Bitcoin (BTC) came back to local highs in the March. 25 Wall Street open as nervous analysts stored track of miners.

DXY provides instant relief for BTC

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD rising to provide a modest challenge to resistance, still not able to flee a recognised buying and selling range.

U . s . States equities likewise headed modestly greater, the S&P 500 and Nasdaq Composite Index up 1% and 1.3%, correspondingly during the time of writing.

The U.S. dollar index (DXY) on the other hand lost ground at the time, falling to the cheapest levels since March. 6 and supplying potential tailwinds for risk assets to close opportunistic gains.

For traders, the intraday established order continued to be in position among a continuing insufficient real volatility. Popular Twitter account Crypto Tony highlighted significant range levels, with $18,900 an essential zone to carry.

Fellow trader Crypto Erectile dysfunction meanwhile says he was “still waiting” for any correction to that particular level, adopted with a bounce past $19,100.

“It could even go a little lower, then returning here, that might be your entry for any lengthy,” he stated inside a YouTube update.

Formerly, commentators had revealed a wait-and-see method of the marketplace, with estimates of the breakout varying from two to eight days.

Miners under surveillance

Downside risk meanwhile firmly centered on miners at the time.

Related: Least volatile ‘Uptober’ ever — 5 items to know in Bitcoin now

With hash rate whatsoever-time highs but place cost at its cheapest in nearly 2 yrs, miners still fight the tightest profit squeeze ever. They might soon have to offload hoarded coins to pay for expenses, some cautioned.

Inside a dedicated research piece around the subject, Caue Oliveira, add-chain analyst at BlockTrends, particularly came focus on hash cost — miners’ revenue per exahash.

“At this moment hashprice, because the indicator is famous, arrived at $66,500 the cheapest value ever recorded,” he described.

“Total revenue has strongly deviated from the average annual growth. What’s common in most bears however with one difference: the expense of maintaining the operation.”

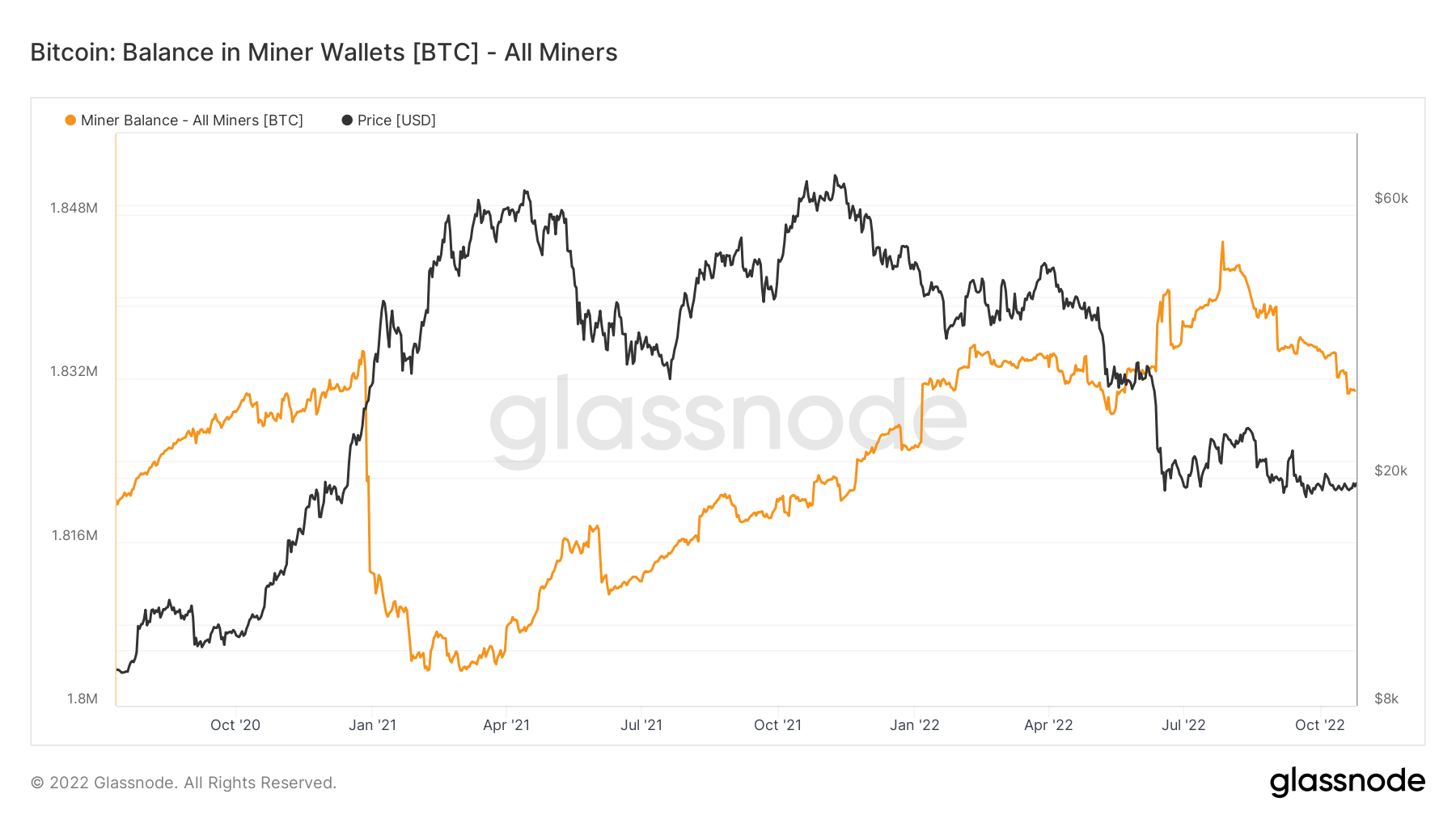

By September, public miners’ BTC balance totaled a combined 34,509 BTC, a sizable tranche of liquidity which “can be unloaded as mining pressures continue,” market analyst Mike Rule commented.

“Bitcoin could conceivably capitulate towards the $10k-$18k range, fueled with a final selloff in the miners. Something I certainly psychologically get ready for,” longtime analyst Tuur Demeester added.

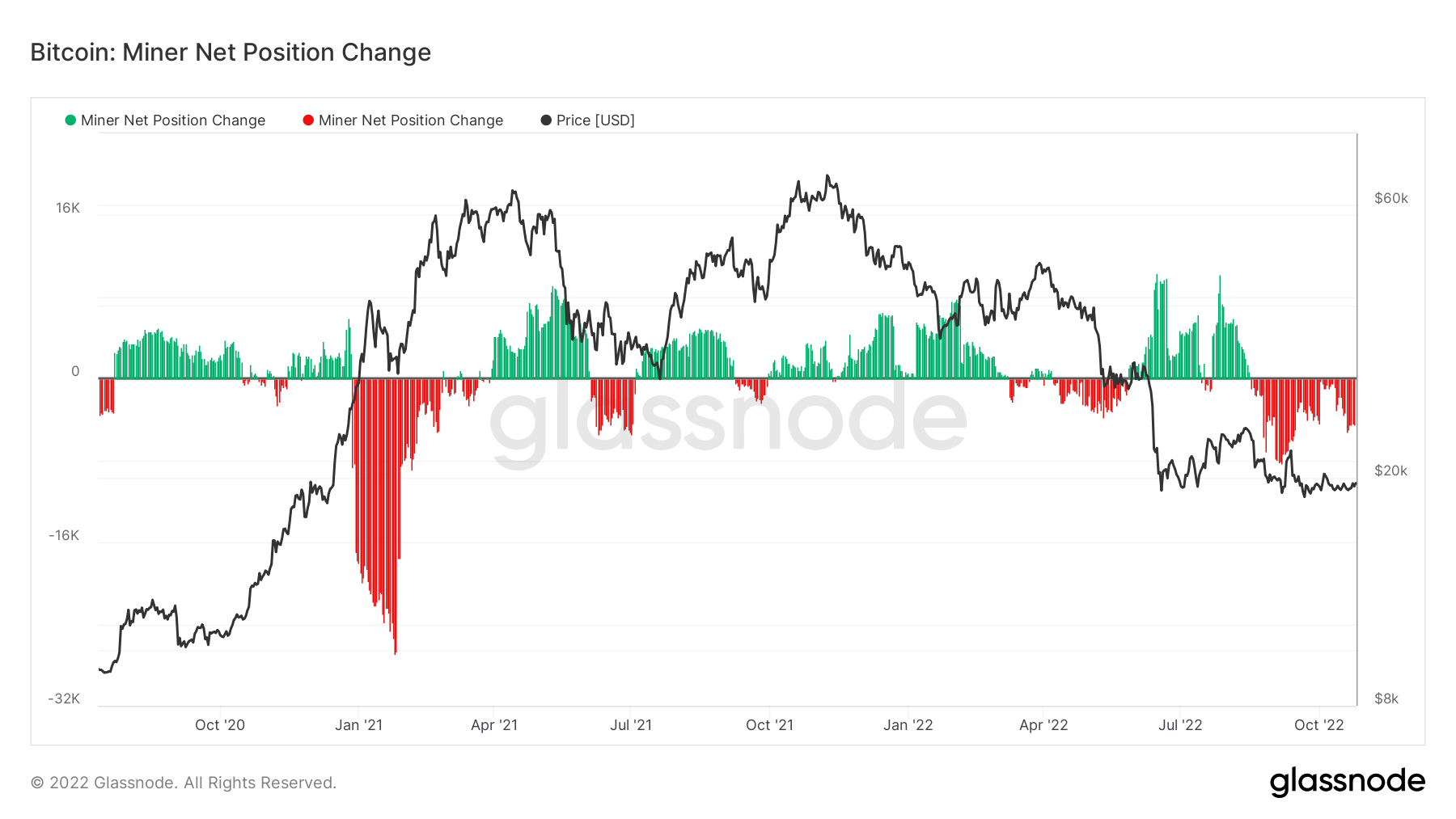

With miners exiting a major capitulation phase in August, however, data shows that even prolonged distribution of coins doesn’t always impact cost action negatively.

At the begining of 2021, for instance, after BTC/USD had removed its 2017 all-time high, miners launched into full of profit-taking exercise, this failing to have to wait Bitcoin because it hit an impulse surface of $58,000 in April that year.

Based on on-chain analytics firm Glassnode, the selling in those days saw roughly 30,000 BTC leave miner wallets within the month The month of january.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.