Bitcoin (BTC) checked losses while U . s . States equities drifted lower on June 22 because the Fed stored quiet on financial policy.

Powell keeps quiet on Given moves

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hovering near $20,500 in the June 22 Wall Street open.

The happy couple had wicked underneath the $20,000 mark overnight before recovering, still lower in the previous day’s $21,700 highs.

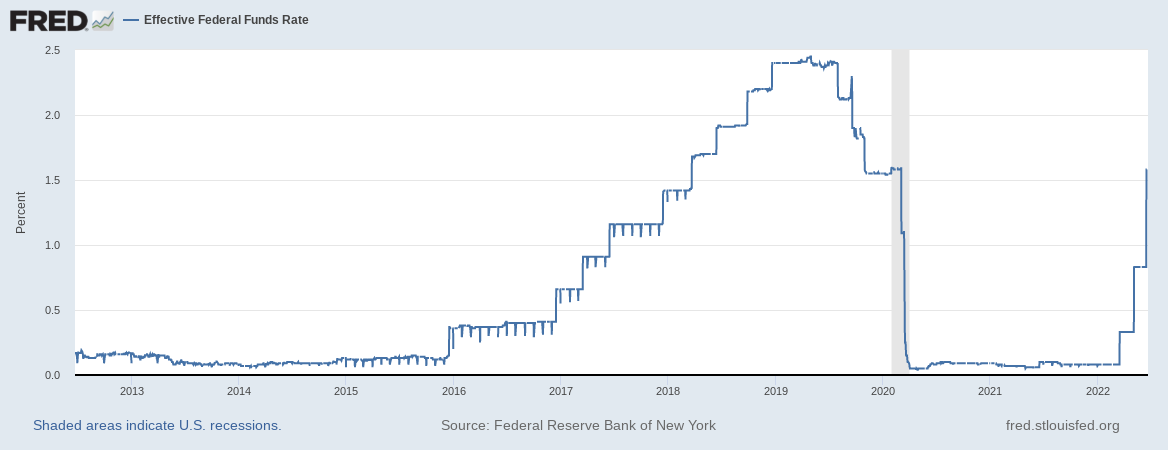

Markets braced for last-minute surprises from testimony to Congress by Given Chair Jerome Powell at the time, this ultimately supplying no fresh understanding of the central bank’s method of taming rampant inflation.

“We anticipate that ongoing rate increases is going to be appropriate the interest rate of individuals changes continuously rely on the incoming data and also the evolving outlook for that economy,” a duplicate of Powell’s testimony released before his appearance read.

“We’ll make our decisions meeting by meeting, and we’ll still communicate our thinking as clearly as you possibly can.”

Both S&P 500 and Nasdaq Composite Index opened up slightly lower after brisk progress at the time prior, supplying similarly non-volatile conditions for crypto markets.

As Cointelegraph reported, the consensus among analysts nevertheless is constantly on the indicate further retests of ‘abnormal’ amounts, with $16,000 particularly famous the situation of Bitcoin.

“Declining volume having a completed impulse wave. Searching to have an ABC pullback too lengthy. I’d include a lengthy, but closed because of the structure completion here,” popular Twitter account Crypto Tony described concerning the overnight market setup.

His concerns about low volume with an upward impulse move were shared by fellow trader and analyst Rekt Capital, who advised Twitter supporters to not place an excessive amount of belief in the effectiveness of the rally.

“The amount about this recent BTC rebound is extremely low and seller-dominated,” he authored.

“This isn’t the type of volume $BTC encounters at Bear Market bottoms.”

Report finds silver linings in crypto cloud

Searching around the vibrant side, meanwhile, buying and selling firm QCP Capital says it saw bearish conditions ebbing after Bitcoin’s reclaim of $20,000 in the weekend.

Related: Bitcoin miners offered all of their May harvest: Report

“On Saturday, support levels broke with BTC collapsing to 17,567 and ETH to 879. For BTC, this can be a 75% drawdown all-time highs (82% for ETH). The crypto credit crisis under way,” it authored in the latest market circular issued to Telegram funnel subscribers.

“However, i was amazed through the strong bounce from the lows on Sunday and into now, taking BTC back above 20,000 and ETH above 1,100.”

Ongoing, it described that funding rates on derivatives markets were now more stable which sell-side pressure in to the weekend lows was “more miners reducing inventory.”

Around the subject of macro, QCP highlighted falling oil prices like a positive move against inflationary pressures.

“With this stated, we stick to guard. Quarter-finish fund redemptions will probably put some pressure on prices combined with the chance of more crypto insolvencies being unearthed,” it added.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.