Like clockwork, the start of a crypto bear market has introduced the “Bitcoin is dead” crowd who gleefully proclaim the finish from the largest cryptocurrency by market capital.

If #Bitcoin can collapse by 70% from $69,000 to under $21,000, it may as fast fall another 70% lower to $6,000. Because of the excessive leverage in #crypto, think of the forced sales that will occur throughout a sell-from this magnitude. $3,000 is really a much more likely cost target.

— Peter Schiff (@PeterSchiff) June 14, 2022

Yesteryear couple of several weeks have indeed been painful for investors, and also the cost of Bitcoin (BTC) has fallen to a different 2022 low at $17,600, however the latest requires the asset’s demise will probably suffer exactly the same fate because the previous 452 predictions with its dying.

Resolute Bitcoiners possess a bag filled with methods and on-chain metrics they use to find out when BTC is within a buy zone, and this is the time to take particular notice their way. Let’s see what time-tested metrics say about Bitcoin’s current cost action and if the 2021 bull market was BTC’s last hurrah.

Some traders always buy bounces from the 200-week moving average

One metric which has in the past functioned like a solid degree of support for Bitcoin is its 200-week moving average (MA), as proven within the following chart published by market analyst Rekt Capital.

As proven in the region highlighted through the eco-friendly circles, the lows established in the past bear markets have happened in areas close to the 200-MA, that has effectively performed like a major support level.

Most occasions, BTC cost has already established a inclination to briefly wick below this metric after which gradually work its long ago over the 200-MA to begin a brand new upward trend.

Presently, BTC cost is buying and selling right at its 200-week MA after briefly dipping underneath the metric throughout the sell-off on June 14. While moving lower can be done, history shows that the cost won’t fall too much below this level to have an longer timeframe.

Multiyear cost supports should hold

Combined with the support supplied by the 200-week MA, there’s also several notable cost levels from Bitcoin’s past which should now work as support if the cost still slide lower.

The final time the cost of BTC traded below $24,000 is at December 2020, when $21,900 acted like a support level that Bitcoin bounced from just before its run-as much as $41,000.

Should support at $20,000 neglect to hold, the following support levels are located near $19,900 and $16,500, as proven around the chart above.

Related: ‘Too early’ to state Bitcoin cost has reclaimed key bear market support — Analysis

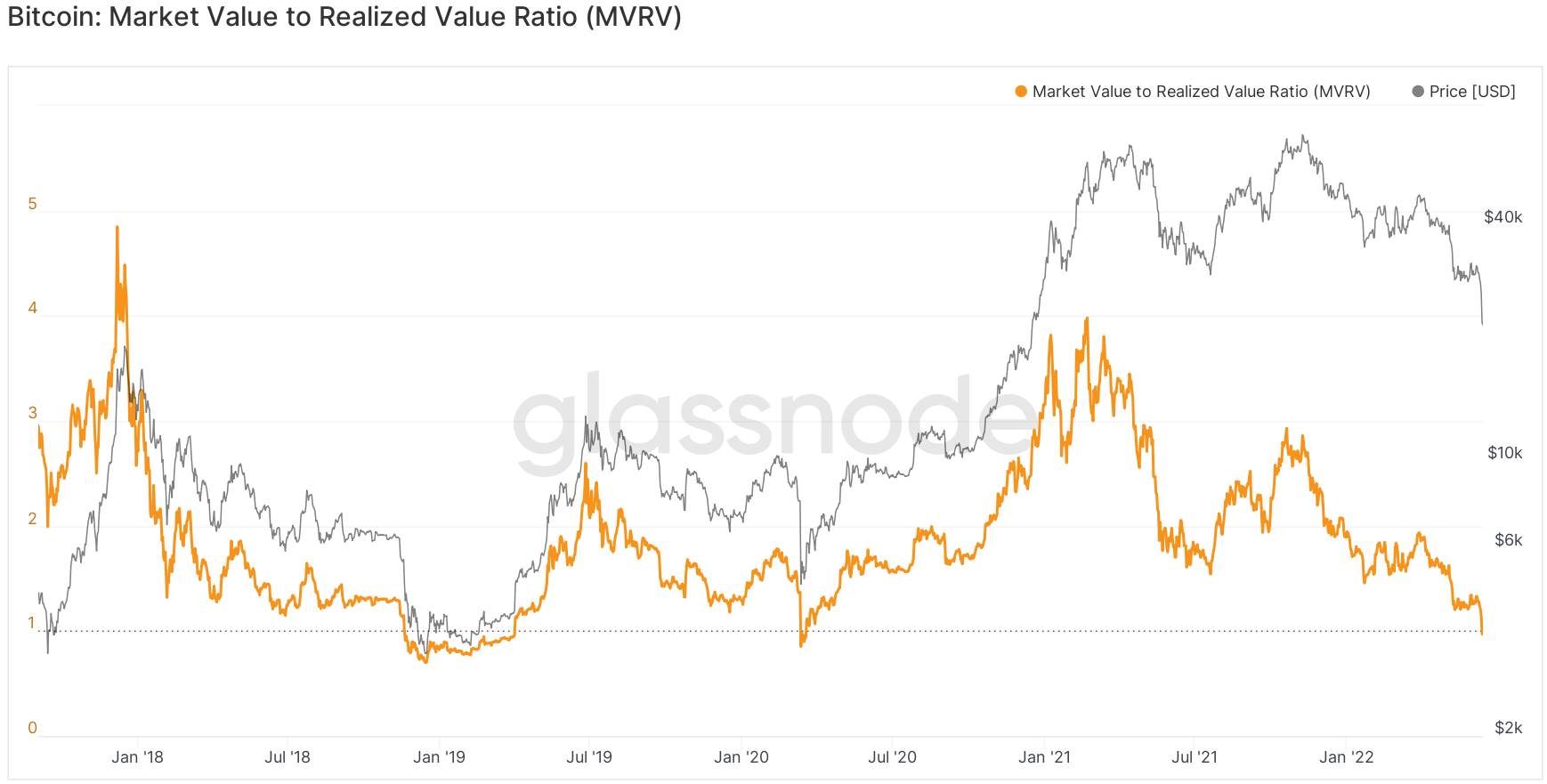

MVRV signifies it is time to begin accumulating

The last metric that implies BTC might be approaching an ideal accumulation phase may be the market-value-to-recognized-value ratio (MVRV), which presently sits at .969.

As proven around the chart above, the MVRV score for Bitcoin has spent more often than not in the last 4 years over a worth of 1, excluding two brief periods that coincided with bearish market conditions.

The brief dip that required devote March 2020 saw the MVRV score hit a minimal of .85 and turn into below 1 for roughly 7 days, as the bear market of 2018 to 2019 saw the metric hit a minimal of .6992 and spent as many as 133 days below something of just one.

As the data doesn’t deny that BTC often see further cost downside, additionally, it shows that the worst from the pullback has occurred which is not likely the current extreme lows will persist for that lengthy term.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.