Bitcoin (BTC) crashed below $22,000 instantly on Sept. 13 after U . s . States inflation data unsuccessful to satisfy estimates.

CPI print sparks major crypto rout

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD quickly falling $1,000 after Consumer Cost Index (CPI) inflation for August arrived at 8.3% year-on-year.

The consensus was that 8.1% will be the latest figure, and also the overshoot recommended that inflation wasn’t slowing in the expected pace.

US CPI for August YoY arriving above expectations at 8.3% (expected 8.1%) but less than in This summer with 8.5%.

Mother core CPI arriving hot at

.6% two times up to the expected .3%.Not exactly what the Given really wants to see.

So 75bps it’s in the next meeting?

— Jan Wüstenfeld (@JanWues) September 13, 2022

Nevertheless, versus This summer, year-on-year growth was still being lower .2%, preserving the general trend of slowing CPI inflation.

It was insufficient to prevent a crypto rout, however, and during the time of writing, Bitcoin was below $21,500, lower 4% at the time.

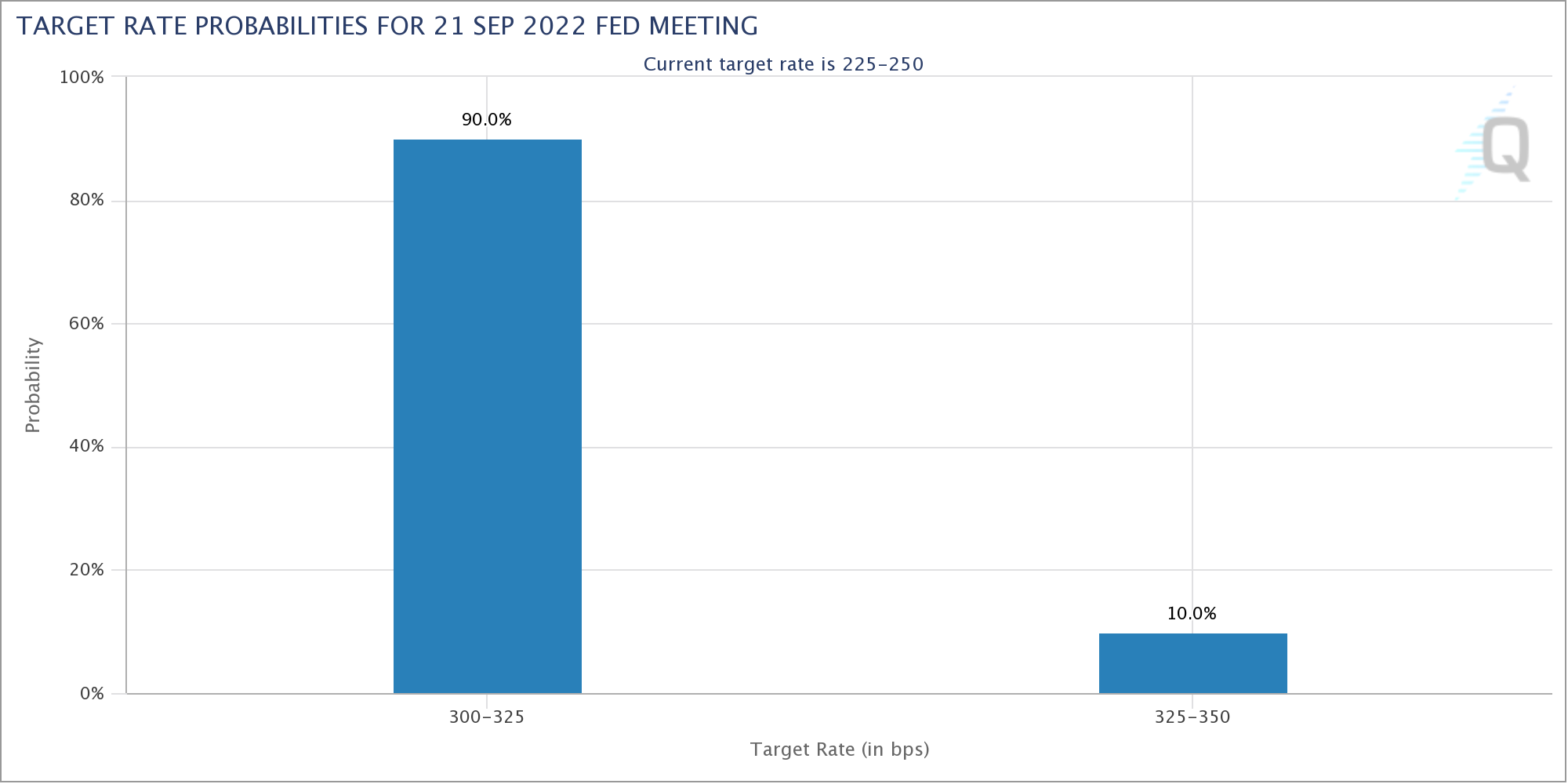

As market participants elevated bets on the further 75-basis-point or even a 100-point rate hike in the Fed in a few days, cold ft were more and more noticeable in front of the Wall Street open.

Case an evaluation from the real

— il Capo Of Crypto (@CryptoCapo_) September 13, 2022

“Plenty of volatility around these occasions and a lot of fake-outs do happen,” Michaël van de Poppe, founder and Chief executive officer of buying and selling firm Eight, responded.

“Help remind yourself might avoid excessive buying and selling. At this time, lows are taken and a few consolidation appears to become happening.”

The U.S. dollar index (DXY) strength, which typically means headwinds for crypto, saw a flash rebound around the CPI news, passing 109 the very first time since Sept. 9.

Ethereum wobbles as Merge hype fades

On altcoins, discomfort for Ether (ETH) ongoing as existing weakness was compounded by Bitcoin’s dip.

Related: Bitcoin and altcoins pop towards the upside, but approaching macro occasions could cap the rally

Despite the incoming Merge event, ETH/USD and ETH/BTC both extended losses because the largest altcoin by market cap unsuccessful to take advantage of surrounding hype.

“Despite the CPI print, it was always a place of resistance,” popular trader Altcoin Sherpa reacted.

“Heavy interaction w. this level within the this past year, will still be a place to consider caution.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.