Bitcoin (BTC) bounced away from ten-month lows on May 11 as the beginning of Wall Street buying and selling gave bulls some respite.

Eventually, $860 million more crypto liquidations

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD erasing the outcome of above-expectation U . s . States inflation data, hitting $32,000 on Bitstamp.

April’s Consumer Cost Index (CPI) print has sent the happy couple right into a fresh tailspin, with $30,000 giving method to levels not seen since This summer 2021.

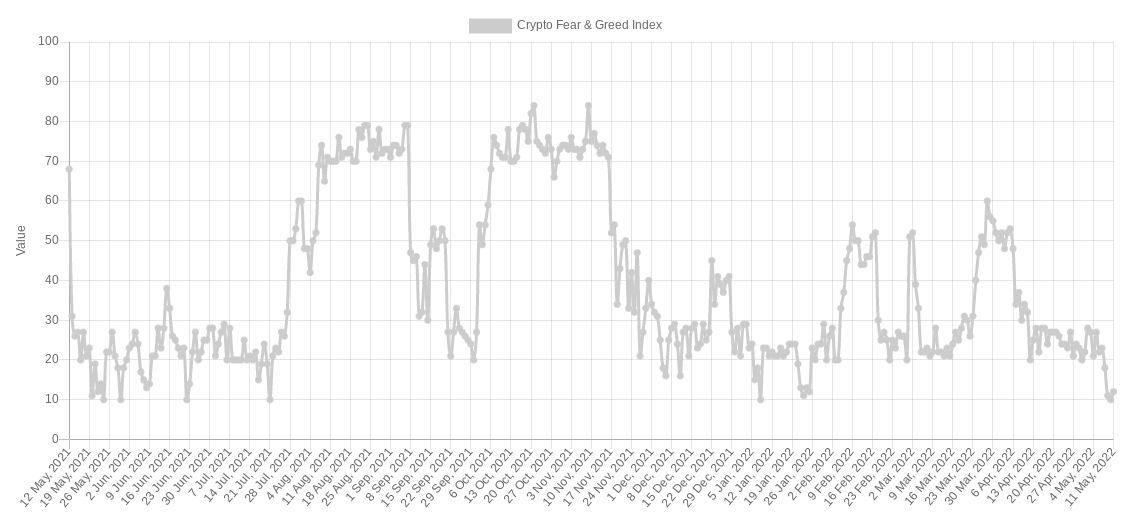

As turmoil over Terra, its LUNA and TerraUSD (UST) tokens and co-founder Do Kwon ongoing, the atmosphere continued to be firmly wary. The Crypto Fear & Avarice Index measured sentiment having a normalized score of 10/100 on May 10, among the cheapest ever recorded.

“May go to $28,000 pretty much,” popular trader Crypto Erectile dysfunction forecast in the latest YouTube and Twitter released prior to the CPI news, adding he considered the down-side “not finished yet.”

#BTC must Weekly Close above orange to verify ~$32000 as support

What exactly short-term market structure could facilitate this type of return above ~$32000?

At the moment, a possible 4HR Climbing Triangular + Bullish Divergence could get it done

Worth watching$BTC #Crypto #Bitcoin pic.twitter.com/Bo6C1YOVp3

— Rekt Capital (@rektcapital) May 11, 2022

The 24 hrs towards the duration of writing meanwhile saw another $860 million in mix-crypto liquidations, data from on-chain monitoring resource Coinglass confirmed.

Bitcoin bad? It may be worse…

From Terra, attention also centered on Bitcoin hard forks at the time.

Related: Little forkers: BCH and BSV get crushed by Bitcoin cost in 2021

Bitcoin Cash (BCH), which hit an optimum of .1829 BTC in December 2017, had the dubious recognition of hitting new all-time lows in BTC terms on May 11.

Now just .0068 BTC, BCH came ridicule consistent with its spin-off Bitcoin SV (BSV), which likewise include a new floor against BTC.

“Bitcoin will help remind you why it’s king. ALT / BTC valuations have been in for any reckoning,” commentator Benjamin Cowen authored.

“The storyline continues to be told previously and it is exactly the same story again. Help you at 60% BTC dominance.”

Bitcoin’s market dominance was at 43.7% during the time of writing, up around 4% from 2022 lows occur The month of january, according to data from CoinMarketCap.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.