Bitcoin (BTC) cost action continues to be surprisingly bullish since May 27. Weekends, especially holiday weekends, are notoriously volatile and indecisive, with major whipsaws in cost movements to be the norm. Even just in bull markets, bearish cost action is frequently standard, but BTC bucked that trend.

Bitcoin rallied nearly 11% between May 27 and could 30, moving with the critical $28,600 level to maneuver back above $30,000 to $31,700. The weekly close was the greatest close of history twenty days also it gave bulls the most powerful three-day run in over two several weeks. However, macroeconomic fears may weigh on any more upside potential.

Global food shortage fears mount at goods prices rise

The worldwide food is really a primary yet easily overlooked factor adding to Bitcoin’s future cost potential. Forever from the COV-19 pandemic, governments worldwide have shut lower their seaports and airports, effectively reducing and interrupting the flow of products. This disruption will require years to go back to normal, but that’s and not the responsible for concern.

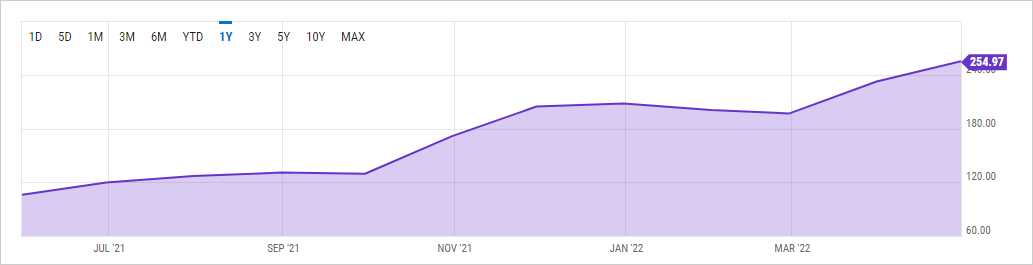

Within the U . s . States, fertilizer costs have risen tremendously in the last 18 several weeks. In The month of january 2021, the Fertilizer Cost Index was at $78.83 and it is presently at $254.97, growing nearly +225%. A mix of logistics disruptions and ongoing shortages will probably continue disrupting the forex market.

Individual commodity prices still rise and therefore are a principal cause of the steady increase in inflation. Particularly, wheat (CBOT: ZW) hit new all-time highs in Feb 2022 and stays near individuals all-time highs. In only 2022, alone, wheat futures have elevated around 76% and also over 143% previously 18 several weeks.

Oil futures (NYMEX: CL) still rise and therefore are now buying and selling at levels not seen since This summer 2008. You will find broad concerns by traders and investors that oil may spike toward $150 per barrel once China ends its COVID shutdown. When occurring, demand will most definitely return and additional impact oil.

Growth concerns in the stock exchange

Equity markets around the world still face significant pressure. Rising inflation, soaring commodity costs, logistics disruptions and also the conflict in Ukraine have put risk-on investors and traders around the defensive.

Several high-impact economic occasions are scheduled to happen now, that will likely pause any major cost action moves in equities and cryptocurrencies. The Eu unemployment data release occurs June 1, combined with the Bank of Japan’s rate of interest decision and manufacturing data. Additionally, U.S. unemployment figures and non-farm payroll data is going to be released on June 3.

Contributing to an active week, on June 3, three former U.S. Fed residents will also be slated to talk: John Johnson and James Bullard talk on June 1, Lael Brainard on June 3.

Technical levels may limit Bitcoin’s recovery to $37,000

Bitcoin is originating off a brand new historic record of nine consecutive weekly losses. Forever of the present weekly candlepower unit, buyers have came back and also have pressed BTC over the entire buying and selling range of history two days and well over the 50% selection of the flash crash around the May 9, 2022 weekly candlepower unit.

If Bitcoin cost can close over the daily Kijun-Sen at or over $31,350, then BTC includes a very open road to hit the $37,000 value area. Furthermore, the 2022 volume profile is extremely thin, between $32,000 and $37,000. But $37,000 might be in which the bulls face sellers again.

If bulls wish to send a note towards the market that the new upward trend is going to begin, they will have to push Bitcoin cost to some daily close near $44,000. For the reason that scenario, BTC would trigger an “ideal bullish Ichimoku breakout,” giving bulls the road required to retest the all-time high.

While stock values stay in bear market territory and goods stay at all-time highs, at the minimum, a brief reversal will probably occur. When the old technical analysis adage, “volume precedes cost,” plays out again, traders should see food goods and oil sell-off while stocks and Bitcoin rise.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.