Bitcoin (BTC) provided a lengthy anticipated breakout into Sept. 7 as BTC cost action dashed bulls’ about a recovery.

$23,000 relief bounce “still likely” states trader

Data from Cointelegraph Markets Pro and TradingView taken snap losses for BTC/USD afterwards Sept. 6, with overnight lows weighing $18,540 on Bitstamp.

The happy couple place in its cheapest levels since June 30, taking liquidity in the This summer floor and just marginally recovering at the time.

Downside cost action adopted almost per week of sideways movements and volatility was nowhere to appear as market participants gritted their teeth wishing to have an exit towards the upside.

In case, these were left disappointed, however for popular trader Il Capo of Crypto, there is still need to think that a relief bounce would occur.

“First of, cost is appropriate now sitting above major daily support (range low, 18,500-19,000),” he contended inside a Twitter thread.

“It’s in which the last bear market rally began, indicating there’s strong demand here. A bounce came from here towards the supply zone (22500-23000) would form an ideal H&S.”

Il Capo of Crypto added that every breakdown have been supported by waning volume, suggesting that sellers were getting to operate more and more from the tide to consider prices lower.

“Funding also signifies that shorts are becoming trapped on every leg lower which there’s lots of fuel for any short squeeze,” he added.

With this to not occur, consolidation will have to begin underneath the late June levels near $18,500.

“Summary: short squeeze to 22,500-23,000 continues to be likely,” the thread concluded.

“Most individuals are bearish and arrogant, but charts show otherwise. Do not get at ease with your short positions. I am still totally on USDT but hedging with this potential move. Time will inform.”

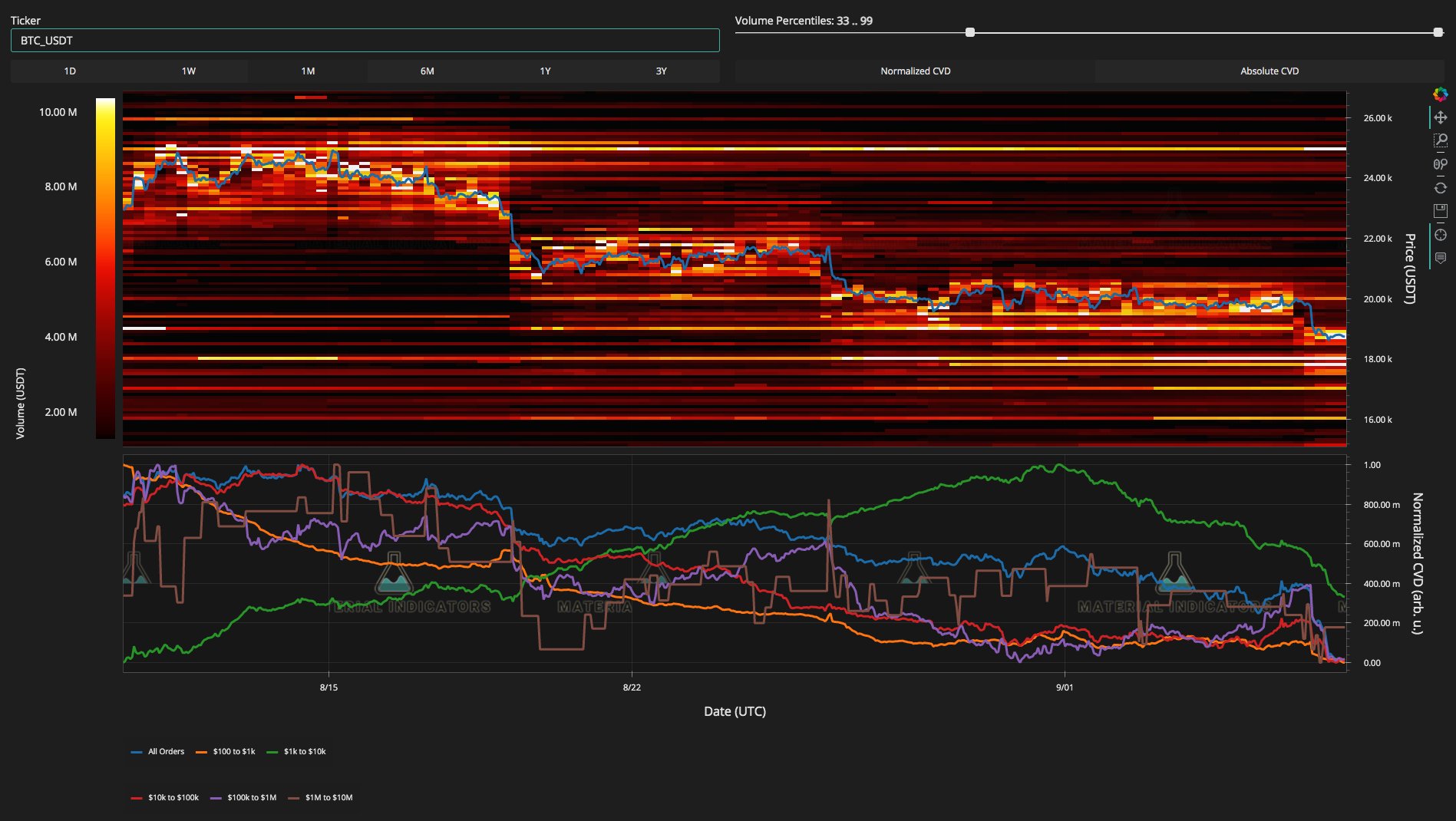

Data in the Binance BTC/USD order book submitted by on-chain monitoring resource Material Indicators confirmed Bitcoin acting within an section of major liquidity.

DXY will get 120 target after “major correction”

Macro markets meanwhile provided interesting viewing at the time because the U.S. dollar raged greater.

The U.S. dollar index (DXY) set new twenty-year highs of 110.78, this supported with a much deeper dive around the euro and yen, ongoing a harsh trend from recent several weeks.

Related: Bitcoin cost falls under $19K as data shows pro traders staying away from leverage longs

For macro economist Henrik Zeberg, a short retracement wasn’t to become celebrated, because the greenback would then return having a vengeance to mind to 120, an amount last arrived at in The month of january 2002.

Nevertheless, he predicted, the correction means crypto could be “flying.”

It’s All About THE #DXY

Reversal soon for major correction – quick – before bottom and new painful rally as much as my final target of ~120

Correction can last couple of several weeks and can send Risk Assets flying #equities #crypto etc. = BLOW-OFF-TOP pic.twitter.com/2hs6b5lKIA

— Henrik Zeberg (@HenrikZeberg) September 7, 2022

By comparison, WTI oil hit its cheapest levels since the beginning of the entire year with what popular buying and selling account Blockchain Backers known as the beginning of “the capitulation of oil.”

U.S. equities opened up modestly greater, using the S&P 500 and Nasdaq Composite Index gaining .3% and .65% within the first hour’s buying and selling, correspondingly.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.