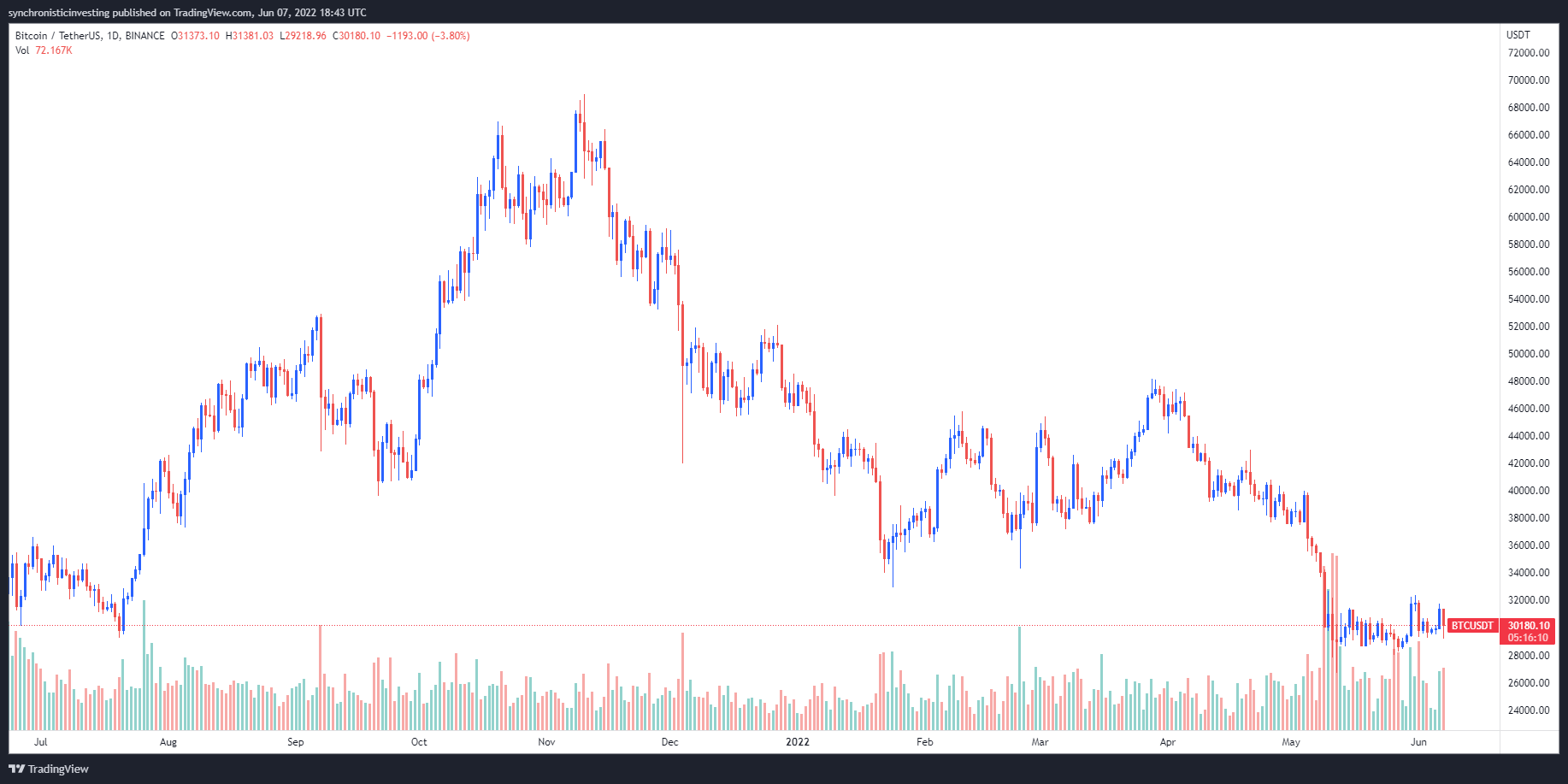

Bitcoin’s (BTC) short-term cost action continues to be covered with whipsaws that trigger round the $31,000 to $32,000 level and also the June 6 reversal at this time triggered a fast sell-off that pressed the cost lower to $29,200.

Surprisingly, on June 7, the cost quickly reversed course as Bitcoin rallied to $31,500, but because of the current rejection only at that level, traders will probably proceed very carefully, instead of expect a fast surge to $35,000.

Here’s what several analysts say concerning the short-term outlook for BTC and just what support levels to keep close track of continuing to move forward.

A obvious redistribution range

The number-bound buying and selling presently impacting Bitcoin was addressed by crypto analyst and pseudonymous Twitter user il Capo of Crypto, who published the next chart highlighting the “clean range” that BTC continues to be stuck set for nearly per month.

The analyst stated,

“What is going on within the range and what is happening in the range high, implies that this really is [a] obvious redistribution range. Clean break from the range low = last leg lower confirmed = 21K–23K.”

Ongoing switch-flop cost action

A rather different outcome to the present market chop was recommended by crypto trader and pseudonymous Twitter user Phoenix, who published the next chart lamenting the month-lengthy range-bound buying and selling for BTC and hinted that it’ll see a lot of same.

Phoenix stated,

“On our way perfectly into a whole month in the small-range again to completely deploy the switch-flop-your-bias-non-stop-angry-pleb-and-gtfo. *Ppl fomoed the very best, lows taken again following the nuke, up we go again?*”

Related: Coinbase balance drops by 30K BTC as Bitcoin cost nurses 6% losses

A potential eliminate to $20K

For traders looking to get some feeling of in which the bottom may be, market analyst and pseudonymous Twitter user Rekt Capital published the next chart highlighting the 200-EMA (exponential moving average) like a key indicator to look at.

Based on Rekt Capital, the cost history for Bitcoin implies that although it “tends to verify uptrends if this breaks over the blue 50-week EMA,” around the switch side it “tends to verify maximum financial chance if this reaches and breaks lower in the black 200-week EMA.”

A closer inspection in the recent cost action around these indicators was provided within the following chart published by Rekt Capital to supply a better picture of the items support level to look for.

Rekt Capital stated,

“This area is ~confluent using the orange #BTC 200-week MA. Actually, $BTC will have to downside wick underneath the 200MA to achieve the ~$20K area. Interestingly, downside wicking has a tendency to occur underneath the 200MA to mark out generational bottoms.”

The general cryptocurrency market cap now is $1.24 trillion and Bitcoin’s dominance rates are 46.4%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.