Bitcoin (BTC) mining revenue and profitability have ongoing to slip combined with the asset’s cost this season because the crypto winter deepens.

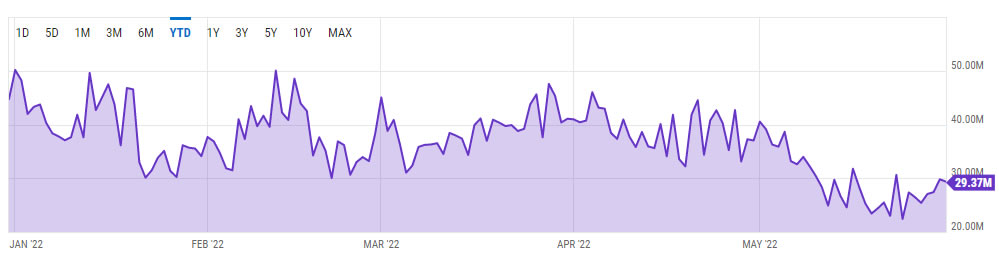

May continues to be among the worst several weeks for Bitcoin miners previously year as revenue and profitability still tank. Bitcoin daily mining revenue tanked around 27% in May, according to data from Ycharts sourcing data from Blockchain.com.

On May 1, the analytics provider reported daily revenue of $40.57 million for BTC miners, but through the finish from the month, it’d fallen to $29.37 million. Daily mining revenue hit an eleven-month low of $22.43 million on May 24.

Daily mining revenue spiked to some peak close to $80 million in April 2021 but has since fallen 62% to current levels.

May ended the streak for miners.

Each month since August 2021 saw cumulative mining revenue above $1b so far.

Last month’s mining revenue: $906m

— Zack Voell (@zackvoell) June 2, 2022

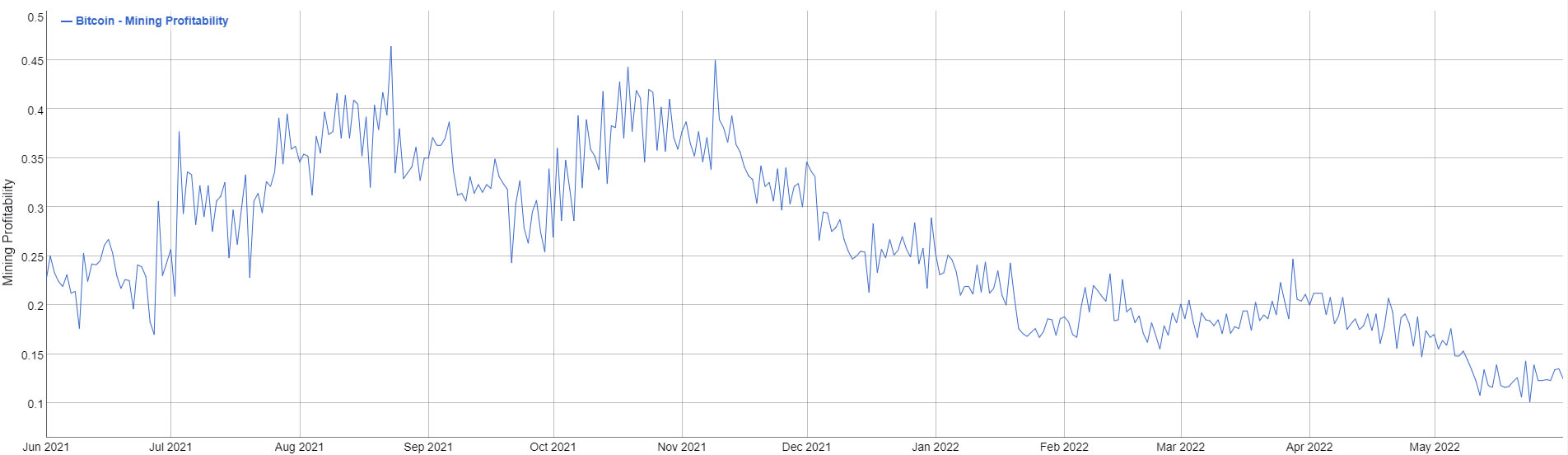

Mining profitability, that is a way of measuring daily dollars per terahashes per second, has hit its cheapest levels since October 2020, according to Bitinfocharts. The crypto metrics provider presently reports mining profitability of $.112 each day for 1 Th/s.

In addition, the metric has witnessed a decline of 56% forever of the season and it is lower greater than 75% because the 2021 highs of $.450 every day per Th/s.

Bitcoin network hash rates remain high, however, using the current daily average at 211.82 exahashes per second, based on Bitinfocharts. The figure is lower roughly 16% from the all-time a lot of approximately 250 Eh/s on May 2.

High hash rates but low profitability might point to that there’s a better competitors within the Bitcoin mining sector than seen formerly. In earlier bear markets, miners have powered lower their rigs because the asset cost dropped and also the operations grew to become temporarily unprofitable.

Related: Controlling 17% of BTC hash rate: Set of openly listed mining firms

Furthermore, miners to switch flows have recently hit a four-month high, based on Glassnode, suggesting that they’re going to make formulations to market some to pay for the falling revenue.

#Bitcoin $BTC Miners to switch Flow (7d MA) just arrived at a 4-month a lot of 6.188 BTC

Previous 4-month a lot of 6.002 BTC was observed on 07 April 2022

View metric:https://t.co/WwBf5cbd33 pic.twitter.com/582pKlSeo5

— glassnode alerts (@glassnodealerts) June 1, 2022