Bitcoin (BTC) headed greater in to the November. 22 Wall Street open after setting another two-year low.

Thanksgiving buywall seems at $12,000

Data from Cointelegraph Markets Pro and TradingView adopted BTC/USD because it recrossed the $16,000 mark, getting set lows of $15,480 on Bitstamp.

Momentum required the happy couple to $16,189 before consolidating, marking gains of three.7% in comparison to the day’s lows.

Talk among analysts continued to be associated with digital Currency Group family, including Grayscale, presently in the center of rumors within the fallout in the defunct exchange FTX.

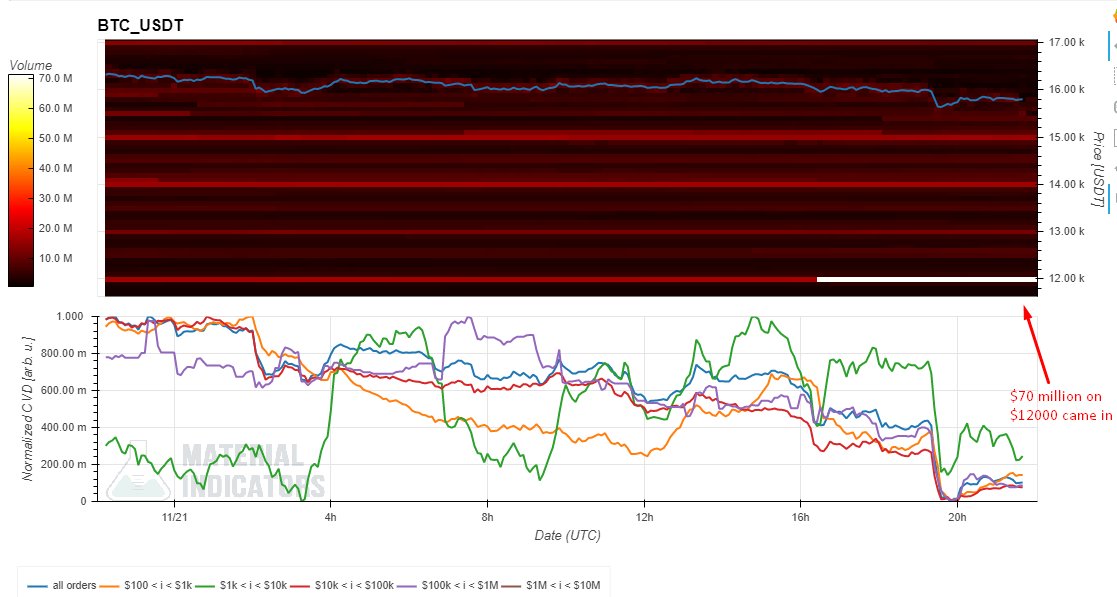

For monitoring resource Material Indicators, a “guard rail” bid at $12,000 could ultimately be what protected the marketplace should a significant capitulation occur within the Christmas period.

“Over $300M in BTC bid liquidity between here and $12k,” it commented on the publish by CryptoQuant contributor Maartunn.

“This new $70M buy wall might be a guard rail for that holiday week, it may be associated with speculation on the Grayscale announcement or anything else. Regardless, we always keep close track of new fat buy walls.”

Maartunn had submitted a heatmap from the Binance order book, showing various active purchase and sell levels.

As Cointelegraph reported, meanwhile, downside targets for BTC/USD mostly centered on $14,000 or under because the week started.

BTC hodlers have the pressure

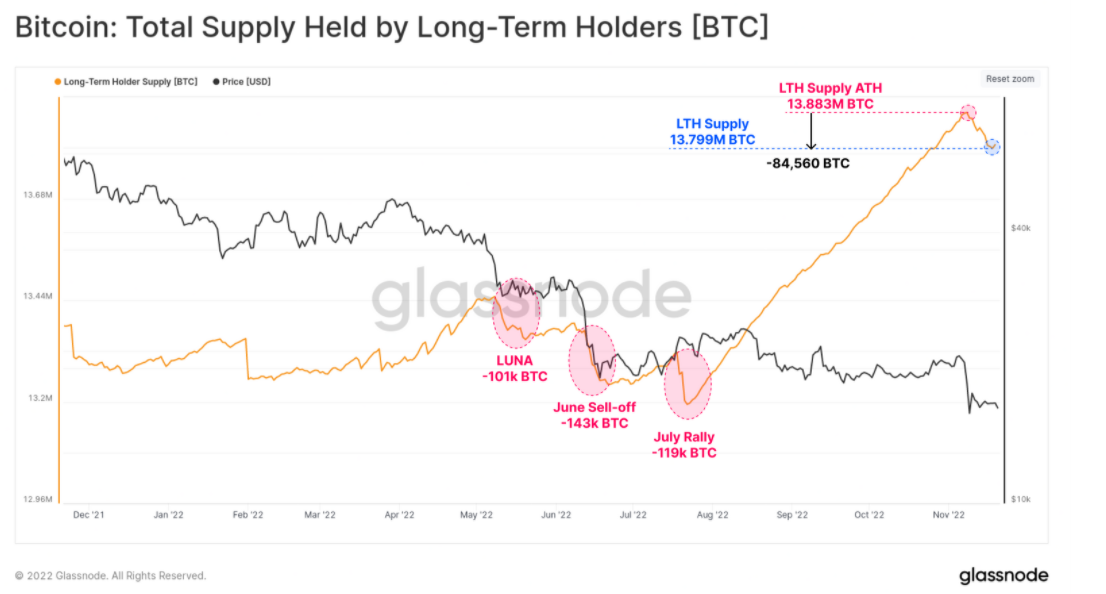

Other growing concerns dedicated to lengthy-term holders (LTHs) of Bitcoin.

Related: Cathie Wood’s ARK Invest adds more Bitcoin exposure as GBTC, Coinbase stock hit new lows

In the latest weekly “A Few Days On-Chain” e-newsletter, analytics firm Glassnode cautioned that “non-trivial spending” from old hands was on the rise.

“Their supply has declined by 84,560 BTC publish-FTX, which remains probably the most significant declines within the this past year,” it noted, adding the decline was “still going ahead.”

Likewise, the biggest BTC investors, whales, were also internet disbursing coins towards the market, next despite previous data showing that particular entities had already commenced purchasing the dip.

“The Whale cohort have been in a mode of internet distribution at the moment, delivering between 5k and 7k excessively BTC into exchanges,” Glassnode added.

“Meanwhile, the flight of coins off exchanges by just about all cohorts reaches an exciting-time high. The whirlwind impact from the FTX collapse is constantly on the engage in, also it remains seen precisely how extensive the shake-as much as investor confidence continues to be.”

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.