Bitcoin (BTC) lost the $28,000 support on June 12 following worsening macroeconomic conditions. The U . s . States Treasury 2-year note yield closed on June 10 at 3.10%, its greatest level since December 2007. This implies that traders are demanding greater rates to carry their debt instruments and expect inflation to stay a persistent challenge.

Louis S. Barnes, a senior loan officer at Cherry Creek, mentioned that because the U.S. reported its greatest inflation in 4 decades, the mortgage-backed securities (MBS) markets had zero buyers. Barnes added:

“Stocks are lower 2% today [June 10], but could be lower a hell of much more if thinking about exactly what a full-pause and housing means.”

MicroStrategy and Celsius leverage use elevated alarms

Bitcoin’s sell-off is adding more pressure towards the cryptocurrency market as well as other media are discussing if the U.S. Nasdaq-listed analytics and business intelligence company MicroStrategy and it is $205 million Bitcoin-collateralized loan with Silvergate Bank will increase the current crypto collapse. The eye-only loan was issued on March 29, 2022 and guaranteed by Bitcoin that’s in a mutually approved custodian’s account.

As mentioned by Microstrategy’s earnings call by CFO Phong Le on May 3, if Bitcoin plummeted to $21,000, yet another quantity of margin could be needed. However, on May 10 Michael Saylor clarified the entire 115,109 BTC position might be promised, lowering the liquidation to $3,562.

Lastly, Crypto staking and lending platform Celsius suspended all network withdrawals on June 13. Speculations of insolvency rapidly become the work moved massive levels of wBTC and Ether (ETH) to prevent liquidation at Aave, a well known staking and lending platform.

Just recognized individuals with open borrows at low collateral ratios on Celsius are getting to choose from getting liquidated because of market crash or depositing more collateral right into a service which has frozen withdrawals and it is potentially insolvent.

Woof.

— Nick Neuman (, ) (@Nneuman) June 13, 2022

Celsius reported surpassing $20 billion in assets under management in August 2021 that was ideally ample to result in a doomsday scenario. While there’s not a way to find out how this liquidity crisis will unfold, the big event caught Bitcoin’s investors at worst possible moment.

Bitcoin futures metrics are near bearish territory

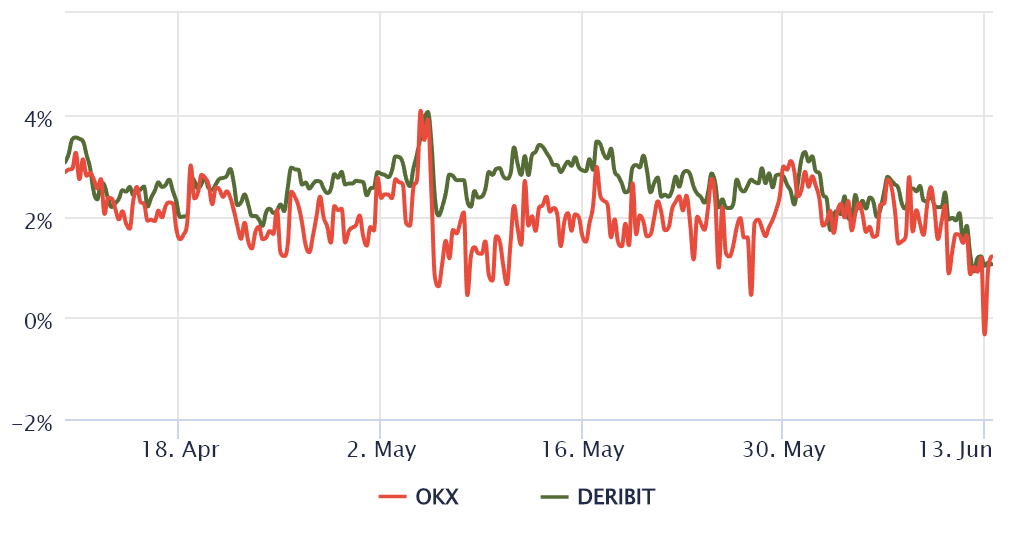

Bitcoin’s futures market premium, the main derivatives metric, briefly gone to live in the negative area on June 13. The metric compares longer-term futures contracts and also the traditional place market cost.

These fixed-calendar contracts usually trade in a slight premium, indicating that sellers request more income to withhold settlement for extended. Consequently, the 3-month futures should trade in a 4% to 10% annualized premium in healthy markets, a scenario referred to as contango.

Whenever that indicator fades or turns negative (backwardation), it’s an alarming warning sign since it signifies that bearish sentiment exists.

As the futures premium had recently been underneath the 4% threshold in the past nine days, it were able to sustain an average premium until June 13. As the current 1% premium might appear positive, it’s the cheapest level since April 30 and sits close to a generalized bearish sentiment.

A poor derivatives marketplace is an ominous sign

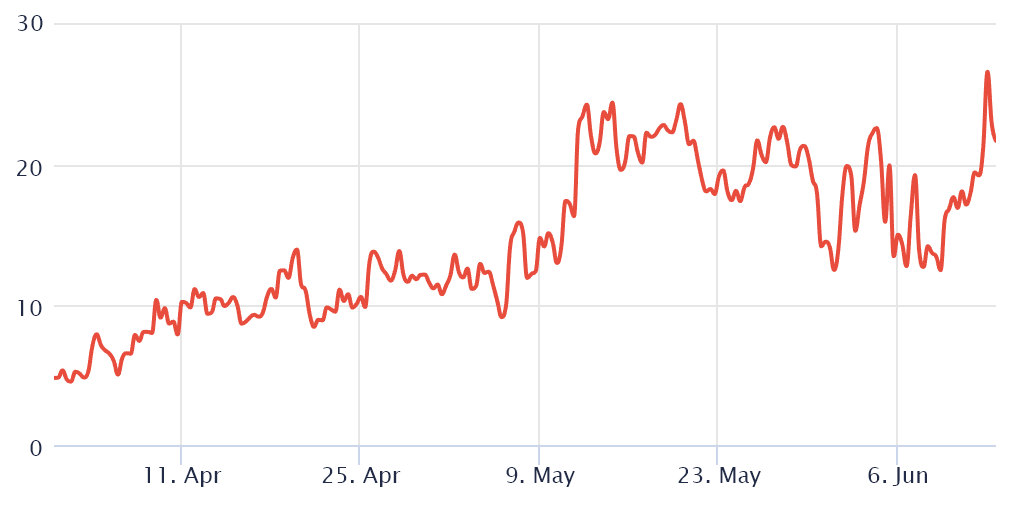

Traders should evaluate Bitcoin’s options prices to help prove the crypto market structure has deteriorated. For instance, the 25% delta skew compares similar call (buy) and set (sell) options. This metric will turn positive when fear is prevalent since the protective put options fees are greater than similar risk call options.

The alternative holds when avarice may be the prevalent mood, which in turn causes the 25% delta skew indicator to shift towards the negative area.

Readings between negative 8% and positive 8% are often considered neutral, however the 26.6 peak on June 13 was the greatest studying ever registered. This aversion to prices downside risks is unusual for March 2020, when oil futures stepped towards the gloomy the very first time ever and Bitcoin crashed below $4,000.

The primary message from Bitcoin derivatives markets is the fact that professional traders are reluctant to include leverage lengthy positions regardless of the very inexpensive. In addition, the absurd cost gap for put (sell) options prices implies that the June 13 crash to $22,600 caught experienced arbitrage desks and market markers unexpectedly.

For individuals planning to ‘buy the dip’ or ‘catch a falling knife,’ a obvious bottom are only created once derivatives metrics imply the marketplace structure has improved. That will need BTC futures’ premium to improve somePercent level and options markets to locate a more balanced risk assessment because the 25% delta skew returns to 10% or lower.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.