lows, even comprising the current cost run-up.

This, Oliveira added, described a four-year lower in exchanges’ BTC reserves, as appetite for buying and selling had decreased consistent with too little speculative activity.

“For the time being, most participants remain inactive, including institutional ones,” he concluded

“Great time for lengthy-term accumulators, however for short-term traders, caution is required.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.