Cryptocurrency investors still love this particular week’s bullish cost action after Bitcoin (BTC), Ether (ETH) and a number of altcoins rallied on This summer 20 alongside gains within the traditional markets.

Data from Cointelegraph Markets Pro and TradingView implies that a mid-day rally by Bitcoin bulls were able to lift the very best crypto to some daily a lot of $24,281, which sparked a brand new round of bullish proclamations on Crypto Twitter.

As the week-lengthy climb helps boost investor sentiment, several analysts are warning traders not receiving too much in front of themselves since the marketplace is still supplying some warning flags worth being attentive to.

Get ready for an unavoidable pullback

Bitcoin’s climb above $24,000 formally confirmed an outbreak in the previous buying and selling range from $18,000 and $22,500, based on market analyst Caleb Franzen, who published the next chart noting the issue the marketplace now faces.

Franzen stated,

“Regardless, my belief would be that the next pullback is a major test in this particular bear market. Will buyers part of strongly on the pullback or capitulate?

Whale wallets remain dormant

One good reason to become wary of the present rally’s capability to sustain is the possible lack of whale wallet activity, based on on-chain research firm Jarvis Labs.

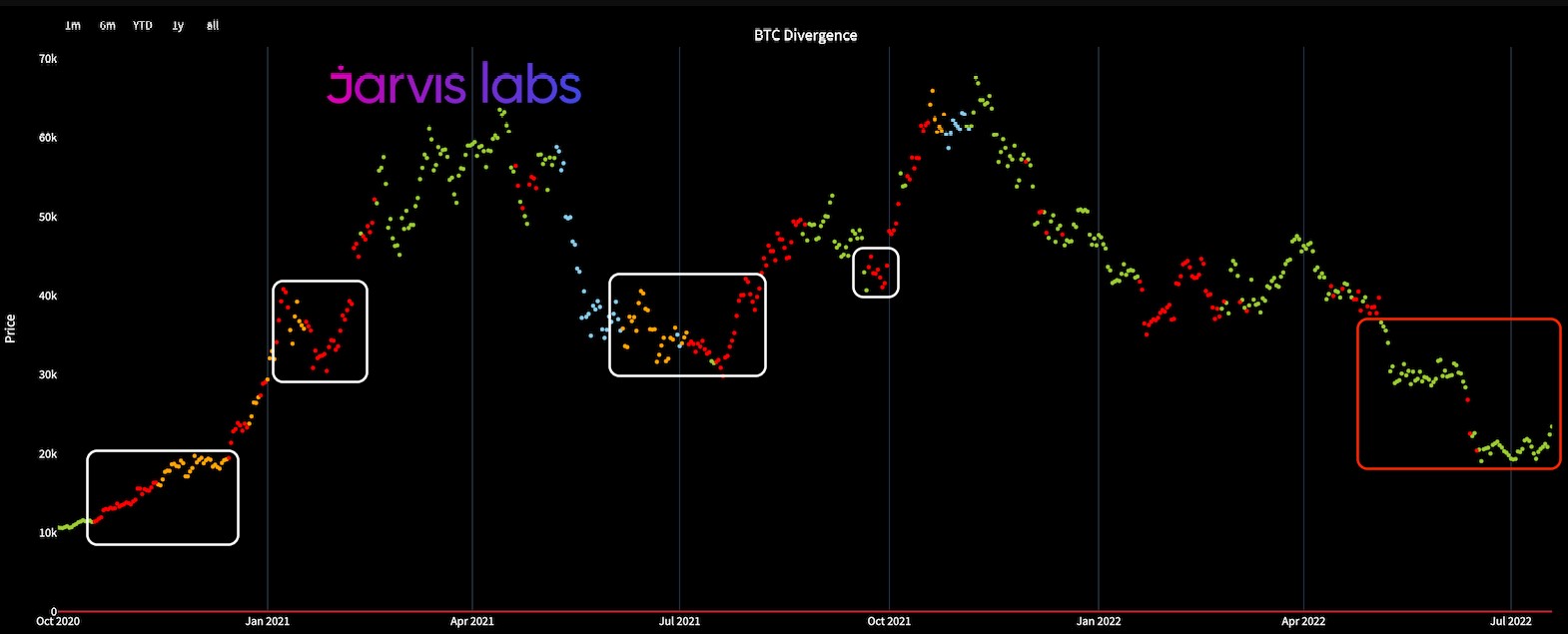

The red and orange dots around the BTC divergence chart above represent buying activity by small and big whale wallets at different deadlines. As proven at a negative balance highlighted box, activity from whales continues to be almost non-existent in the last couple of several weeks as Bitcoin trended lower.

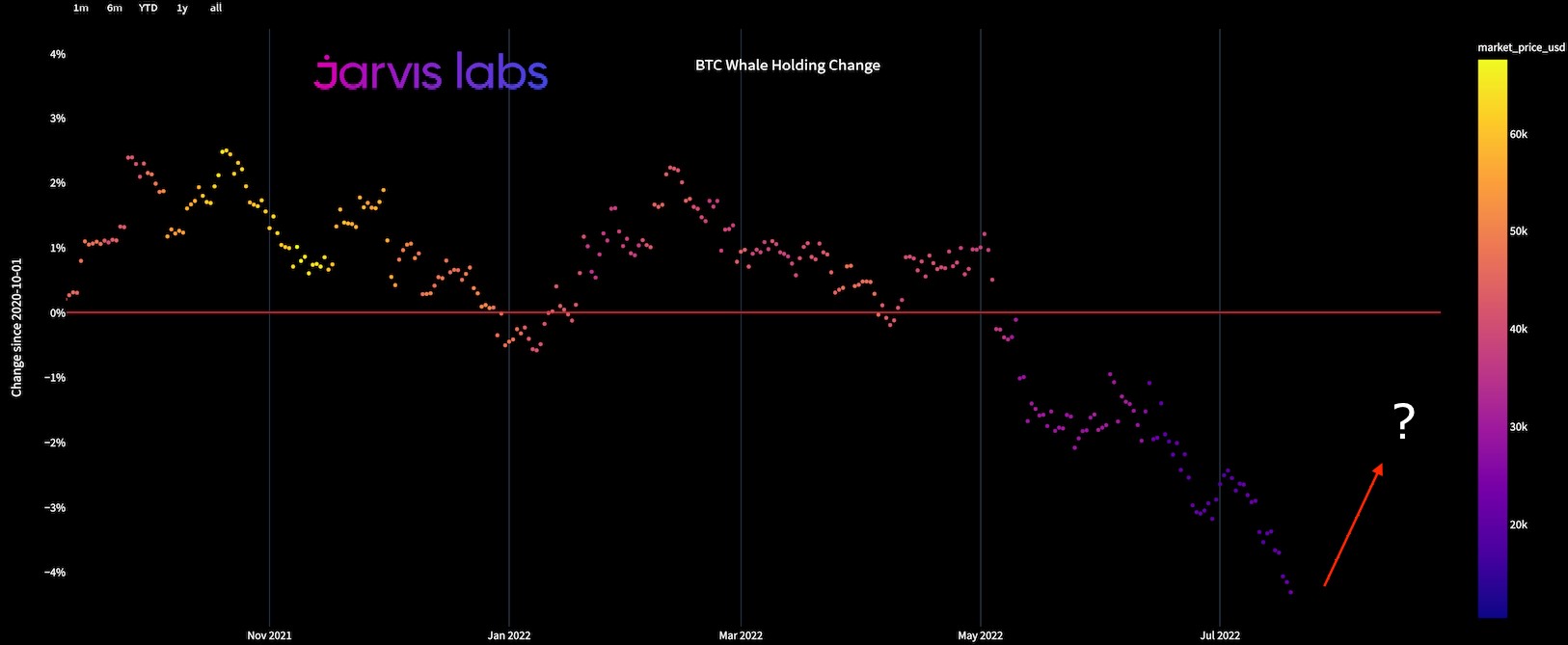

Data from Jarvis Labs also demonstrated that bigger entities haven’t yet go back to active buying, and also the chart below shows the modification in BTC whale holdings.

Jarvis Labs stated,

“You want to check this out pattern of colored dots begin upgrading and right. When we have it, then that’ll be considered a positive sign that any rally might have significant momentum behind it.”

In line with the trends identified, Jarvis Labs mentioned that “it is challenging too looking forward to a rally extending past the liquidity that sits around $28,000,” and rather recommended that “For now, the low band at $25K appears probably.”

Related: Bitcoin may hit $120K in 2023, states trader as BTC cost gains 25% per week

Our prime time period trend remains bearish

The turnaround in sentiment in the last week was acknowledged by market analyst and swing trader il Capo of Crypto, who noted the “Low time-frame trend is bullish, without a doubt.”

Before jumping all in about this rally, il Capo of Crypto also published the next chart warning the “high time-frame trend continues to be bearish which is another lower high.”

Il Capo of Crypto stated,

“Ltf [low time period] bearish confirmation is below $22K. Primary target remains $15.8K-$16.2K.”

The general cryptocurrency market cap now is $1.062 trillion and Bitcoin’s dominance rates are 42.7%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.