Bitcoin (BTC) dipped further below $19,000 on March. 21 as rumors circulated within the U . s . States Fed.

Given still on the right track for major November rate hike

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD abruptly shedding prior to the Wall Street open, hitting lows of $18,660 on Bitstamp.

A recovery required the happy couple greater, also it was attempting reclaim $19,000 as support during the time of writing.

The experience came as commentators claimed the Given was softening its policy on rate hikes in front of the November. 1–2 Federal Open Market Committee (FOMC) meeting.

Citing mainstream media quotes from Given officials, they recommended the November hike may be the last 75-basis-point adjustment, with smaller sized ones following.

“Some officials tend to be more wanting to calibrate their rate setting to prevent overtightening,” Nick Timiraos, chief financial aspects correspondent in the Wall Street Journal, summarized.

“But they won’t wish to dramatically release financial conditions if they hike by 50 bps (rather of 75). This meeting could allow officials to obtain aligned on next steps.”

Timiraos arrived for skepticism following his words, with a few accusing him of “dripping” data that might be sensitive for markets.

“How silly that you have a designated Given leaker that may drop a prompt tweet thread and instantly impact global markets,” popular commentator Stack Hodler authored.

“Think of the havoc if a person hacked this guys account and leaked a 100bps raise. Yields rocket so we get United kingdom pension crisis 2. — exactly what a janky financial system.”

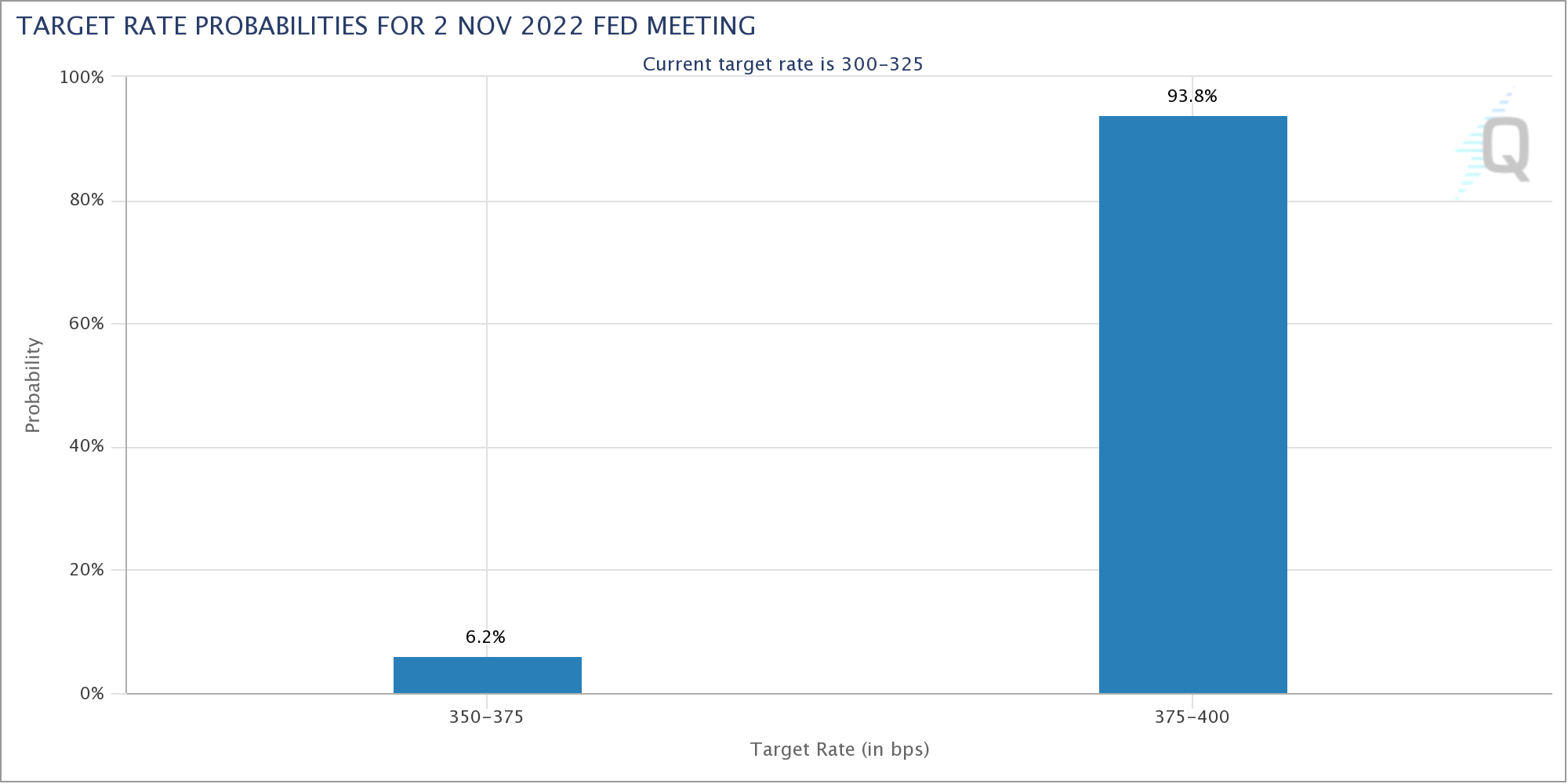

According to CME Group’s FedWatch Tool, the chances of the 75-basis-point hike the following month continued to be almost guaranteed, having a mere 6.2% possibility of 50 basis points.

Dollar retreats after yen seals more lows

U.S. equities saw a good begin to buying and selling at the time, as the U.S. dollar quickly lost ground after earlier causing fresh discomfort for buying and selling partner currencies.

Related: Global recession may last until near 2024 Bitcoin halving — Elon Musk

The U.S. dollar index (DXY) was below 113 during the time of writing, getting spiked to close 114 hrs prior.

“It’s about DXY and also the consolidation between recent highs and D1 upward trend,” popular crypto trader and analyst Pierre described, citing the sooner analysis.

In an indication of how problematic the dollar’s rise was becoming, japan yen weakened beyond the psychologically significant 150 mark — a 32-year low.

“Unless of course the BOJ gives in in the bond yield suppression, the yen continuously power lower. JPY 150 breeched,” Alasdair Macleod, the mind of research for Goldmoney, forecast.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.