Bitcoin (BTC) spiked to $17,000 in the November. 15 Wall Street open as fresh U . s . States economic data ongoing to exhibit inflation cooling.

“Good” PPI boosts risk assets

Data from Cointelegraph Markets Pro and TradingView adopted BTC/USD because it came nearer to multi-day highs.

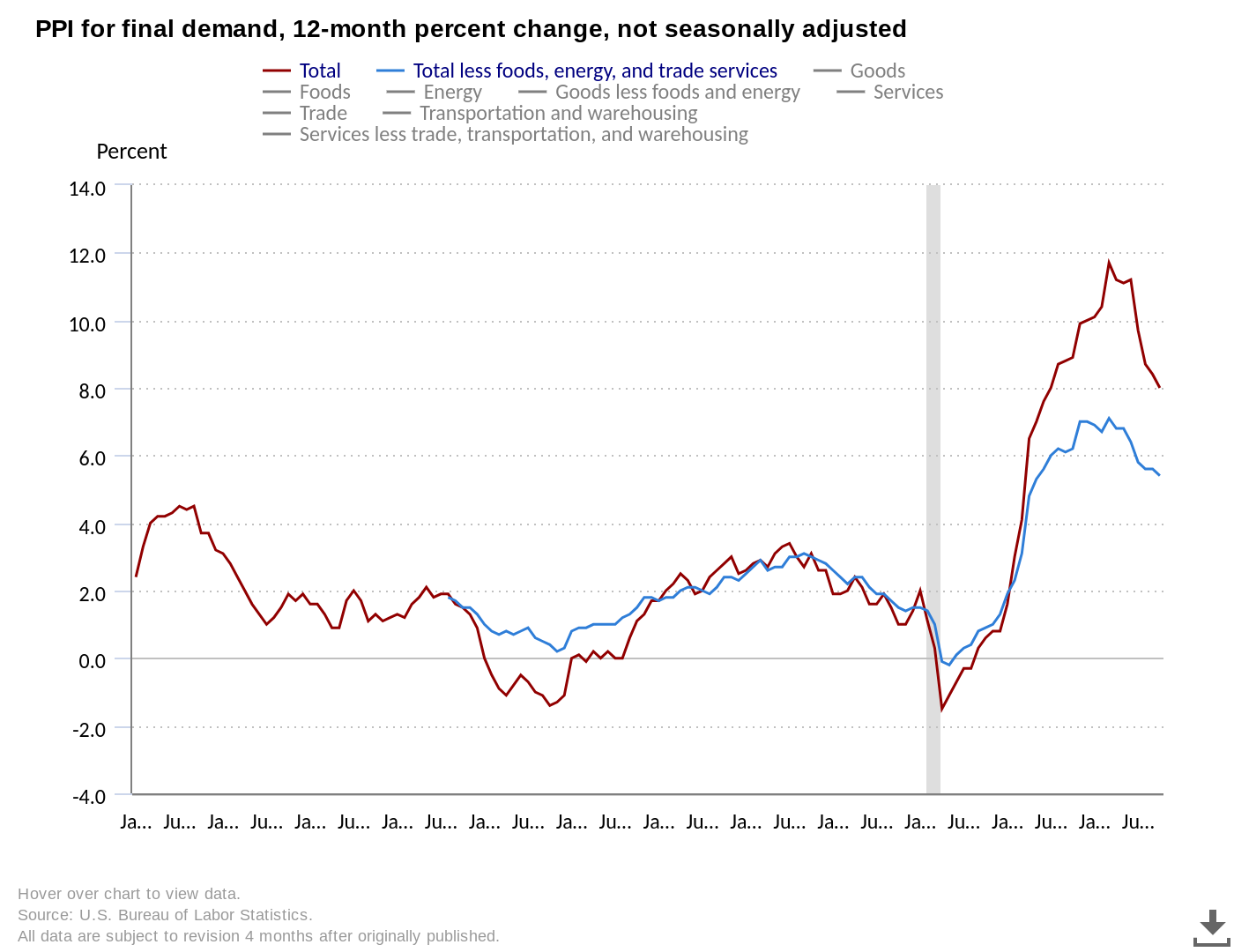

Volatility had came back an hour or so prior to the open because the U.S. Producer Cost Index (PPI) arrived below expectations.

Core PPI was unchanged month-on-month, using the PPI overall up .2% in comparison to the .4% forecast. Year-on-year PPI was 8% in comparison to the 8.3% forecast.

The information, already in stark contrast to last month’s PPI, follows on from October’s Consumer Cost Index (CPI) readout a week ago, this showing that cost increases within the U.S. were slowing.

An evidently good sign for crypto together with risk assets, lower figures theoretically increase the probability of an early on pivot in hawkish economic policy in the Fed.

“Good CPI & Good PPI,” Michaël van de Poppe, founder and Chief executive officer of buying and selling firm Eight, reacted.

Others were more concered about the outcomes considering such aggressive quantitative tightening (QT) measures.

“The PPI may be the inflation number Given uses to create decisions,” popular analyst Venturefounder authored partly of the Twitter analysis.

“Market rallies in the news, inflation might have peaked however i think probably the most alarming part is after record QT for several months the PPI continues to be at 8%.”

Stocks naturally appreciated the most recent economic changes, using the S&P 500 and Nasdaq Composite Index up 1.7% and a pair of.4%, correspondingly, in the open.

The already precarious U.S. dollar index (DXY), meanwhile, felt pressure, briefly shedding below 105.5 to the cheapest levels since mid-August.

Bullish divergences satisfy the “final capitulation” risk

For Bitcoin, optimism was still being difficult to find in analytical circles.

Related: Edward Snowden states he feels ‘itch to lessen in’ to $16.5K Bitcoin

Nevertheless, for trader and analyst Seth, a brand new bullish divergence around the weekly chart was something to feel confident about.

“Bears required credit for that FTX Blackswan. Very few understood second largest Exchange was going Bankrupt!” associated Twitter comments mentioned.

Bleaker news originated from fellow analyst Matthew Hyland, whose previous warning of the bearish chart mix came true.

“The previous two crosses led to -46% and -57% moves Following the mix was confirmed,” he reiterated concerning the three-day chart’s moving average convergence/divergence (MACD) indicator.

Il Capo of Crypto, still eyeing a much deeper macro low, meanwhile, added the “final capitulation is probably.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.