Bitcoin (BTC) saw fresh volatility after July’s final Wall Street open as highs north of $24,000 continued to be solid resistance.

Resistance strikes BTC at $24,000

Data from Cointelegraph Markets Pro and TradingView reflected bulls’ ongoing struggle as BTC/USD lurched round the $24,000 mark on This summer 29.

The happy couple had tried to match the week’s local surface of $24,450, this ultimately neglecting to materialize like a resurgent U.S. dollar pressured crypto regardless of the gains of U.S. stocks .

The U.S. dollar index (DXY) ongoing greater throughout the Wall Street buying and selling, passing 106 after falling to the cheapest levels since This summer 5.

Record eurozone inflation added towards the mixture of macro triggers at the time, as the monthly close continued to be a guessing game for Bitcoin analysts.

On short timeframes, popular trader Crypto Tony eyed what he known as a “classic short setup” round the high, which continued to be Bitcoin’s best since mid-June.

A vintage short setup having a obvious invalidation point ..

Did anybody catch it pic.twitter.com/DTW2rAYM9K

— Crypto Tony (@CryptoTony__) This summer 29, 2022

Nevertheless, other key levels continued to be likely to behave as support in case of a much deeper drawdown. These incorporated Bitcoin’s 200-week moving average around $22,800 and recognized cost at $21,820.

#bitcoin back above recognized cost, light blue, I love it pic.twitter.com/Rr0r4boljC

— PlanB (@100trillionUSD) This summer 29, 2022

With regards to the former, however, Bitcoin’s weekly candle will have to close for confirmation of the resistance/support switch, fellow trader and analyst Rekt Capital noted at the time.

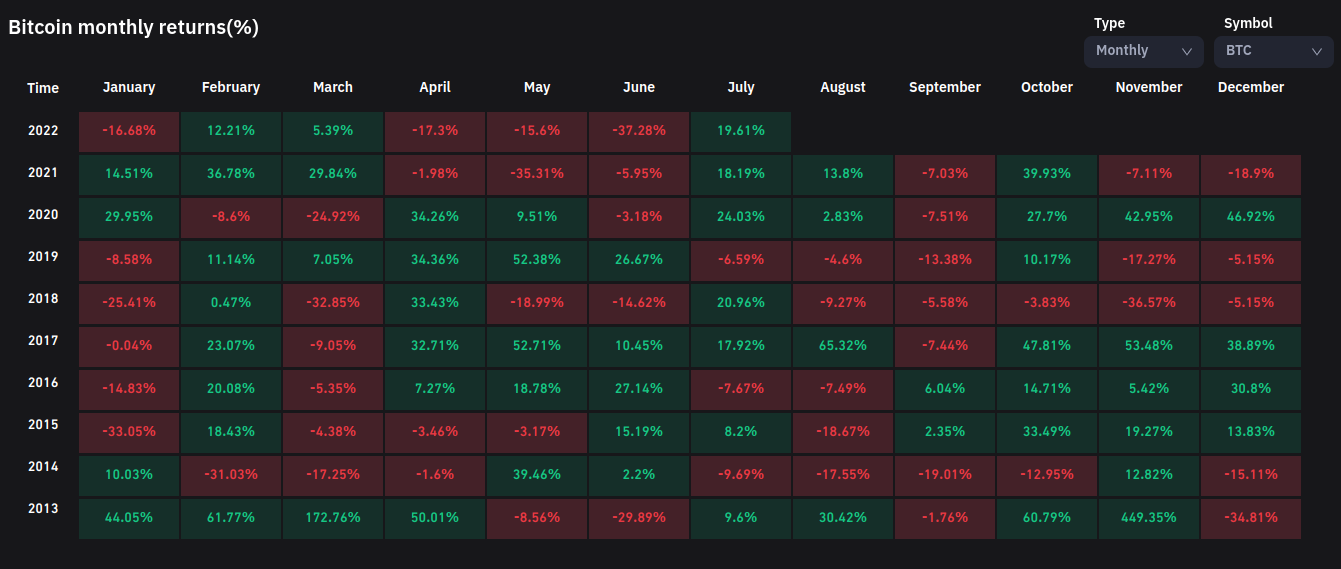

The weekly close would also behave as the monthly close, making This summer 31 a vital mental day’s reckoning after June’s 40% drawdown — Bitcoin’s worst monthly performance since September 2011, figures from on-chain data resource Coinglass confirmed.

180 days until “full recovery”?

Summing up 2022 for crypto markets to date, meanwhile, a brand new report from on-chain analytics firm Glassnode and markets site CoinMarketCap hinted at just how lengthy the direction to recovery might be.

Related: Bitcoin bear market over, metric hints as BTC exchange balances hit 4-year low

Following the mayhem, which started using the Terra (LUNA) — now renamed Terra Classic (LUNC) — collapse in May, a “resetting” had happened throughout crypto assets, the report contended.

With Bitcoin and Ether (ETH) alone lower 75% all-time highs within a year, it might not be until 2023 the trend can alter for sure.

“The marketplace only has experienced it since mid-June, and former bear cycles took typically 180-days before full scale recovery is at effect,” it read.

Glassnode and CoinMarketCap, particularly, highlighted the plight of miners who, as Cointelegraph reported, faced ongoing profit squeezes over Q2 and much more lately. The report concluded:

“Overall, 2022 has so far been a significant resetting of market expectations, a large varying de-leveraging, and ideally, the beginning of a brand new group of foundations, where even taller structures might be built,”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.