Terra’s recent collapse continues to be repeatedly singled out because the primary supply of weakness affecting crypto assets, but it is more likely that a mix of factors are behind the beginning of this current bear market.

Simultaneously the market was reeling in the Terra saga, the two-year mark for the following Bitcoin (BTC) halving seemed to be entered which is a metric some analysts used being an indicator for that finish of the bull market.

As proven around the chart above, previous cycles have experienced BTC hit an optimum adopted with a cost decline that first drops underneath the 50-day moving average (MA) a culminating capitulation event that thrusts the cost underneath the 200-day MA.

Many traders were tossed off by the possible lack of a blow-off top in the newest bull market cycle as this phenomenon has typically marked the late stage of the exhausted trend.

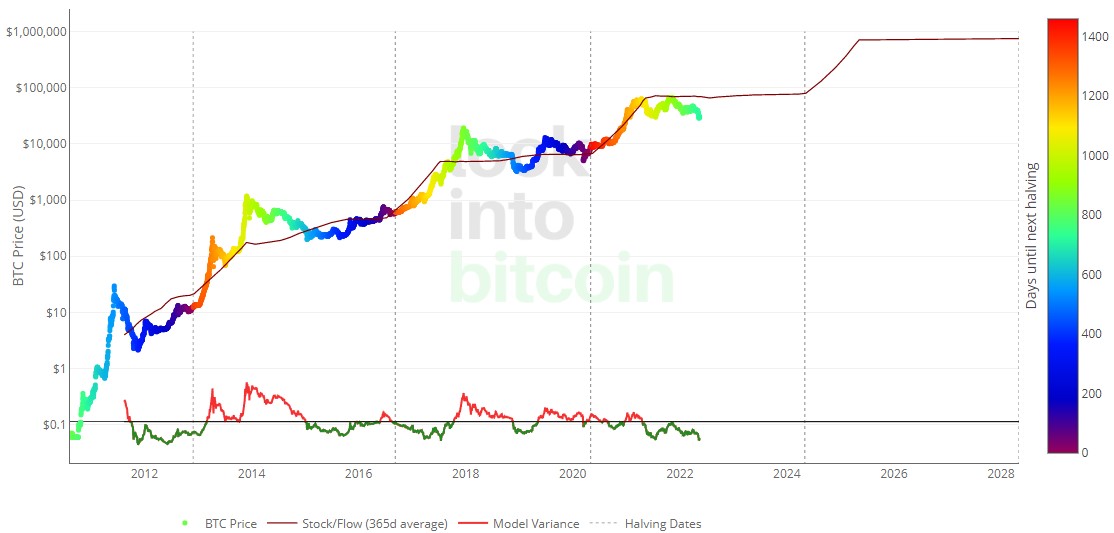

Traders also asked the validity from the popular stock-to-flow model after BTC unsuccessful hitting $100,000 prior to the finish of 2021.

During previous market cycles, BTC was buying and selling well over the S2F model at this time in the progression using the model variance within the positive. Presently, the model variance is giving a studying of -.86 as the cost of BTC is well underneath the S2F line.

This insufficient a blow-off top has motivated some traders to face by earlier requires the last cost run-up which will see BTC hit $100,000 before entering a long bear market, however that remains seen.

Searching toward being bearish af following this wave up over 100k that I’m expecting completes. Seeing the way in which sentiment has become throughout a mid-cycle correction means the correction that corrects the whole bull cycle from 3k to 100k+ will probably be absolutely brutal. $BTC

— CrediBULL Crypto (05.27) (@CredibleCrypto) May 17, 2022

Most likely the market will bottom in November?

Although some still hold on expect one further hoorah prior to the bear market really takes hold, a far more pessimistic view is predicting another 6 several weeks of cost decline prior to the market hits a bottom.

According to previous cycles, the reduced on the market came roughly 13 several weeks following the market top, which may advise a bottom sometime around December of the year when the current trend holds.

This really is further validated when searching at that time from a market bottom and subsequently Bitcoin halving event.

Throughout the previous cycles, each cycle low was hit roughly 17 to18 several weeks prior to the next halving. The following BTC halving is anticipated to happen on May 5, 2024, which may claim that the market will bottom in November or December of 2022.

Related: Bitcoin is discounted near its ‘realized’ cost, but analysts say there’s room for deep downside

Traders continue to be permabulls regardless of the current cost action

So far as cost predictions go, there’s much less consensus about this matter because of BTC’s underperformance over the past cycle where most traders were expecting $100,000.

Traders still demand BTC towards the exceed $100,000 mark within the not-too-distant future along with a handful are keeping the penultimate $a million target.

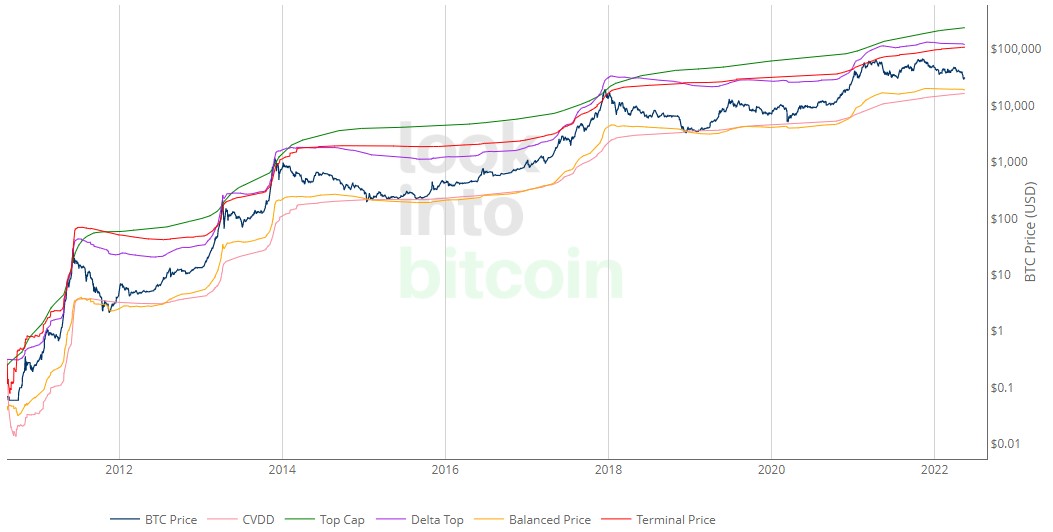

An over-all selection of possible prices outlined by LookIntoBitcoins’ price conjecture tool suggests a BTC a lot of $238,298, as the delta top indicator signifies a higher of $119,886. The terminal cost indicator is presently supplying a cost conjecture at $107,801.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.