Bitcoin (BTC) and crypto markets fell heavily into November. 8 as contagion in the FTX debacle spilled over.

Analysts dismiss FTX insolvency fears

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD falling to $19,351 on Bitstamp — its cheapest levels since March. 25.

The happy couple, together with altcoins small and big, had already commenced to exhibit weakness as moves by Binance to cancel contact with FTX’s in-house FXT Token (FTT) token were confirmed by Chief executive officer Changpeng Zhao.

Inside a Twitter thread afterwards November. 7, Zhao defended the choice, while FTX Chief executive officer Mike Bankman-Fried tried to reassure markets that his buying and selling platform was solvent.

“There were questions regarding a sizable ($580m) FTT deposit to Binance, so we were transparent concerning the fact that we’re closing our FTT position,” a part of certainly one of Zhao’s tweets read.

Bankman-Fried’s appeal, meanwhile, made an appearance to fall on deaf ears. Overnight, FTX saw an outburst in withdrawals, with monitoring sources even showing negative BTC balances for that exchange’s wallets.

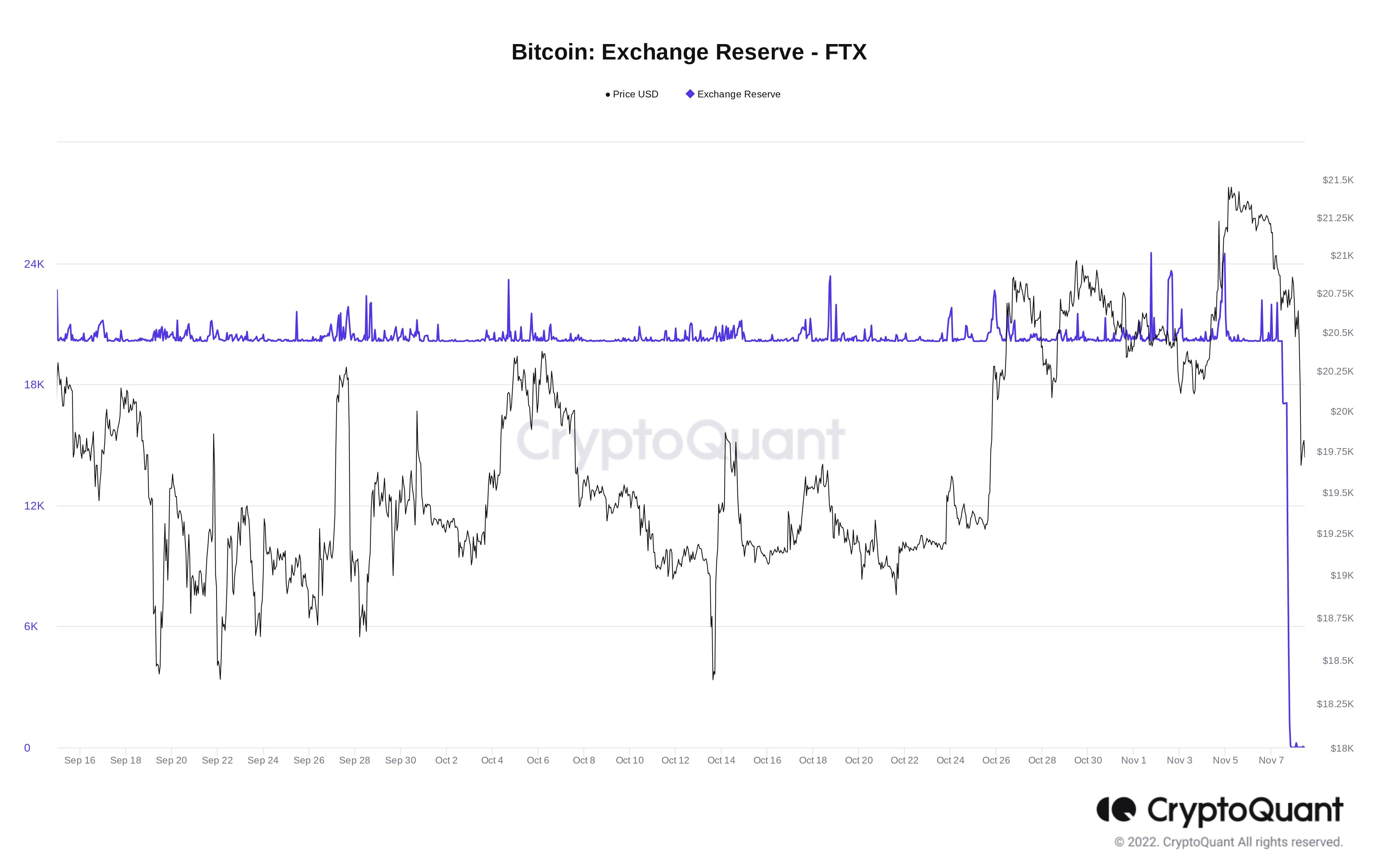

Data from on-chain analytics platform CryptoQuant put FTX’s BTC balance reduction on November. 7 alone at -19,956 BTC.

Its BTC reserves were apparently just 7.1 BTC during the time of writing, further data demonstrated, with this particular potentially because of alterations in wallet management.

“FTX, the #2 crypto exchange, is experiencing a financial institution run,” Jack Niewold, founding father of e-newsletter Crypto Pragmatist, started an investigative Twitter thread by stating:

“Pushed towards the edge with a debt crisis & a comment from the #1 competitor, ~$1b has bled out of the platform within the last couple of days.”

In another of numerous reactions towards the ongoing turmoil, Dylan LeClair, senior analyst at UTXO Management, contended that although may possibly not be over financially for FTX, the transparency of their operations was reason to be concerned.

“I don’t think it’s probable that FTX is insolvent, however i think the Alameda worries are notable, if little else,” a part of Twitter comments mentioned.

“I don’t think FTX goes lower. May be, however i don’t think so,” Michaël van de Poppe, founder and Chief executive officer of buying and selling platform Eight, ongoing:

“Binance simply really wants to sell the positioning because of the reasons discussed, by which a sell-off was initiated. Bit not the same as $LUNA and Celsius, but has similarities too.”

Bitcoin surrenders $20,000 mark

For Bitcoin, the outlook continued to be cloudy as cold ft required your hands on market sentiment.

Related: Funding rates hit 6-month high before CPI — 5 items to know in Bitcoin now

BTC/USD retrieved just $400 from the lows at the time, making $20,000 once again from achieve.

Further volatility was coming, meanwhile, because the U . s . States midterm elections coupled with Consumer Cost Index (CPI) data due for release on November. 10.

“$FTT tanking heavily, by which also Bitcoin and all of those other markets show listlessness,” Van de Poppe summarized.

Because of its part, FTT were able to stage a modest comeback at the time after falling to lows of just above $15.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.