Buying and selling over the cryptocurrency market was relatively subdued on This summer 5 because the ecosystem is constantly on the digest the fallout in the Three Arrows Capital scandal and Voyager Digital announcing it has declared Chapter 11 personal bankruptcy protection.

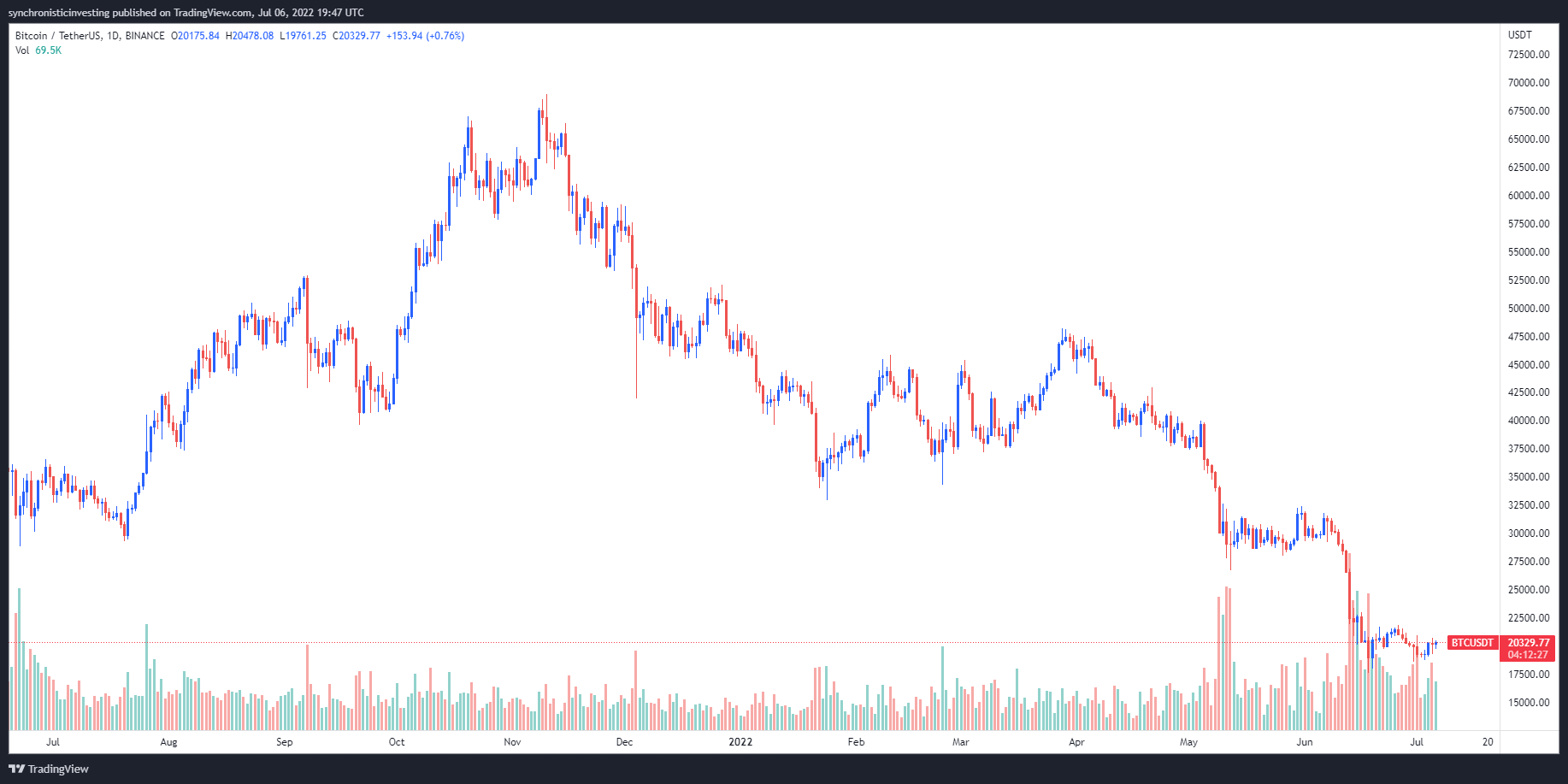

Data from Cointelegraph Markets Pro and TradingView implies that the cost of Bitcoin (BTC) has spent your day oscillating round the $20,000 support level, varying from the low of $19,775 for an intraday a lot of $20,480 on $25.48 billion in buying and selling volume.

Here’s a glance at what several analysts say by what could come next for Bitcoin and just what support and resistance levels to keep close track of in case of a clear, crisp relocate cost.

Watch the repeating pennant pattern

An obvious pattern around the Bitcoin chart before the pullbacks which have happened since November 2021 was stated by crypto analyst and pseudonymous Twitter user Moustache, who published the next chart displaying the similarities in between each drawdown.

Moustache stated,

“$BTC has been doing exactly the same pattern each time, but each climbing down triangular has become smaller sized and smaller sized? Another bearish breakout and also the target could be between $14,000 and $16,000.”

Noted market analyst Peter Brandt also lately highlighted the repeating pennant pattern around the Bitcoin chart, but stopped lacking saying which way the cost could move when the formation completes.

When it appears as though a pennant and functions just like a pennant it’s frequently a pennant $BTC pic.twitter.com/O7RtnvFSp0

— Peter Brandt (@PeterLBrandt) This summer 5, 2022

Address count grows because the market searches for a bottom

Recently, probably the most popular topics of conversation on crypto Twitter continues to be focused on attempting to predict the underside in Bitcoin cost.

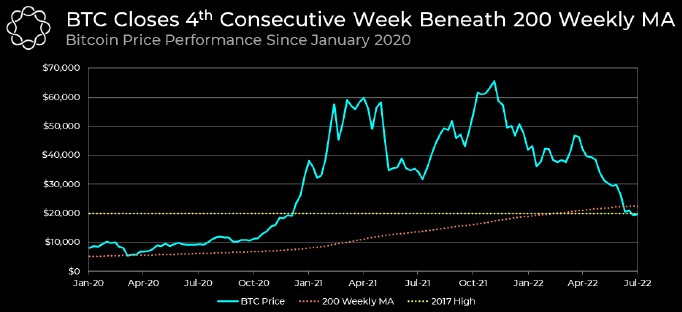

Based on cryptocurrency research firm Delphi Digital, Bitcoin has closed below its 200 weekly average for four consecutive days, an improvement which has in the past “marked previous market bottoms.”

For whether Bitcoin traders should be expecting an immediate recovery, Delphi Digital noted that “this may be the longest BTC has continued to be below its 200 weekly average” and highlighted the truth that “Bitcoin’s weekly correlation coefficient remains as inversely associated with the united states Dollar because it hit a 17-month low of -.77.”

While a powerful dollar shows that Bitcoin cost continuously struggle alongside other assets, Delphi Digital highlighted one encouraging development that implies BTC adoption keeps growing.

Delphi Digital stated,

“With prices ongoing to fall, the amount of BTC addresses accumulating BTC keeps rising. Addresses holding a minumum of one BTC have arrived at a brand new all-time a lot of 877,501.”

Related: World’s first short Bitcoin ETF sees exposure explode 300% in days

Some traders predict chop through out 2022

A macro take a look at exactly what the past performance of Bitcoin suggests about its future was supplied by market analyst and pseudonymous Twitter user KALEO, who published the next chart outlining previous market cycles.

In line with the chart and also the predicted path provided, Kaleo recommended the market continuously trade sideways for that near future and will also be “defined with a crab market saying above HTF logarithmic support.

Kaleo stated,

“Most likely path came from here is visiting a base range from $16K – $30K established, that eventually resolves around December when cost finally breaks above HTF diagonal resistance.”

The general cryptocurrency market cap now is $916 billion and Bitcoin’s dominance rates are 42.5%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.