Bitcoin (BTC) lost 25.4% in 48 hrs, bottoming at $15,590 on November. 9 as investors rushed to exit positions after the second biggest cryptocurrency exchange, FTX, stopped withdrawals. More to the point, the sub $17,000 levels were last seen almost 2 yrs prior, and also the anxiety about contagion grew to become apparent.

The move liquidated $285 million price of leverage lengthy (bull) positions, leading some traders to calculate a possible problem with $13,800.

How much of an exciting time for you to come alive! Loving the volatility these elites are coming up with! They wana buy LOW prior to the next bull cycle! Thank heavens i was ready several weeks in advanced!

Shall we be gona hit that 13k target? So what, its an enormous buy chance lengthy term! $BTC #BTC pic.twitter.com/2v0ThmIoNG

— JD (@jaydee_757) November 14, 2022

As explained independent market analyst jaydee_757, the bearish trend is constantly on the exert its pressure, with $17,200 like a level of resistance. Still, this kind of analysis provides no be certain that the best $13,800 bottom is going to be hit.

Strangely enough, the cost action coincided with improving conditions for global equity markets on March. 4, because the S&P 500 index acquired 6.4% between November. 10 and November. 11 and also the tech-heavy Nasdaq Composite rallied 9.5%. Hence, a minimum of theoretically speaking, Bitcoin completely decoupled from traditional finance.

Additional uncertainty on Bitcoin continues to be introduced on by Grayscale Bitcoin Trust (GBTC) buying and selling on over-the-counter stock markets following the $11.4 billion fund discount to the assets surpassed 40%.

watching GBTC liquidity and lenders contact with stated product for contagion risk

appears someone is selling lots of GBTC

discount has become >40% and widening, implied BTC cost is $9K, and lots of GBTC is relaxing in toxic places atm

— Vance Spencer (@pythianism) November 11, 2022

As noted by Vance Spencer, the implied BTC cost based on the funds’ buying and selling is below $9,000, and pressure should continue if some holders use their shares as collateral for loans.

Still, the negative sentiment that caused Bitcoin to interrupt below $20,000 does not necessarily mean professional investors are bearish in the current cost levels.

Margin traders didn’t close their longs

Monitoring margin and options markets provide excellent understanding of how professional traders are situated, allowing investors to gain access to cryptocurrency to leverage their buying and selling position.

For example, it’s possible to increase exposure by borrowing stablecoins to purchase yet another Bitcoin position. However, Bitcoin borrowers are only able to short the cryptocurrency because they bet on its cost declining. Unlike futures contracts, the total amount between margin longs and shorts isn’t always matched.

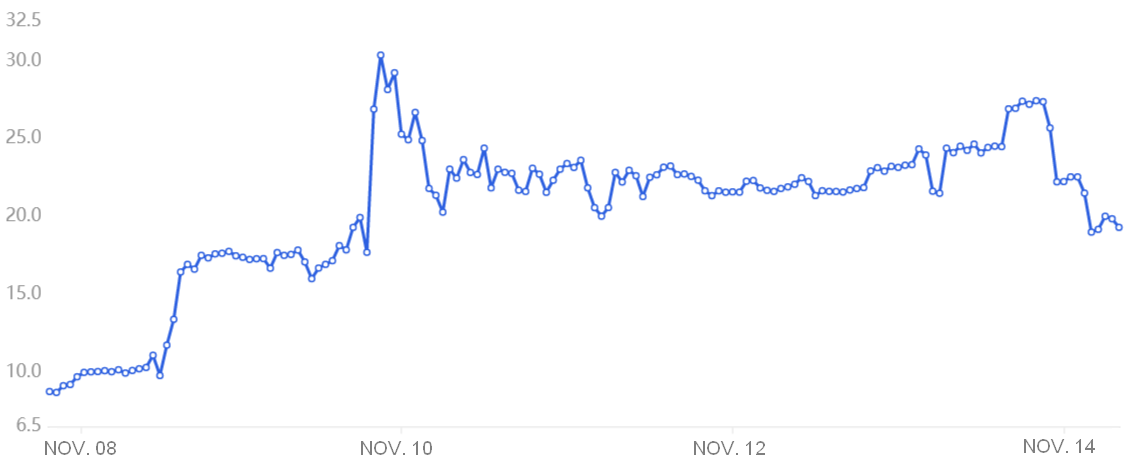

The above mentioned chart implies that OKX traders’ margin lending ratio has elevated from November. 8 to November. 10, signaling traders didn’t close their leverage longs regardless of the 25.4% cost correction.

In addition, the metric is constantly on the favor stablecoin borrowing with a wide margin, indicating traders happen to be holding bullish positions.

Option markets flipped bearish

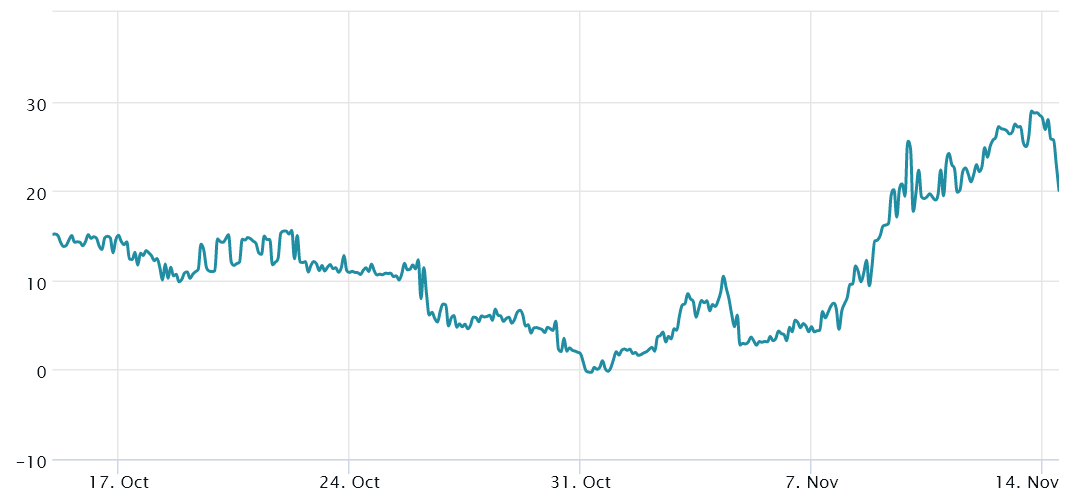

Traders should scan options markets to know whether Bitcoin can reclaim the $18,500 support. The 25% delta skew is really a telling sign whenever arbitrage desks and market makers are overcharging for upside or downside protection.

The indicator compares similar call (buy) and set (sell) options and can turn positive when fear is prevalent since the protective put options fees are greater than risk call options.

The skew indicator will move above 10% if traders fear a Bitcoin cost crash. However, generalized excitement reflects an adverse 10% skew.

As displayed above, the 25% delta skew have been below 10% since March. 26, however it rapidly moved above that threshold on November. 8, suggesting options traders were prices a greater chance of unpredicted cost dumps.

Whenever this metric stands above 10%, it signals that traders are fearful and reflects too little curiosity about offering downside protection.

Related: Crypto.com’s CRO is within trouble, however a 50% cost rebound is within play

FUD dismissal does not occur overnight

Regardless of the bearish Bitcoin options indicator, the OKX margin lending rate demonstrated whales and market makers maintaining bullish bets. The contagion fear might explain the mixed feeling as investors find it difficult to interpret recent movements through the Crypto.com exchange, including an “accidental” change in 320,000 Ether (ETH) to Gate.io.

Operate on Crypto com starts after FTX collapse. Investors started pulling funds from Singapore-based crypto exchange inside a sign the dramatic collapse of FTX is sparking contagion among exchanges. Cronos, token underpinning Crypto com business, has stepped. https://t.co/evk4J1vnnL pic.twitter.com/wMJmvch2D0

— Holger Zschaepitz (@Schuldensuehner) November 14, 2022

Analyst Holger Zschaepitz’s publish describes investors’ current sentiment as reluctant to consider risks on centralized exchanges offering similar services and products in the now-bankrupt FTX.

Consequently, derivatives are reflecting low confidence in regaining the $18,500 support until more data implies that the cryptocurrency ecosystem’s liquidity continues to be restored.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.