Bitcoin (BTC) ranged around $16,500 on November. 17 as markets digested the most recent occasions surrounding exchange FTX.

FTX Chief executive officer informs of “complete failure of corporate controls”

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD seeing only mild volatility in the Wall Street open.

The happy couple demonstrated acclimatization to occasions round the FTX insolvency, the most recent including revelations that Alameda Research have been immune from liquidation while buying and selling around the platform.

Following the departure of Mike Bankman-Fried, new Chief executive officer John Ray III wasted virtually no time in acknowledging the level from the problems left in the wake.

Inside a filing using the U.S. Personal bankruptcy Court for that District of Delaware, Ray describes the organization charge of FTX like a “complete failure.” He authored:

“Never within my career have I seen this type of complete failure of corporate controls and the like an entire lack of reliable financial information as happened here.”

As Cointelegraph reported, U . s . States lawmakers plan to hold a passionate hearing on FTX the following month, while Bankman-Fried is apparently susceptible to efforts to extradite him in the Bahamas.

BTC cost action has nevertheless were able to get rid of related volatility, as evidenced within the modest response to news of contagion impacting the crypto lending arm of Genesis Buying and selling on November. 16.

Analyzing the present climate, however, popular commentators on November. 17 were not even close to positive.

“Bulls really should reclaim $17,600 for all of us so that you can shift nicely inside a lengthy position,” Crypto Tony tweeted, adding that “for now bears have been in control.”

Il Capo of Crypto, repeating an alert that altcoins often see further losses as high as 50%, being franker in the message to supporters.

“I repeat… EXIT All Of The MARKETS,” he mentioned on November. 16, suggesting that “most individuals are not prepared for what’s coming.”

Bid liquidity offers $13,500 support

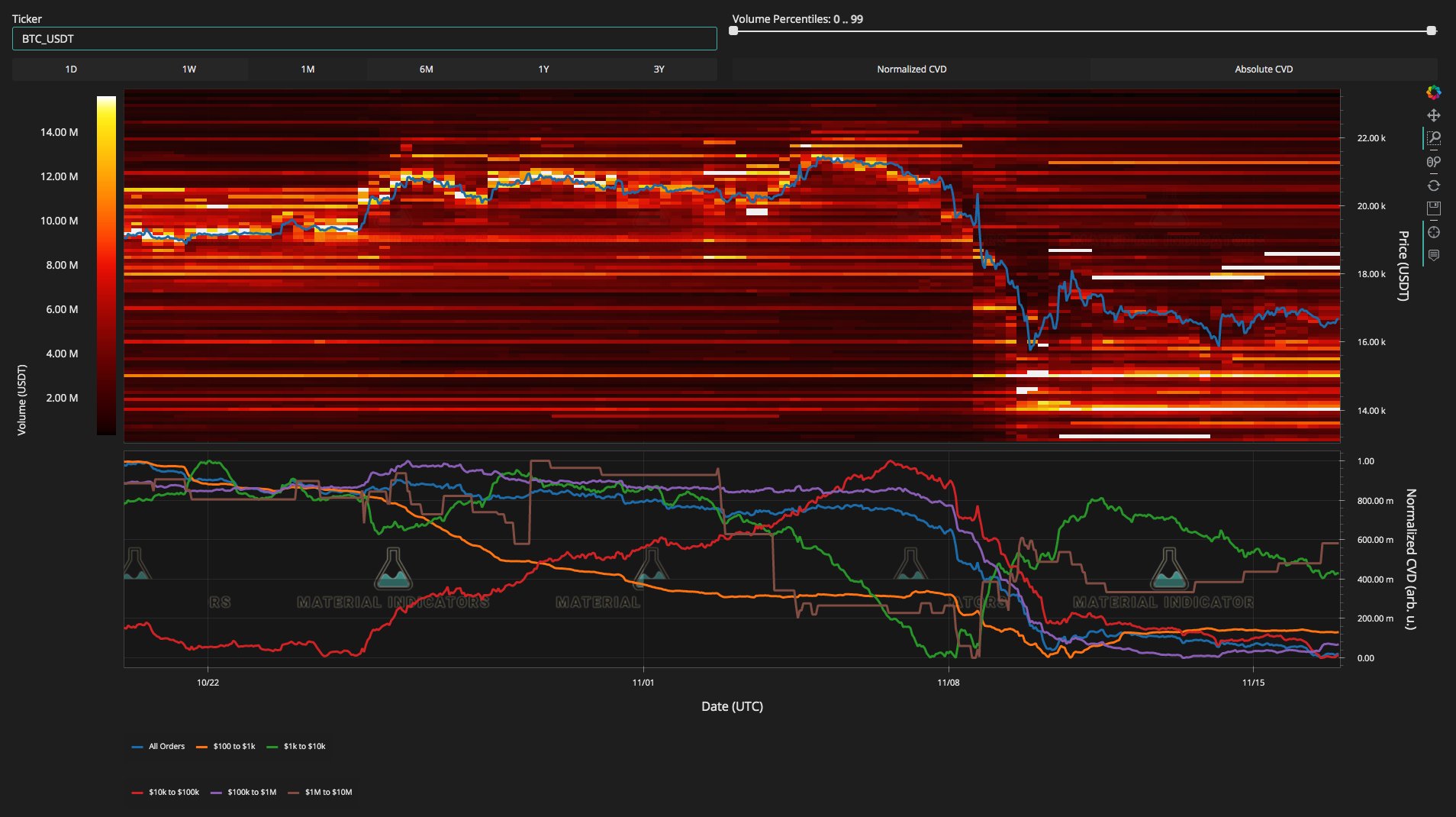

Around the subject of potential BTC/USD downside targets, fellow analyst Titan of Crypto flagged various high-liquidity zones on exchange order books.

Related: FTX Bitcoin stash worth just like Mt. Gox 840K BTC before hack

The biggest of those, comments stated, lies at $13,500.

“Although there’s liquidity to seize around $18.5k, $17.2k and $15.5k, the larger the first is lower at $13.5k,” they mentioned.

Analytics resource Material Indicators, meanwhile, calculated the total bid liquidity between your place cost and $13,000 as $195 million around the Binance order book.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.