Bitcoin (BTC) may fall greater than 40% from last week’s bottom, new data warns as you analyst confronts what he states has become a bear market.

In a number of tweets on May 20, popular trader and analyst Rekt Capital contended that BTC/USD should dive to close $20,000 to adapt to historic norms.

Dying mix BTC cost target now $22,700

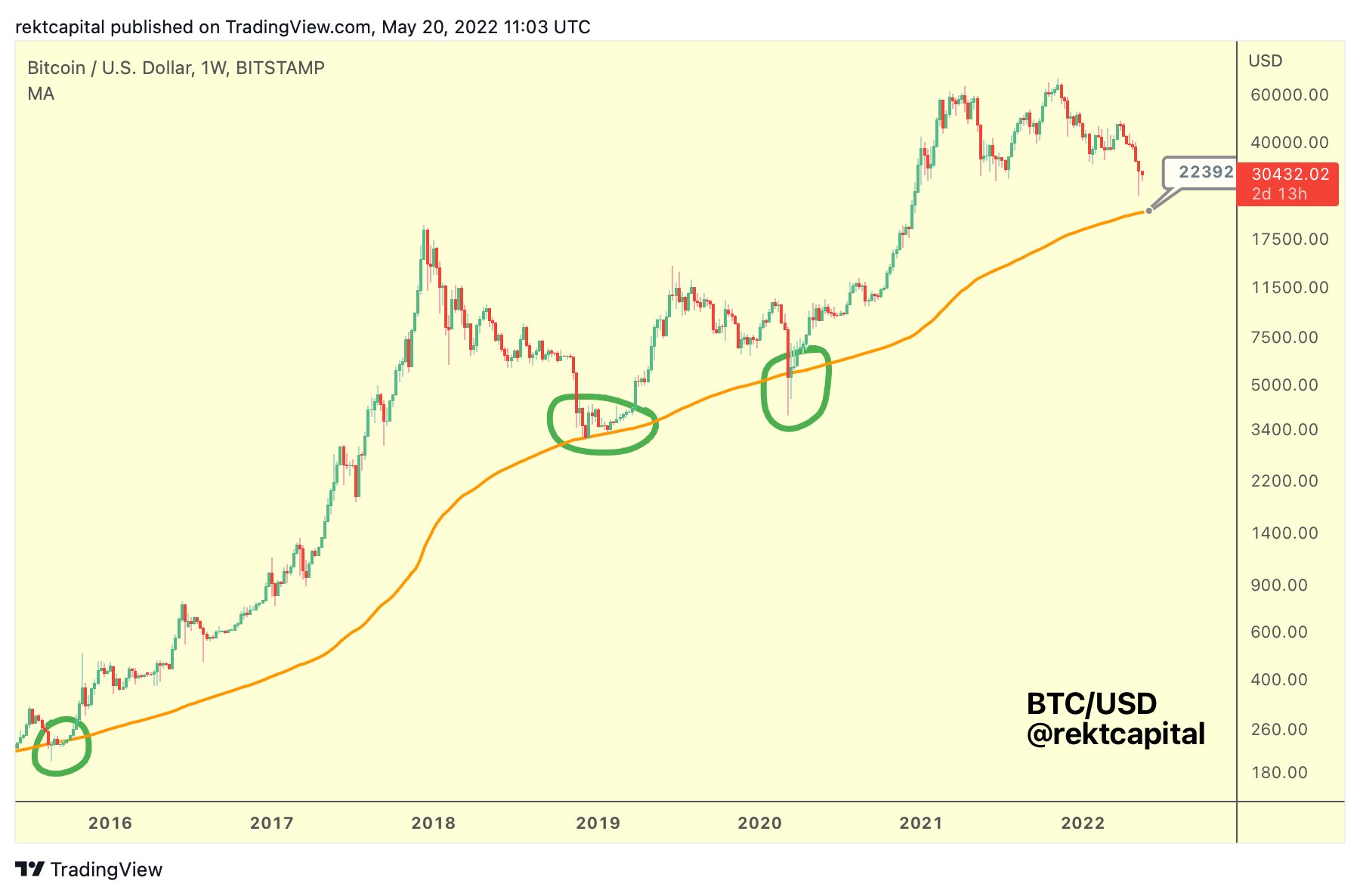

Much debate has encircled the so-known as “dying mix” constructions around the Bitcoin chart. These involve the declining 50-period moving average (50MA) crossing underneath the 200MA.

Frequently previously, this kind of event has triggered considerable cost downside, this then starting with mark what Rekt Capital calls “generational bottoms.”

“Generally, the depth of the $BTC correction pre-Dying Mix is comparable to retrace depth publish-Dying Mix,” he summarized.

Both March 2020 and could 2021 broke the guidelines with regards to publish-dying mix losses, however — both in instances, the dying mix, itself, marked the underside.

In The month of january 2022, the historic trend appeared to come back, like a dying mix event came after BTC/USD had already declined 43% from the November 2021 all-time highs of $69,000.

Another 43% after that, however, puts the happy couple at $22,700.

20.

So since #BTC has crashed -43% since November ’21 before the Dying Mix…$BTC could retrace a little more to achieve a general retracement of -43% publish-Dying Mix, if this should historic inclination still repeat

This could create a ~$22,700 $BTC#Crypto #Bitcoin pic.twitter.com/aH91tn2xmr

— Rekt Capital (@rektcapital) May 20, 2022

“What’s interesting concerning the scenario of the -43% publish-Dying Mix crash however is it would create a $22000 BTC,” the concluding tweet read, alongside a chart highlighting key roi (Return on investment) possibilities during generational bottoms.

“Which ties along with the 200-SMA (orange), which has a tendency to offer fantastic possibilities with outsized Return on investment for $BTC investors (eco-friendly circles highlight this).”

Facing to the bear market

Elsewhere, fellow analyst Filbfilb, co-founding father of buying and selling suite Decentrader, stated arrived to confess that Bitcoin is within a bear market.

Related: Bitcoin must defend these cost levels to prevent ‘much deeper’ fall: Analysis

In the latest market update on May 20, Filbfilb flagged the main one-year MA because the key level to get back to exit the quagmire which resulted after losing it as being support at the begining of April.

“Ultimately we still sit inside a bear market. It has been the situation since cost retreated from the 1yr moving average which we highlighted like a key risk […] when cost got rejected off that much cla,” he authored.

“Until we are able to reclaim that much cla we must face the matter that we’re inside a bear marketplace for $BTC.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.