Bitcoin (BTC) remained rangebound on April 29 like a welcome retracement saw the U.S. dollar come lower from 20-year highs.

Trader eyes $40,600 as “crucial” breaker

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD hugging support near $39,300 after neglecting to hold $40,000.

The happy couple had managed some modest upside despite a “parabolic rally” in U.S. dollar strength through the week.

The U.S. dollar index (DXY) finally started cooling Friday after reaching its greatest levels since 2002.

Despite its inverse correlation, BTC/USD had yet to exhibit any indications of direct take advantage of the altering mood during the time of writing.

Cointelegraph contributor Michaël van de Poppe was nevertheless certain that bullish momentum would go back to Bitcoin for the short term.

“Bitcoin gets right into a narrow arena and it is ready for any big impulse move,” he told Twitter supporters at the time.

“I’m betting around the upside, because the DXY is showing listlessness too. Crucial level to interrupt: $40.3-40.6K first.”

Van de Poppe had formerly highlighted current place cost levels as essential to hold to be able to open the road towards $42,000 and above.

Further tailwinds for BTC came by means of Asian market buying and selling, meanwhile, using the Shanghai Composite Index up 2.4% and Hong Kong’s Hang Seng managing 10% at the time inside a broad comeback from earlier Coronavirus-caused sell-offs.

Hang Seng Tech Index jumps 10% after China makes another pro-market statement. A gathering is placed to happen soon between govt & major tech comps, raising hopes the regulatory landscape with this market is set to help ease moving forward. https://t.co/9JG07mzvej (HT @understanding_vital) pic.twitter.com/4RuFkAHqzn

— Holger Zschaepitz (@Schuldensuehner) April 29, 2022

European indices were flatter, with Germany’s DAX up 1.2% and also the FTSE 100 up .35% working in london.

Research warns over hodler “capitulation”

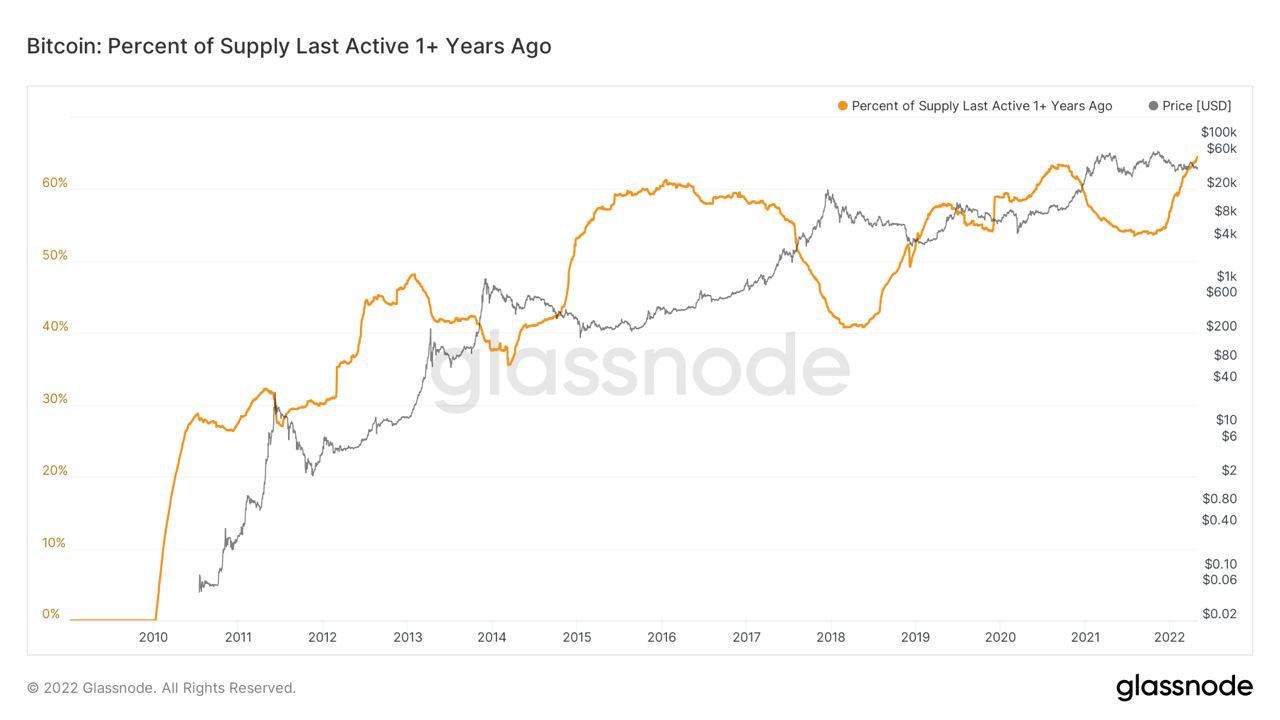

Analyzing who among Bitcoin holders is selling in current conditions, popular analyst Root identified altering habits among lengthy-term holders (LTHs) — individuals with coins unmoved for 155 days or longer.

Related: $27K ‘max pain’ Bitcoin cost is ultimate buy-the-dip chance, states research

Individuals who bought among $18,000 and also the all-time highs of $69,000 — a substantial slice of the LTH base — are having to exit because of exterior forces, he cautioned.

“They are de-risking/capitulating because of macro conditions,” a part of a Twitter thread read, Root adding that it’s “bullish how cost continues to be supporting very well.”

As Cointelegraph reported, the proportion from the BTC supply dormant for any year or even more has nevertheless made new all-time highs this month, based on data from on-chain analytics firm Glassnode.

Bitcoin (BTC) remained rangebound on April 29 like a welcome retracement saw the U.S. dollar come lower from 20-year highs.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.