Bitcoin (BTC) fell around the May 24 Wall Street open as weakness in stocks saw sell-side pressure return.

Equities give crypto no respite

Data from Cointelegraph Markets Pro and TradingView followed BTC/USD because it revisited its cheapest quantity of a past 7 days.

During the time of writing, BTC/USD traded around $28,800 among volatility, getting hit $28,614 on Bitstamp — a zone last seen on May 18.

The S&P 500 lost 2.4% around the open, as the Nasdaq 100 managed a 3.5% decline.

Stocks once more manipulating the cost of #Bitcoin. What’s surprising is when well it’s supporting relatively though. Most stocks getting way bigger daily drops than $BTC.

— IncomeSharks (@IncomeSharks) May 24, 2022

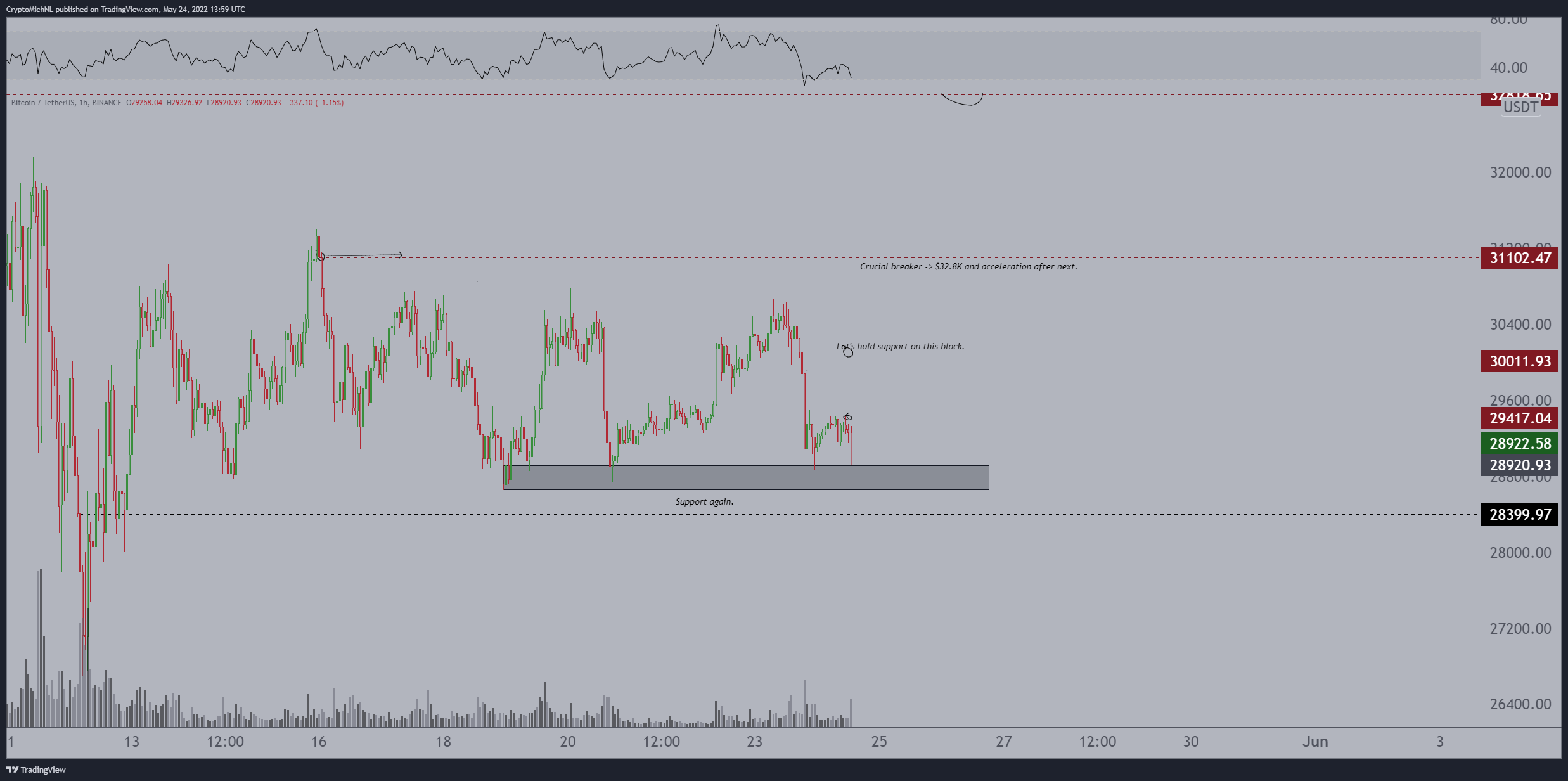

Inside a fresh Twitter, Cointelegraph contributor Michaël van de Poppe flagged a pivot reason for $29,400 remaining as resistance, opening the chance for any “sweep” of lower support levels.

“No break of this area at $29.4K, so we’ll see levels that Bitcoin might be testing here,” he commented alongside a chart showing the targets.

“Gray zone continues to be supported yesteryear week, however a sweep and test around $28.3Kish is not a poor factor either. Could be massive for longs.”

For on-chain monitoring resource Material Indicators, meanwhile, a wall of bid support created the foundation for assessing where BTC/USD may go next.

Automobile as much as #Bitcoin sitting on the top of ~$50M in bid liquidity. This may be a great setup for any rally, but recently these concentrations of liquidity have been receiving taken. Waiting to find out if this really is truly support or it aims to obtain filled. #FireChartshttps://t.co/VzE3V2kA8Q pic.twitter.com/VgKJw9h0kP

— Material Indicators (@MI_Algos) May 24, 2022

A subsequent update demonstrated the marketplace eating in to the wall, which in fact had little presence below $28,800.

Altcoin drop intensifies

Altcoins once again faster declines at the time, with some of the top cryptocurrencies by market cap approaching 10% daily losses.

Related: Bitcoin dives to fill CME gap among claim new all-time highs will require 24 months

Ether (ETH) lost $2,000 to trade around $1,920 during the time of writing and approaching its last type of support over the wick lower to $1,700 lows seen a week ago.

The greatest loser at the time was Solana (SOL), which traded lower 9.3% at $48.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.