Bitcoin (BTC) briefly broke above $32,000 on May 31, however the excitement lasted under four hrs following the level of resistance demonstrated to become tougher than expected. The $32,300 level symbolized a 20% increase in the May 12 swing low at $27,000 also it provided the required expect bulls to purchase some $34,000 and greater call options.

The fleeting optimism reverted to some sellers’ market on June 1 after BTC dumped 7.6% in under six hrs and pinned the cost below $30,000. The negative move coincided using the U . s . States Fed beginning the entire process of scaling lower its $9 trillion balance sheet.

On June 2, former BitMEX exchange Chief executive officer Arthur Hayes contended that the Bitcoin bottom in May might have been a powerful signal. Using on-chain data, Hayes predicts strong support at $25,000, considering that $69,000 marked this cycle’s all-time high, a 64% drawdown.

Despite the fact that analysts might issue rosy cost predictions, the specter of regulation is constantly on the cap investor optimism and the other blow came on June 2 once the U.S. Commodity Futures Buying and selling Commission (CFTC) sued against Gemini Trust Co for alleged misleading statements in 2017 concerning the self-certification look at a Bitcoin futures contract.

On June 7, an invoice to ban digital assets as payment has been around since the Russian parliament. The balance loosely defines digital financial assets as “electronic platforms,” which may be acknowledged as the topics from the national payment system and obliged to undergo the central bank registry.

Bulls placed their bets at $32,000 and above

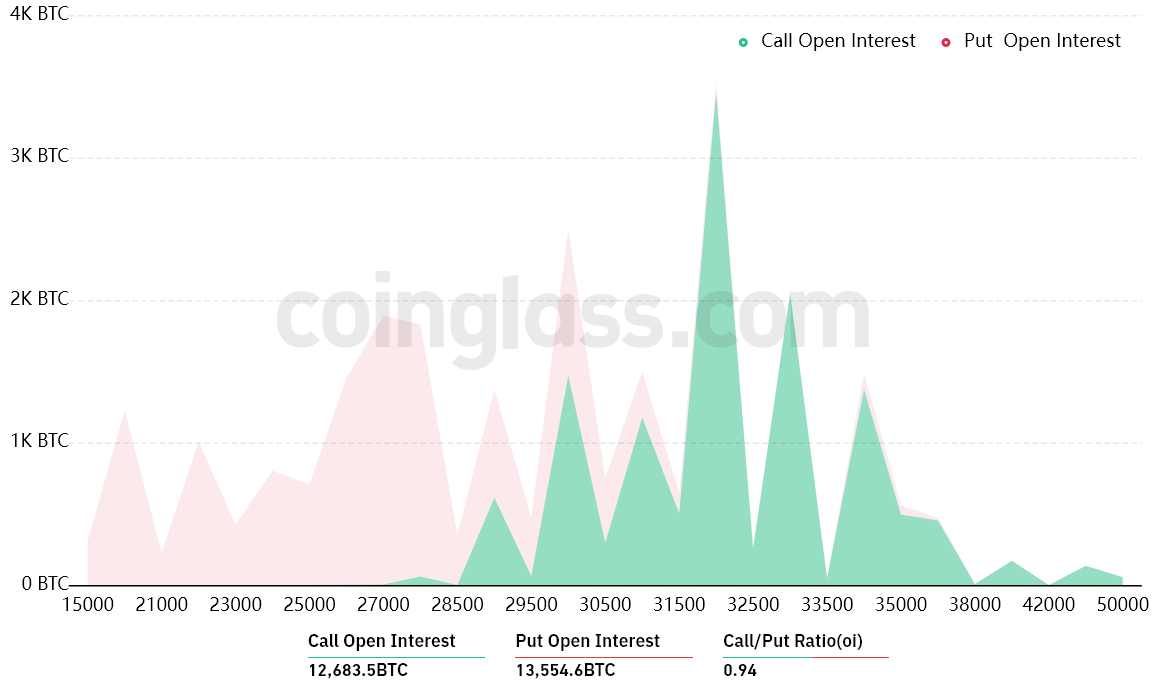

Outdoors interest for that June 10 options expiry is $800 million however the actual figure is going to be reduced since bulls were excessively-positive. These traders may have been fooled through the short-resided pump to $32,000 on May 31 as their bets for Friday’s options expiry extend as much as $50,000.

The .94 call-to-put ratio shows the total amount between your $390 million call (buy) open interest and also the $410 million put (sell) options. Presently, Bitcoin stands near $30,000, meaning most bullish bets will probably become useless.

If Bitcoin’s cost moves below $30,000 at 8:00 am UTC on June 10, only $20 million price of these call (buy) options is going to be available. This difference is really because the right to purchase Bitcoin at $30,000 is useless if BTC trades below that much cla on expiry.

Bears strive for sub-$29,000 to learn $205 million

Here are the 4 probably scenarios in line with the current cost action. The amount of options contracts on June 10 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $28,000 and $29,000: 50 calls versus. 7,400 puts. The internet result favors the put (bear) instruments by $205 million.

- Between $29,000 and $30,000: 700 calls versus. 5,500 puts. The internet result favors bears by $140 million.

- Between $30,000 and $32,000: 3,700 calls versus. 3,400 puts. The internet outcome is balanced between bulls and bears.

- Between $32,000 and $33,000: 7,700 calls versus. 750 puts. The internet result favors the phone call (bull) instruments by $220 million.

This crude estimate views the put options utilized in bearish bets and also the call options solely in neutral-to-bullish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

For instance, an investor might have offered a put option, effectively gaining positive contact with Bitcoin over a specific cost, but regrettably, there is no good way to estimate this effect.

Related: ‘Can it have any simpler?’ Bitcoin whales dictate when you should purchase and sell BTC

Bulls will attempt to pin BTC above $30,000

Bitcoin bulls have to push the cost above $30,000 on June 10 to prevent a $140 million loss. However, the bears’ best situation scenario needs a pressure below $29,000 to maximise their gains.

Bitcoin bulls just had $200 million leverage lengthy positions liquidated on June 6, so that they must have less margin needed they are driving the cost greater. With this particular stated, bears will unquestionably attempt to suppress BTC below $30,000 in front of the June 10 options expiry.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.