Bitcoin cost is extending a few days-lengthy rally which has seen it blast past $20,000 the very first time since early November. Bulls have $24,000 around the corner, however, they have to disperse the persistent seller congestion zone at $21,000.

Bitcoin Cost around the Cusp Of The Bull Market

During the last two days, Bitcoin cost has disapproved requires further downside action to $13,000 and $9,000, and analysts are altering the stay tuned favor of the sustainable bullish breakout.

The bullish outlook in BTC cost began after flipping over the 50-day Exponential Moving Average (EMA) (in red). However, the following break beyond the 100-day EMA (in blue) resolved the bulls’ presence on the market, paving the way in which for any much-needed undertake the falling trend line (dotted).

Bitcoin cost now trades at $20,720 after tagging a brand new yearly a lot of $21,383 because the eco-friendly candle extended its wick. A breakthrough resistance in the 200-day EMA (in crimson) is essential for BTC to verify a macro bullish outlook.

Altcoin Sherpa, a well known crypto analyst and trader, told his greater than 188k supporters on Twitter that investors should think about taking profit in the 200-day EMA – supply zone. “Overall move looks a little overextended along with a pullback ought to be coming. Still don’t believe this is actually the overall macro bottom but let us see,” he authored.

Therefore, a regular close above this level could be crucial for Bitcoin cost as bulls push for an additional sharp proceed to $24,000 and $30,000 next. Failure to do this would encourage more investors to reserve profits with the expectation of purchasing a minimal-priced BTC downhill.

Based on another crypto analyst, Mags, “Bitcoin cost is closing in around the mid-range level around $21,500.” It’s worth mentioning the cost has erased the whole FTX implosion dump. Came from here, the “best situation scenario will be a continuation till $25k without re-testing $18.7k,” Mags stated.

As experts require a ongoing move north, Captain Faibik believed to his 44k supporters that “once 21.3k resistance will get removed, bull run 2023 will formally start.” For the time being, the road using the least resistance seems to keep its northbound direction, bolstered with a buy signal in the Moving Average Convergence Divergence (MACD) indicator on a single daily time period chart.

Traders searching for additional lengthy positions in Bitcoin must hold back until the 200-day EMA resistance is taken care of. Furthermore, they have to make sure the MACD sustains the upward trend over the mean line which its histograms stay eco-friendly.

Fundamentals Back Bitcoin Cost Relief Rally

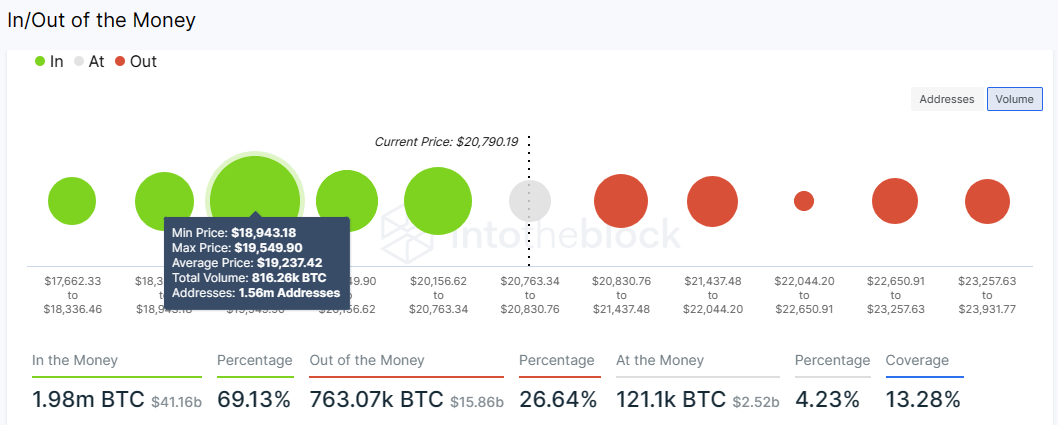

Over 1.56 million addresses that formerly purchased 816 BTC between $18,943 and $19,549 will probably keep tossing how much they weigh behind Bitcoin cost because it climbs toward $30,000. Furthermore, the IOMAP model by IntoTheBlock implies that the biggest cryptocurrency faces shrinking resistances above $20,000.

As observed in the chart below, Bitcoin cost is within a appropriate position to help keep the rally intact instead of retracing below $20,000. Nonetheless, if investors book profits in droves, overhead pressure may pressure it to check support at $18,500 and $15,500.

Related Articles: